Articles & Questions

Every week I publish a fun new article on a money topic I think you’ll find interesting. I also answer a handful of reader questions. Subscribers to my newsletter get to see everything first — but you can browse some of my past articles & questions on this page.

My Best Articles

Not sure where to start? Below I’ve handpicked a few of my favourites. And if you like what you see, don’t forget to subscribe to my free newsletter to get new issues before anyone else!

Search Articles

Tiny House, Big Dreams

In light of the current housing crisis, my partner and I are looking into buying a ‘tiny house’ to live in. We believe this will allow us to live without the stress of a huge mortgage or crazy high rent.

Hi Barefoot,

In light of the current housing crisis, my partner and I are looking into buying a ‘tiny house’ to live in. We believe this will allow us to live without the stress of a huge mortgage or crazy high rent. We would initially look at renting land from someone while paying the tiny house off, and then eventually sell the tiny house and buy our own land when our needs change. What do you think about tiny house living?

Lucy

Hi Lucy,

I’ve changed my mind on tiny house living. My wife and I lived in a Winnebego with four kids for five months and we loved it. However, if we were still living tiny today I’m quite sure I’d be in a mental asylum right now. In other words, what made it fun was that it had a time limit. I don’t know many people who live their entire life in a tiny house … and very few families could do it long term.

So what do I think?

I think you need to work out where you want to be eventually. Is it in a home on land? If that’s the case, the only reason you’d buy a tiny house is if it were dramatically cheaper than renting. After all, your house is on wheeIs so it’s going to lose money over the long term.

Scott

Robbing Peter to Pay Paul

I've written some pretty damn good questions to you before and you've never answered them. Hopefully, I'm not wasting my time with this one.

Dear Scott,

I've written some pretty damn good questions to you before and you've never answered them. Hopefully, I'm not wasting my time with this one. My husband is not putting his money where his mouth is. He runs his own business and is the sole breadwinner for our family. We have read your book and set up buckets with our income going into mortgage, daily expenses and splurge. This year his business has been slower and the percentage going into our mortgage has not covered the monthly repayments. On top of this, I have discovered he hasn’t been putting the percentage we agreed upon into the mortgage and has instead been skimming it into our daily expenses. If the mortgage isn’t paid each month, I want to know about it! And I definitely want to be involved in any decisions about ‘robbing Peter to pay Paul’. How do I make sure the money goes where we have agreed it should?

Wendy

Hi Wendy,

I want you to re-read the first two sentences of your question.

(Go on, have a read, I’ll wait.)

It’s kind of … gruff.

Is that the same tone and approach you use with your husband?

If so, that may be part of the problem.

(After all, it’s not like he’s siphoning off the cash to blow on wizz fizz and hokey-pokey.)

Wendy, like it or not, you’re a small business family, and he needs to know that you’ve got his back.

Here are a couple of suggestions on what you can do together:

Set up buckets for the business – especially for paying tax and suppliers. Separating the business from your personal finances is really important. Ultimately, the business needs to pay at least as much as he’d get working for someone else; otherwise, what’s the point?

Once you have your buckets set up, and a clear picture of what the break-even earnings of the business are, work together to set some sales goals over the next year.

Finally, if things get really tough, call the Small Business Debt Helpline (sbdh.org.au, 1800 413 828). They’re experts. They’re confidential. And they’re free.

Scott.

The Stress Test

If you’re stressed about your money right now, you’re not alone. Australians’ mental health is actually in worse shape now than during the Covid lockdowns, according to a new study by KPMG and Smiling Mind.

If you’re stressed about your money right now, you’re not alone.

Australians’ mental health is actually in worse shape now than during the Covid lockdowns, according to a new study by KPMG and Smiling Mind.

Our biggest source of stress?

The rising costs of practically everything … especially interest rates.

Here’s the thing: when it comes to our mental health, Australians are good at asking for help. We are, after all, the second largest users of antidepressants in the world.

Yet when it comes to dealing with money stress?

Not so much.

But ignoring things won’t make it any better … nor will doom-scrolling. The only thing that’s guaranteed to get you back in control is for you to take action.

So let me give you three action items you can do right now.

The first action item is to pick up your phone, google MoneySmart’s ‘Mortgage Calculator’ and see what your repayments would be if interest rates went up another 2%.

(Hang on, why 2%? Because the bulk of the senior bank economists predict rates will rise 1.5% over the next 12 months. Having said that, these are the same guys who all once famously lost a financial forecasting contest with my golden retriever … so let’s be conservative.)

Write down what your monthly repayment would be, and then …

… act as if it’s this figure already.

Get into a bit of role-play for the evening:

What would you have to do to meet your repayments?

Then check your home loan. Here are some numbers: the average variable rate is 4.55% … or 5.10% if you’re with one of the big banks (but why would you be?). If you have more than 20% equity in your home, you should call up your bank and bitch (rather than go through the hassle of switching). A good variable rate to demand is 3.5%. Do that and you’re three-quarters of the way there.

The second action item is to review your spending.

Disclaimer: I’ve never stuck to a budget in my life, so I’m afraid I can’t help you with a rigid spreadsheet. Instead, I’d suggest that you review your Barefoot Buckets and spend consciously … which means be lavish on things you love and use a lot (hello Dunlopillo) and vicious with anything you don’t (goodbye Netflix).

The third and final action item – regardless of whether or not you have a home loan – is to get a payrise. Yes, I know the thought of asking for more money probably makes you feel a little queasy, but this is a total non-negotiable. Besides, everyone else is doing it. With inflation burning through 7% of your wallet this year, you need to get at least that much of a payrise, or you’ll be going backwards.

So there you have it: three practical, positive and empowering action items that you can do right now to take back control of your money. Let me know how you go!

Tread Your Own Path!

We Retired on the Amount You Suggested …

I read your ‘How much you really need for your retirement?’ column a few weeks ago, and I cut the article out and pinned it on my office wall at home.

Hi Scott

I read your ‘How much you really need for your retirement?’ column a few weeks ago, and I cut the article out and pinned it on my office wall at home. It made me feel amazing, and I breathed a sigh of relief. My husband and I retired with around the amount you mentioned in your column. Now, three years on, we are going well. We have been on a road trip to Darwin, and we enjoy the simple things like catching up with family and friends. Our cup is full. It’s not about what you have, but about who you have in your life. Thank you.

Lara

Hi Lara,

No, thank you! You’re living proof that the ‘million dollar myth’ is just that.

I got smashed with negative responses, but this one from Divya, a pre-retiree, made it all worthwhile:

“I am an immigrant from a poor background, and I used to feel paralysed and ashamed that I ‘have not made it’. That shame translated into me not taking productive action about my wealth. Yet I now realise that I’m actually doing well financially, maybe even very well, and that it’s worth respecting the efforts I’ve put in over the past 10 years, and taking care of what I’ve got! Thank you from the bottom of my heart.”

Here’s to everyone working hard, saving hard, and nailing their realistic retirement number!

Scott.

Chilled to the Bone

I felt chilled to the bone when I read about that poor family who lost their house deposit to scammers. Is there anything we can do for them?

Scott,

I felt chilled to the bone when I read about that poor family who lost their house deposit to scammers. Is there anything we can do for them? They have seven kids! It just doesn’t seem fair that the bank would only refund them $5,000 and the cops say ‘too bad’. There has to be justice!

Raj

Hi Raj,

I feel like I need to take a cold bath and scrub myself clean after the week I’ve had.

I’ve been inundated by readers sharing their scam stories with me. I also spent the week researching what could be done.

Here are some back-of-the-envelope calculations:

Last year Aussies lost $227 million to payment redirection scams. Yet we also know that roughly a third of people are too embarrassed to report they’ve been duped, so let’s call it $300 million.

Five years ago banks in the Netherlands introduced account name checking and it reduced this type of fraud by a staggering 81%! So that would save consumers a massive $243,000,000.

Yet that’s the customers’ money, and who gives a toss about them?

So let’s look at it from the bank’s perspective.

How many of the bank’s staff hours are chewed up dealing with those $300 million in losses?

From chasing the scammers, to dealing with the heartbreak of customers who lost their life savings, and even sometimes, maybe, kinda, partly refunding them.

It’d have to cost the banks tens of millions, at least.

It seems like common sense to me. Kind of like, if your bank makes you give them the account name of the person you’re transferring money to – it’s because they’re actually going to cross-check it.

So I had a commonsense chat with Stephen Jones, the Minister for Financial Services, this week.

I asked him if he could, say, get all the bank chiefs in a headlock and not let them go until they all agreed to check account names, and in doing so save their customers as much as $243 million and untold amounts of heartbreak.

He said that’s a really good question and one that he’ll be asking the banks. But he thought my headlock idea was taking things a little too far. I also gave him the details of the young family with seven kids who were scammed out of their deposit.

Let’s hope commonsense prevails.

Scott.

Chasing a Ghost

Just before Covid hit, I paid a $3,000 deposit for a new fence. Then Covid hit, and everything stopped.

Dear Scott,

Just before Covid hit, I paid a $3,000 deposit for a new fence. Then Covid hit, and everything stopped. After restrictions were lifted we got in contact with the fencer and he started all the excuses under the sun about why he wasn’t able to start the job. He finally admitted he was not going to do it. We asked for our deposit back, we still have not got it. We have told him we will take the matter to small claims court but this has made no difference to him. The trouble is we only have his first name, his bank account details, his phone number and his company name. What can I do?

Danielle

Hi Danielle,

You can do an ASIC search on his company name and find his registered details, and with that possibly take him to a small claims tribunal (like VCAT in Victoria).

So by all means, give it a go.

Having said that, he sounds like a crook. And it also sounds like this isn’t his first rodeo. So you could end up spending a lot of time, energy and emotion chasing this guy … and you still may never get the money back.

Look, I don’t want to sound too woo-woo, but sometimes you just have to let these things go …

So if it were me, I’d put that energy into finding a good tradie who’ll build you a good fence.

(And know that, one day, that guy’s going to get his nuts nailed to a fence.)

Scott.

The email came through with the subject line ‘REGRET’

Scott, My partner and I are both professionals in our early thirties. We bought a house last year and we hate it. We are struggling to adapt to a slower pace of life in the suburbs and have learnt we don’t need as much space as we thought we did.

The email came through with the subject line ‘REGRET’.

Scott,

My partner and I are both professionals in our early thirties. We bought a house last year and we hate it. We are struggling to adapt to a slower pace of life in the suburbs and have learnt we don’t need as much space as we thought we did. We feel stupid for spending a ton of money on something we can’t stand.

What are our options?”

Erica

Strewth!

There’s more emotion in Erica’s email than a midnight meltdown from my 18-month old:

They hate their new home … they feel stupid … they can’t stand it.

Well, the dream of owning your first home is a lot like parenting a newborn … the thrill rubs off disturbingly quickly … and then the reality of the responsibility sets in:

I’ve signed up for a lifetime of this?!

It’s not hard to understand why Erica is spitting the dummy.

This time last year everyone was FOMO-ing off their face. Interest rates were at all-time lows. The Reserve Bank had committed to no rate rises till 2024. Property prices had risen 30% since COVID. And that’s when Erica and her partner got property-pregnant. And that’s also when everything changed.

Today, the value of her property is going down, and the cost of her mortgage is going up. Way up. In the last three months her repayments have shot up by an extra $565 a month (based on a $600,000 loan).

And some experts are warning that house prices could drop by as much as 25%, leaving people like Erica who bought at the top in a ‘Mortgage Prison’ and unable to refinance their loan in a few years.

So what should Erica do?

Well, my advice would be to stop listening to experts about the economy. As a new property-parent you have zero fluffs to give. All it will do is freak you out and psyche you out.

I know you think you’ll never make it. But you will. You’ll grind it out, meet your mortgage repayments, and eventually get ahead. And then, in a few years, you’ll have forgotten about all the pain you went through, and you’ll trade up your family and do it all over again!

Tread your own path!

Why ING Sucks

Fiona is a young high school maths teacher who has a lot on her mind. She’s knee deep in planning her wedding, so her head is full with nuptial numbers

Fiona is a young high school maths teacher who has a lot on her mind.

She’s knee deep in planning her wedding, so her head is full with nuptial numbers:

The guest list, her wedding dress, flowers, bridesmaid dresses … bridesmaids.

One afternoon recently her phone rang.

It was a private number.

As with most people, Fiona’s reflex was to ignore it and let it go to voicemail, but then she remembered she was expecting a call from a supplier about the wedding, so she answered.

Turns out it was Telstra.

“The Telstra rep seemed to know all my details, and they ran me through the privacy stuff. Then they told me that my internet server had been compromised and that I was vulnerable to hackers”, she told me.

Fiona was a little suspicious … but the rep directed her to a Telstra website and asked her to put in her IP address. Sure enough it showed that she had in fact been hacked.

“O.M.G!”

From there, she was directed to open her emails, and then her ING banking app.

The Telstra employee (who had given Fiona her Telstra employee ID for verification purposes) asked her to write down a long series of numbers that she would need to give to the technician that would be visiting her house the next day and reset her internet.

While Fiona was busy writing down numbers, her fiancé arrived home from work and went to the study to do some banking. A few moments later he stormed out and to the lounge room and waved his ING app in her face.

The $20,000 they’d saved up in their ING account to pay for their wedding?

Gone.

Fiona had in fact been talking to a scammer all this time.

“Please make me look silly to your readers,” Fiona pleaded as she told me her story. “Because I am silly. I thought that these scams only happened to Boomers!”

Yet here’s what got my goat:

The scammers hit her account every 30 seconds, each time taking random amounts:

$546, $990, $7.50, $1,000, $99.

And they kept smashing the account until all $20,000 was drained.

Yet get this: the account name the money was going to was spelt “Drothy”.

OH COME ON!

We’re not in Kansas anymore, ING!

Grab the Tin Man and Toto and go bite these buggers!

Seriously, you’d think that Australia’s fifth largest bank – which trousered $549 million in profits after tax last year – would have tipped even just a little bit of that dough into having the most basic banking safety features … like, say, a trigger that detects when a customer is potentially getting scammed and puts a temporary lock on the account?

Nope.

Yet it gets worse.

After a lot of back and forth and tears from Fiona, ING agreed to pay her half the money back.

Half?

That makes absolutely no sense to me.

Either ING believes it’s not their problem, in which case they would tell her (politely) to go jump. Or they admit they should have detected the fraud and pay the money back.

So which is it?

You can’t get half up the duff, Drothy!

In fact, ING’s behaviour is depressingly very bank-like:

“When customers get scammed, it’s a lottery if they get reimbursed by their bank. Sometimes it’s 50%, sometimes it’s 75%, sometimes we find they get nothing”, says Gerard Brody from the Consumer Action Law Centre.

ING’s logo is a lion, which is kind of apt.

In The Wizard of Oz the cowardly lion is given a dish of courage to drink, which instantly transforms him and allows him to protect Dorothy.

Time to lick the bowl, ING.

You’re Australia’s most recommended bank. Start acting like it.

And if, dear reader, you’re thinking “There’s no way I would have fallen for a Telstra scam”, then you really need to read the following question and see how you would have fared …

Tread Your Own Path!

Rich Kid, Poor Kid … Worried Mum

We have twin girls and we recently went all in on the Barefoot pocket money strategy.

Hi Scott

We have twin girls and we recently went all in on the Barefoot pocket money strategy. One of the twins is highly motivated when it comes to jobs and earning her pocket money, while the other doesn’t care for it at all. Like AT ALL! Her ‘currency’ is connections, not money. She barely gets any pocket money each week and we’re not making up the difference, but she still doesn't care. What do you do when financial or future motivation is not an incentive for a kid?

Worried mum

Hello!

So you have a kid who isn’t materialistic in the slightest and values people over money?

Sounds like an awesome kid to me!

Here’s what I’ve learned: lecturing and hassling your kids doesn’t work.

That’s why my brand new book (due out in November) is written directly for kids.

I gave a review copy to a kid who sounds exactly like your daughter. He’s not motivated by money at all … yet he read it cover to cover and started plotting out his own small business, not to buy stuff, but to donate to Foodbank.’

Scott.

A Scammer Stole Our Family Home!

My husband and I have seven kids, aged from one to 13. Five weeks ago we finally took the plunge and bought a big family home!

Hi Scott,

My husband and I have seven kids, aged from one to 13. Five weeks ago we finally took the plunge and bought a big family home!

After the deal was done, our solicitor, Jenny, called and directed us to pay our deposit of $165,000 to the trust account. Then at 6:47am the next morning Jenny emailed us with a ‘correction’ to that account. I thought that was a bit weird, so I emailed back to confirm. Jenny came back almost immediately. All good.

So my husband took the morning off work and went to the bank to wire the money to the account. He paid the $35 bank transfer fee and made sure the teller checked and rechecked the numbers. That night we celebrated!

Then, two days ago, Jenny called to ask us where the deposit money was! Unbeknownst to her, hackers had taken over her computer and communicated with us from her exact email address, posing as her, using her exact language!

So we immediately called the police. They did an investigation and found that the scammer is in Kenya, so it was out of their jurisdiction. They also told us that Interpol doesn’t deal with ‘small amounts’. “There’s nothing you can do”, the police told us.

We have spent hours on the phone to our bank. They have given us $5,000 on the proviso that we drop any action against them. To say we are gutted is an understatement. Please alert all your readers to the risk of hackers accessing online transactions.

Nathan and Natalie

Hi Guys,

My heart absolutely breaks for you.

Here’s what you learned the hard way … that most people don’t know:

When you transfer money your bank always asks for the name of the account that you’re transferring the money to. Logically, you’d think that’s so their systems match and verify the account name.

But they don’t.

You could write ‘IMA BANK ROBBER’ in the account name and it’d still go through.

(Or ‘Drothy’, take your pick.)

Yet hang on, don’t the banks invest billions of dollars a year into cutting-edge artificial intelligence so they can cross-sell you credit cards every time you log on? Surely matching the account name would be a pretty basic code for them to add on?

Well, it turns out it is, and it works!

Five years ago banks in the Netherlands introduced account name checking and it reduced this type of fraud by a staggering 81 per cent.

So … why aren’t our banks doing it?

Well it seems it’s just not a priority for them.

But it is for me.

Nathan and Natalie, let’s make a ruckus this week, and see what happens.

Stay tuned.

Scott.

Dude, I’m HEXED!

Looks like I’m one of three million (presumably young) Australians pooping their pants about the recent announcement of a HECS index increase to 3.9%.

Hello Scott,

Looks like I’m one of three million (presumably young) Australians pooping their pants about the recent announcement of a HECS index increase to 3.9%. I’ve got a whopping HECS debt of just over $53,000 (for my two degrees which currently see me sitting in a casual position earning $26.50 per hour). In the past you’ve advised to focus on other debts or investments, rather than HECS. Does this still stand?

Lina

Hi Lina

You’re right, inflation has increased the cost of everything, including the indexation amount on HECS.

In 2021 it was just 0.6%, this year it’s 3.9%, next year … who knows?

That being said, it’s still the best debt you’ll have: your repayments are contingent on your income and, while it is tracking inflation, it’s not attracting a commercial rate of interest.

Now I don’t have a full picture of your financial situation, but it makes sense to prioritise other (higher rate) debts over your HECS.

Finally, you need to look at your return on investment:

You spent $53,000 on your education and your (admittedly short-term) return is a casual position earning $26.50 an hour?

Now that is something worth pooping your pants over.

Scott.

So about last week ...

Wow-wee! Last week’s column – on how much you need to retire – triggered an avalanche of reader responses. “That’s WAY TOO LOW!”

Wow-wee!

Last week’s column – on how much you need to retire – triggered an avalanche of reader responses.

“That’s WAY TOO LOW!”

“Are they eating baked beans in retirement?”

“You need AT LEAST $1 million to do anything half decent in retirement!”

Let’s recap:

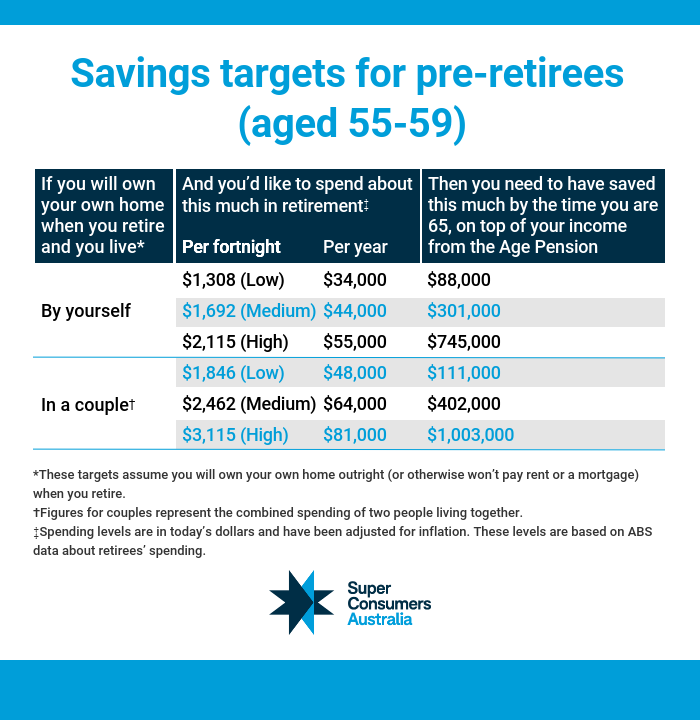

Super Consumers analysed the actual spending data of retirees, and concluded that the average home owning Aussie couple in their late 50s needs $402,000 to fund a comfortable retirement. And to be clear, that figure takes into account the rising cost of inflation, medical expenses and aged care costs.

That figure shocked a lot of readers.

‘Why was it so much less than the ‘magical million’ that always gets bandied about?’ they asked.

Well, it’s because that ‘million dollar’ retirement figure has been largely influenced by the super funds lobby ASFA (Association of Superannuation Funds of Australia), who calculate their figure for a comfortable retirement at $640,000 for a couple and $545,000 for a single.

Yet that’s not a realistic figure for the average Aussie.

In fact, according to Super Consumers, that ASFA figure is only achievable for the top 20% of retirees. And that also explains why the government’s independent Productivity Commission advised policymakers to simply ignore it!

However, the media has not ignored it – it has instead entrenched it. And in doing so it’s created a much bigger problem that affects millions of retirees, both wealthy and poor: they spend the little time they have left worrying about money, and hoarding it, instead of enjoying it.

My view?

The million dollar retirement number is a myth. It’s basically like telling a thirty-five year old, “look I’ve crunched the numbers, and if by now you’re not earning $200,000 a year, well I’m sorry but you’re going to live a crap life”.

Bugger off!

As long as you own your own home, you can live a meaningful, purposeful, retirement with much less money. After all, we have the amazingly good fortune to be living in the greatest country on earth, with a strong social safety net based on the aged pension plus subsidised medical and aged care.

And the truth is that whether you’re 35 or 65, once you’ve comfortably covered the basics, having more money won’t necessarily make you any happier.

Case in point, I spoke to a retiree this week who admitted he’d spent the best years of his life working in a job he hated so that he had ‘enough’ money to retire. Now, five years into retirement, he told me the things that really made him happy are: catching up with his daughter, watching the footy with his son, walking along the beach at low tide, and sitting on the porch in the afternoon sun. And none of them cost him a cent.

Tread Your Own Path!

Help me, help them

I’m a teacher, and I have an opportunity to put together a short finance course (10 lessons) for a Year 10 cohort at my school. I want to focus on how to set them up with really achievable, totally practical and easily applied approaches for future financial security.

Hi Scott,

I’m a teacher, and I have an opportunity to put together a short finance course (10 lessons) for a Year 10 cohort at my school. I want to focus on how to set them up with really achievable, totally practical and easily applied approaches for future financial security. There’s so much I want them to understand and so little time. What do you feel are the most critical lessons our teenagers need right now for the years ahead?

Sandra

Hi Sandra,

Kids don’t learn by lectures, but by rolling up their sleeves and doing stuff.

That’s why a few years ago I came up with my Barefoot Ten, which are ten things every kid should do before moving out. And since you need ten lessons, they could be useful inspiration. Here they are:

1. Open a zero-fee, high-interest saving account.

2. Buy and sell something second-hand.

3. Learn to cook at least two low-cost delicious, nutritious meals from scratch.

4. Volunteer in their local community.

5. Save their parents at least $100 on your household bills.

6. Promise to never, ever get a credit card.

7. Get a part-time job from age 15.

8. Earn at least one glowing reference from a boss.

9. Open up an ultra-low cost, high-growth super fund.

10. Set up a savings account for a home deposit (and nickname it even with a buck),

Feel free to steal these or create some of your own.

And if there are any primary school teachers reading … I have a book coming out in November that starts kids really early. I’ve just put the finishing touches on it. After I handed it to my editor, he said:

“This is the best book you’ve ever written.”

Scott.

Should I kick my friend out?

I’m in a difficult situation with my friend. She’s been renting my large family home from me for the last three years, paying $825 a week in rent.

Dear Scott,

I’m in a difficult situation with my friend. She’s been renting my large family home from me for the last three years, paying $825 a week in rent. I recently had a rental appraisal done and the estimated rent for the house is now between $1600-1800 per week! I’ve sent her the agent’s quote and asked her to make a decision within the month. My friend said the agent has overpriced my house and she wouldn’t pay much more than $820 per week. I know there is a housing crisis on at the moment and she has a family to consider. Help! What would be a fair thing to do? She’s already ‘unfriended’ me on Facebook!

Jocelyn

Hi Jocelyn

Thank-you for providing me with reason #784 that I am not on social media.

Look, it’s your money and not my place to judge what you do with it … but we’re not exactly quibbling over ten bucks here: you’re subsidising her to the tune of $50,000 per year!

So, you’ll have to decide whether you want to continue doing that.

If you don’t, I’d recommend hiring an agent to deal with this for you. Yes, it’s an added cost … but then again, so is the emotional cost of being unfriended on Facebook!

My advice?

Be classy, with your head held high. Tell the agent you want to give your current tenant the first right of refusal at the market rate. And if I were in your thongs, I’d be generous about giving her time to find alternate accommodation if she doesn’t want to pay the market rate.

Scott.

You Have ZERO Credibility, Barefoot

Both my sons (age 13 and 15) have read your books and are practising the ‘Buckets’ strategy. They are slowly, slowly building their wealth to financial independence using earnings from weekend chores, part-time jobs and compound interest.

Scott,

Both my sons (age 13 and 15) have read your books and are practising the ‘Buckets’ strategy. They are slowly, slowly building their wealth to financial independence using earnings from weekend chores, part-time jobs and compound interest. However, I now question your credibility and moral compass. Your misguided publication of your cringe-worthy response to the unbelievable letter claiming “my hard-working 13-year-old has saved $200,000” has left me flabbergasted. Was this a joke? What 13-year-old saves $200,000? Hardworking? Probably. Lucky and the beneficiary of an inheritance or family trust fund? Definitely. This is a slap in the face to every Aussie battler. Sadly, Scott, you have lost a reader here.

Anthony

Hi Anthony,

Congratulations, you have won my reader ‘spray of the year’ award!

So the kid in question did make the $200,000 on their own … they’re actually in the entertainment business. (However, at the parents’ request I’m not being any more specific than that.)

Yet the real issue here isn’t with the kid, it’s with you.

It sounds like you have a lot of hang-ups about wealth. Now, Anthony, your concrete is set, and you’re unlikely to change. But you don’t want your sons to inherit your anger-envy. After all, it’s totally unproductive.

Fact is, they’re going to meet wealthy people who’ve gotten money from their family. That’s life. Not everyone is equal. Not even you. (Just try comparing your salary to an average Indonesian’s.) But your sons can control one thing: the amount of effort they put in.

Scott.

Lost in Space

I am a new investor swept up in a crazy world of shares and crypto (and insane house prices). I put $5,000 in the share market using the Spaceship app, and then the market crashed!

Hey Scott,

I am a new investor swept up in a crazy world of shares and crypto (and insane house prices). I put $5,000 in the share market using the Spaceship app, and then the market crashed! Now whenever I look at my portfolio I feel queasy and want to pull it all out. Is Spaceship worth the hype, or have I thrown away my savings? And is my gut feeling to pull it out and invest in an ETF right, or should I hold on through this ‘bear market’?

Alison

Hi Alison,

Let’s you and I jump in the DeLorean and go back in time.

This time last year you were probably suffering major FOMO hearing your friends boasting about how much fast money they were making betting on Dogecoin, hot stocks and NFT-ape jpegs.

So you looked at all the investing apps and chose the one that had delivered the highest short-term returns, Spaceship. The reason it shot the lights out was because it was investing in red-hot growth stocks that investors seemingly couldn’t get enough of.

And then … investors changed their minds, sending growth stocks deep into the red. This year Apple is down 18%, as is Amazon (-35%), Tesla (-40%), Facebook’s Meta (-53%), and Netflix (-70%).

This explains why Spaceship’s flagship portfolio is down 35%.

Yet what you want to know is: where does it go next?

Honestly, I have no idea. I totally suck at market forecasts (as does every other human). And that’s why I don’t forecast. Instead, I invest in index funds that own shares in business across a range of industries. They really are set-and-forget investments, and when you combine them with low fees on many of these apps they’re great.

Scott.

Help, My Daughter Is Blackmailing Me

My adult daughter, her partner and one-year-old son are renting in a regional area and cannot afford a home loan deposit. I have offered to have them live with me rent free for six months while they save.

Dear Scott,

My adult daughter, her partner and one-year-old son are renting in a regional area and cannot afford a home loan deposit. I have offered to have them live with me rent free for six months while they save. But they want me to take it a step further and go guarantor for them. I did consider it, but as a single parent with three teens at home and a mortgage already I’m not comfortable with the risk. The problem is they are insistent that it is their only way of owning a home and that I am the only person who can help them. They have told me it will be my fault if they are homeless. I feel like they are blackmailing me. What would you do, Barefoot?

Valerie

Hi Valerie,

I’m with you.

Know this: parents all over the country are having this conversation with their kids.

It’s frustrating, because you might really want to do it. However, as they say on the plane, you need to fit your own oxygen mask before helping others. Besides, six months free rent is a bloody generous offer already!

If you feel your daughter is emotionally blackmailing you now, can you imagine what she’d do if prices continue to fall and she finds herself in a financial pickle?

Remember, as a single woman with three kids, statistically you are at the highest risk of being homeless.

Scott.

How much do you REALLY need to retire?

Let me tell you about the worst speech I’ve ever given in my life. It happened five years ago when a friend asked if I’d speak about retirement at a lunch for his men’s group.

Let me tell you about the worst speech I’ve ever given in my life.

It happened five years ago when a friend asked if I’d speak about retirement at a lunch for his men’s group.

“They’re lots of fun”, he said with a smile.

As I drove up to the gates, I realised this was no ordinary bunch of blokes: it was an exclusive private club in a wealthy suburb of Melbourne.

Specifically, two hundred slightly sozzled old guys.

I started on safe ground, talking about the state of the sharemarket.

Then I let one slip through to the keeper, explaining my Donald Bradman Strategy:

“If you own your own home, get the aged pension, and you’re willing to do a bit of paid work, you could comfortably retire on as little as $250,000”, I said matter-of-factly.

Talk about leg before wicket …

“BULLDUST!” yelled one angry multi-millionaire.

“That’s less than I paid for my yacht!” blasted another.

The crowd erupted, and basically bounced me off stage.

Howzat?!

Clearly I’d hit a nerve. After all, the number one question every pre-retiree wants to know is this:

“How much do I need in super to retire on?”

And until now there’s only been one number that everybody quotes: the Association of Superannuation Funds of Australia (ASFA) standard: $545,000 for a single and $640,000 for a couple to have a comfortable retirement.

There are two problems with this.

First, it’s out of reach for most people: the ABS says that the median super balance on retirement is $250,000 for men and $200,000 for women. So for an average working Aussie, why bother trying?

Second, the people who calculate the ASFA figure are … the super fund lobby. It’s a bit like asking old Dr Kellogg, “What’s the most important meal of the day?” (Breakfast, of course!)

Yet for years theirs was the only retirement figure available.

Until now.

A group called Super Consumers Australia (a partner of CHOICE) has done the research and come up with their own figures — and given me a sneak peek.

Not only are their figures much more attainable, they’re based on ABS research on what Aussie retirees actually spend.

So what’s their number for a comfortable retirement in these inflation-stressed times?

The newest figures are $302,000 for a single and $402,000 for a couple in a middle-income household, again assuming they don’t pay rent or a mortgage.

(This is, admittedly, a little higher than my Don Bradman figure, but that’s mainly because I encourage retirees to keep working at least a day a fortnight to supplement their income.)

Either way, for far too long the super industry has played to the millionaires in the members’ stand. What these figures do is give the average Aussie a fighting chance at scoring 100 (not out!).

Tread Your Own Path!

Scammers Got the Lot

My daughter recently clicked on a text message from scammers saying they were from ANZ. She entered her login details and gave the scammers full access to her account.

Hi Scott,

My daughter recently clicked on a text message from scammers saying they were from ANZ. She entered her login details and gave the scammers full access to her account. I’m worried about what will happen next. I’ve googled it a bit and have seen that scammers can change your postal address and steal your identity. Is there anything my husband and I can do to help her work through this and protect her from what they might do with her info?

Kellie

Hi Kellie,

Grab your phone. Grab your daughter. Dial 1800 595 160.

That’s the number for IDCARE, Australia’s national identity and cyber support service. Their hotline is manned by specialist identity and cybersecurity counsellors who will give your daughter free advice.

Tell your daughter not to beat herself up too much. These things happen a lot. In fact, 2.1 million Aussies experienced one or more types of personal fraud in 2021, according to the Australian Bureau of Statistics (ABS). Yet, shockingly, only half of those who experienced a scam said they reported it to an authority.

Don’t let them get away with it!

Scott.

I’M FREAKING OUT!

I’m sitting here watching my portfolio plummet. The stock market is down 4.75%, and my portfolio is down 5%. IN ONE DAY. I have only been investing for a couple of years and I am freaking out. What should I do?

Hi Scott,

I’m sitting here watching my portfolio plummet. The stock market is down 4.75%, and my portfolio is down 5%. IN ONE DAY. I have only been investing for a couple of years and I am freaking out. What should I do?

Louise

Hi Louise

I feel your pain.

Now, as Warren Buffett would say … actually bugger that! All the Mr B quotes in the world can’t prepare you for your first drop in the market.

Here’s how I deal with it.

First, I don’t invest any money in the share market that I think I’ll need in the next five years.

Yes, the interest rate I’m getting sucks, but not as much as seeing the money I need evaporate in a sell off, right when I need to spend it. If you put short-term money in stocks or (god help you) crypto, you really need some time in the contemplation corner.

Second, I have come to think of my share portfolio like my farm. It’s there to provide me with a golden harvest of dividends over my lifetime. Some years there will be bumper crops, other times there will be droughts. That’s just how the world works. Yet over the long term, owning the farm makes sense (especially when I don’t have to drive a tractor to get the income!).

Finally, how do I react to savage sell offs like we had last Monday?

Well, I don’t. I feel the same way about shares falling as I do reading a newspaper headline that says ‘farm prices are down 5%’. Sure, it’s a bummer, but what can I do about it?

Call up a real estate agent and sell?

They’d be very happy to claim the commission, but would I be any better off?

Of course not!

I’m now invested in broad based, low cost index funds, and my golden rule is this: ‘never sell the farm’.

And so if I never plan on selling, what do I care about the price?

Scott.