Articles & Questions

Every week I publish a fun new article on a money topic I think you’ll find interesting. I also answer a handful of reader questions. Subscribers to my newsletter get to see everything first — but you can browse some of my past articles & questions on this page.

My Best Articles

Not sure where to start? Below I’ve handpicked a few of my favourites. And if you like what you see, don’t forget to subscribe to my free newsletter to get new issues before anyone else!

Search Articles

Help! My Hubby Won’t Retire

My husband of 43 years has his own small business and it’s his identity, but I would like him to retire. Thanks to modest living, saving, superannuation and an inheritance, we have $2 million under our belt.

Hey Scott,

My husband of 43 years has his own small business and it’s his identity, but I would like him to retire. Thanks to modest living, saving, superannuation and an inheritance, we have $2 million under our belt. We own our own home and have zero debt. He’s never taken long service leave, only three or four weeks off every year, so I reckon it’s our turn to spend some time together and enjoy life more. But he won’t (can’t) bring himself to stop working. Please tell him he’s a nong.

Lonely wife.

Hello Lonely Wife!

Your husband sounds like a typical nong-y small business owner.

And we all have the same disease: it’s our baby that never really grows up, and will always need us.

So let me offer a suggestion:

Your husband needs to find someone young, and full of energy to shack up with*.

*In a business sense.

Selling a small business lock stock and barrel can actually be quite difficult, especially if the business owner is central to that business. And another big problem is that banks generally don’t lend people dough to buy a small business, unless it’s against an asset like a house, which limits the pool of buyers.

That’s why one idea I suggest to the business owners is to sell the business to one of their workers, or to find someone who is willing to take over the business, and structure it as a multi-year earn out, where the worker earns a small wage, while paying off the agreed price for the business over say three to five years.

Why would they do that?

Because it works for everyone.

The young worker learns how to run the business while the owner is there.

The owner gets to start to wind down … and not annoy his wife (you).

And he also not only gets to mentor someone, he knows that his baby is hopefully in very good hands.

We Retired on the Amount You Suggested …

I read your ‘How much you really need for your retirement?’ column a few weeks ago, and I cut the article out and pinned it on my office wall at home.

Hi Scott

I read your ‘How much you really need for your retirement?’ column a few weeks ago, and I cut the article out and pinned it on my office wall at home. It made me feel amazing, and I breathed a sigh of relief. My husband and I retired with around the amount you mentioned in your column. Now, three years on, we are going well. We have been on a road trip to Darwin, and we enjoy the simple things like catching up with family and friends. Our cup is full. It’s not about what you have, but about who you have in your life. Thank you.

Lara

Hi Lara,

No, thank you! You’re living proof that the ‘million dollar myth’ is just that.

I got smashed with negative responses, but this one from Divya, a pre-retiree, made it all worthwhile:

“I am an immigrant from a poor background, and I used to feel paralysed and ashamed that I ‘have not made it’. That shame translated into me not taking productive action about my wealth. Yet I now realise that I’m actually doing well financially, maybe even very well, and that it’s worth respecting the efforts I’ve put in over the past 10 years, and taking care of what I’ve got! Thank you from the bottom of my heart.”

Here’s to everyone working hard, saving hard, and nailing their realistic retirement number!

Scott.

So about last week ...

Wow-wee! Last week’s column – on how much you need to retire – triggered an avalanche of reader responses. “That’s WAY TOO LOW!”

Wow-wee!

Last week’s column – on how much you need to retire – triggered an avalanche of reader responses.

“That’s WAY TOO LOW!”

“Are they eating baked beans in retirement?”

“You need AT LEAST $1 million to do anything half decent in retirement!”

Let’s recap:

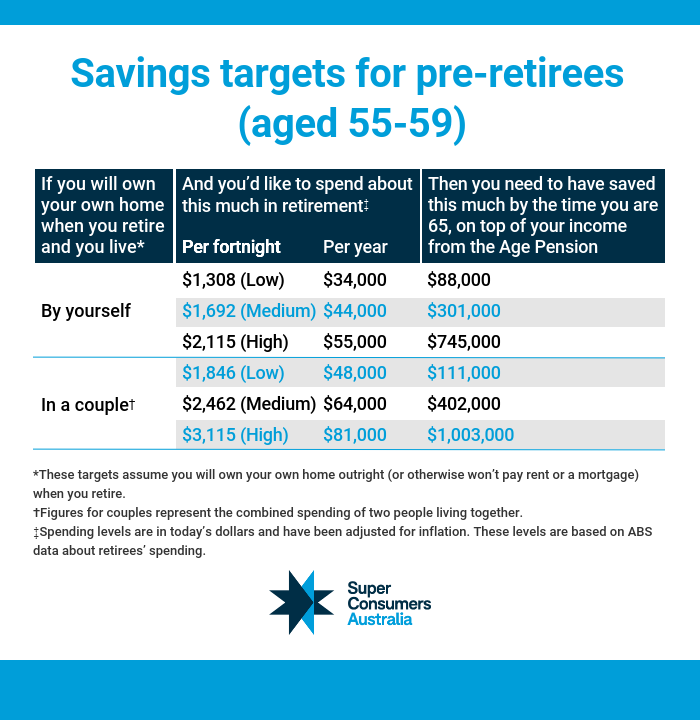

Super Consumers analysed the actual spending data of retirees, and concluded that the average home owning Aussie couple in their late 50s needs $402,000 to fund a comfortable retirement. And to be clear, that figure takes into account the rising cost of inflation, medical expenses and aged care costs.

That figure shocked a lot of readers.

‘Why was it so much less than the ‘magical million’ that always gets bandied about?’ they asked.

Well, it’s because that ‘million dollar’ retirement figure has been largely influenced by the super funds lobby ASFA (Association of Superannuation Funds of Australia), who calculate their figure for a comfortable retirement at $640,000 for a couple and $545,000 for a single.

Yet that’s not a realistic figure for the average Aussie.

In fact, according to Super Consumers, that ASFA figure is only achievable for the top 20% of retirees. And that also explains why the government’s independent Productivity Commission advised policymakers to simply ignore it!

However, the media has not ignored it – it has instead entrenched it. And in doing so it’s created a much bigger problem that affects millions of retirees, both wealthy and poor: they spend the little time they have left worrying about money, and hoarding it, instead of enjoying it.

My view?

The million dollar retirement number is a myth. It’s basically like telling a thirty-five year old, “look I’ve crunched the numbers, and if by now you’re not earning $200,000 a year, well I’m sorry but you’re going to live a crap life”.

Bugger off!

As long as you own your own home, you can live a meaningful, purposeful, retirement with much less money. After all, we have the amazingly good fortune to be living in the greatest country on earth, with a strong social safety net based on the aged pension plus subsidised medical and aged care.

And the truth is that whether you’re 35 or 65, once you’ve comfortably covered the basics, having more money won’t necessarily make you any happier.

Case in point, I spoke to a retiree this week who admitted he’d spent the best years of his life working in a job he hated so that he had ‘enough’ money to retire. Now, five years into retirement, he told me the things that really made him happy are: catching up with his daughter, watching the footy with his son, walking along the beach at low tide, and sitting on the porch in the afternoon sun. And none of them cost him a cent.

Tread Your Own Path!

How much do you REALLY need to retire?

Let me tell you about the worst speech I’ve ever given in my life. It happened five years ago when a friend asked if I’d speak about retirement at a lunch for his men’s group.

Let me tell you about the worst speech I’ve ever given in my life.

It happened five years ago when a friend asked if I’d speak about retirement at a lunch for his men’s group.

“They’re lots of fun”, he said with a smile.

As I drove up to the gates, I realised this was no ordinary bunch of blokes: it was an exclusive private club in a wealthy suburb of Melbourne.

Specifically, two hundred slightly sozzled old guys.

I started on safe ground, talking about the state of the sharemarket.

Then I let one slip through to the keeper, explaining my Donald Bradman Strategy:

“If you own your own home, get the aged pension, and you’re willing to do a bit of paid work, you could comfortably retire on as little as $250,000”, I said matter-of-factly.

Talk about leg before wicket …

“BULLDUST!” yelled one angry multi-millionaire.

“That’s less than I paid for my yacht!” blasted another.

The crowd erupted, and basically bounced me off stage.

Howzat?!

Clearly I’d hit a nerve. After all, the number one question every pre-retiree wants to know is this:

“How much do I need in super to retire on?”

And until now there’s only been one number that everybody quotes: the Association of Superannuation Funds of Australia (ASFA) standard: $545,000 for a single and $640,000 for a couple to have a comfortable retirement.

There are two problems with this.

First, it’s out of reach for most people: the ABS says that the median super balance on retirement is $250,000 for men and $200,000 for women. So for an average working Aussie, why bother trying?

Second, the people who calculate the ASFA figure are … the super fund lobby. It’s a bit like asking old Dr Kellogg, “What’s the most important meal of the day?” (Breakfast, of course!)

Yet for years theirs was the only retirement figure available.

Until now.

A group called Super Consumers Australia (a partner of CHOICE) has done the research and come up with their own figures — and given me a sneak peek.

Not only are their figures much more attainable, they’re based on ABS research on what Aussie retirees actually spend.

So what’s their number for a comfortable retirement in these inflation-stressed times?

The newest figures are $302,000 for a single and $402,000 for a couple in a middle-income household, again assuming they don’t pay rent or a mortgage.

(This is, admittedly, a little higher than my Don Bradman figure, but that’s mainly because I encourage retirees to keep working at least a day a fortnight to supplement their income.)

Either way, for far too long the super industry has played to the millionaires in the members’ stand. What these figures do is give the average Aussie a fighting chance at scoring 100 (not out!).

Tread Your Own Path!

From Homeless to Hero

I’m a single woman in my fifties. Not long ago I was homeless and in debt. Then I came across your book, read that apparently “I’ve Got This”, and was determined to get myself out of the hole I had dug for myself.

Hi Scott,

I’m a single woman in my fifties. Not long ago I was homeless and in debt. Then I came across your book, read that apparently “I’ve Got This”, and was determined to get myself out of the hole I had dug for myself. And I did. A couple of years on I have paid off my credit card debt, triumphantly (quietly) phoned my bank to close that account, signed a lease for a very beautiful home, bought $10,000 in ETFs, and saved $15,000 in Mojo (which gives me a huge sense of peace and freedom while I am between jobs and have no income). A big, warm thank-you for giving me and so many others such strength and hope, without shame and guilt for being in a financial mess.

Now I am wondering what people like me, who don’t have enough life left to accomplish ‘Step 4: Buy Your Home’, should do. Or have I got this too?

Sarah

Hi Sarah,

Before I get into your question, let me address the elephant in the room.

Some people would be reading your story and be shocked that you could be homeless.

However, you and I know that it’s actually pretty normal. In fact, around 400,000 women over the age of 45 are at risk of homelessness, according to a report from Social Ventures Australia.

Why?

Because older women who don’t own a home and have very little savings often end up falling through the cracks, and don’t even have access to social housing.

So should you consider taking up the Government’s Help to Buy scheme and buy with just a 2% deposit?

Heck, no!

By all means keep saving like a woman possessed. And who knows — when the time is right, you may be able to afford to comfortably buy your own home. Understand that you have already achieved financial security against all the odds … so never trade it away.

Finally, it’s human nature to forget how far you’ve come.

You went from being homeless to being debt free, owning shares and having an emergency fund behind you. Stop for a moment and celebrate it. You, Sarah, are incredible!

Keep going, you got this!

Scott.

A super fund option with ZERO fees?

If you've been reading my stuff for a while, you’ll know I bang on – a lot – about minimising your super fees.Well, today I'm going to tell you about a super fund that has zero fees.

If you’ve been reading my stuff for a while, you’ll know I bang on – a lot – about minimising your super fees.

Well, today I’m going to tell you about a super fund that has zero fees. As in a donut.

From the get-go of my career, I’ve advocated that people should invest in low-cost index funds for their super. (An index fund simply tracks the market by automatically investing in, say, the top 300 companies on the market).

And I have put it on record that I invest my super with Australia’s lowest cost index super fund, the Hostplus Index Balanced Fund.

This has opened me up to criticism that I’m biased towards Hostplus, yet my answer has always been the same:

I have no axe to grind, it’s simply about getting the lowest fees.

The long-term evidence is clear:

If you’re investing in anything other than a low-cost index fund, you’re likely to be a loser.

Ratings agency Standard and Poor’s (S&P) has tracked over one thousand managed funds and ranked them against a simple, low-fee index fund over a 15-year period.

Almost nine in ten (87 per cent) international share funds failed to beat a simple low-cost index fund.

Almost eight in ten (77 per cent) Aussie share funds underperformed a simple low-cost index fund.

Faced with this overwhelming evidence, investors the world over have embraced index funds.

It’s not even debated any more … except here in Australia.

We’re like the flat-earthers of the finance world, openly questioning the ‘lower fees equal higher returns’ argument.

And the result is … last year Aussie super funds swiped $32 billion in fees, which over the long term robs future retirees of hundreds of thousands of dollars from their nest eggs.

ASIC has been trying to force fee-gouging super funds to give investors more transparency on the fees we pay, yet this week it was delayed again … thus far it’s dragged on for almost six years!

(No surprise there: Warren Buffett has sagely warned, “Remember, your fees are their income”.)

Anyway, of the thousands of super funds on offer, only a surprising few offer low-cost index funds, like Hostplus does. And I’ve always said that the day another low-cost index fund came onto the market, I’d let you know about it too.

Well, today is that day.

This week REST Super launched a suite of index funds that have 0 per cent fees:

Australian Shares Index Fund – which tracks the 300 biggest companies in Australia (think the banks, Woolies, CSL, Sydney Airport).

Overseas Shares Index Fund – which tracks 1,576 of the biggest companies in the world (think Amazon, Alphabet (Google), Berkshire Hathaway, and Toyota … though no tobacco stocks, which this fund has chosen to strip out). Dividends are reinvested in Aussie dollars.

Balanced Index Fund, which consists of 30 per cent Australian shares, 45 per cent overseas shares, 20 per cent bonds and 5 per cent cash.

(Technical point: REST is using Macquarie Bank’s True Index funds, which use derivatives to manage their portfolio. REST say they have done their due diligence and are comfortable with the risk.)

Let’s be fair dinkum though … nothing is free (except my wife’s apricot chicken casserole … and that has its own risk profile).

So how can this fund be free?

The answer is, it’s not. The investment fee is zero, that’s true.

However, REST also charges an administration fee, which is $67.60 per year plus 0.10 per cent of your super balance per year (capped at $800 per annum).

Still, it’s very cheap.

Of course, before you switch to this (or any other) fund, I’d suggest you speak to a professional and get personal advice. Just make sure you’re speaking to an advisor who puts your interests first, and advocates low-cost investing.

Tread Your Own Path!

Reminder: I first wrote about this years ago and highlighted the low fees. Today there are cheaper index super funds on offer. How do I know? Because my readers constantly email me about them! So before you do anything, go to YourSuper.gov.au and compare super funds first.

Could We Lose All Our Money?

My husband and I are working through your book, but we are stuck at the superannuation chapter. We both work for the Queensland Government and have our super in the QSuper Lifetime Aspire fund.

My husband and I are working through your book, but we are stuck at the superannuation chapter. We both work for the Queensland Government and have our super in the QSuper Lifetime Aspire fund. The fee is 0.9%, which is just above your recommended 0.85%. QSuper feels ‘safe’. If we changed to another fund, can we be sure we are guaranteed by the Government? Could we lose all our money?Thanks,

Merryn

Hi Merryn,

Let me clear this up: you are not guaranteed by the Government if you lose all your money in super. (That only happens with money you have in the bank -- see the question above.)

Instead, your superannuation fund is a trust, and the trustees of the fund are legally obliged to act in your best interests (as the Royal Commission has shown, some do a better job of this than others). QSuper appears to be doing a good job: they’re a not-for-profit industry fund that charges competitive fees, and they have a decent track record.My advice would be to call up the fund and request to sit down with one of their advisors, and have them help you select the most appropriate asset mix within your current QSuper fund. Why? Well, a Vanguard study showed that 90% of your returns comes from the asset allocation you choose. Make that your focus.

Scott

Reminder: I first wrote about this years ago and highlighted the low costs. Today there are better deals on offer. How do I know? Because my readers constantly email me about them! So before you do anything, do a quick google.

Is AMP Heading South?

Hi Barefoot, On advice from our financial adviser, my wife and moved our super from Australian Super to AMP MyNorth Super a year ago. We have generally been happy with the advice we have received and, like all funds, in the past year MyNorth has had its ups and down.

Hi Barefoot,

On advice from our financial adviser, my wife and moved our super from Australian Super to AMP MyNorth Super a year ago. We have generally been happy with the advice we have received and, like all funds, in the past year MyNorth has had its ups and down. However, with the findings of the banking royal commission and recent stock market volatilities affecting AMP, we think we should maybe go back to the industry fund. Is it likely AMP could go under in future, meaning we could lose all our super?

Cliff

Hi Cliff,

I’ve had a number of people ask me the same question ‒ whether their money is safe with AMP.

Let me be clear: your money is safe.

That’s because the money you have in super is held via a legal trust for you. ‘(and this applies to AMP as much as any super fund)’. Super is strictly regulated, and the trustees have a legal duty to manage the fund for the benefit of members.

However, the same can’t be said for the suffering AMP shareholders.

The very fact that so many of its customers are questioning whether this 170-year-old blue-blooded company will survive is an indication of just how much the brand has been battered.

As Dr Phil says, it’s hard to win back trust.

Speaking of which, I’d ask your advisor to do a financial comparison between your old industry fund and your MyNorth fund since you switched.

Scott

Super Stressful

Hi Scott, I am 27 and earn $95,000 a year, so my super is adding up. But I received my annual superannuation statement and found I am being charged three separate fees: administration fees (0.

Hi Scott,

I am 27 and earn $95,000 a year, so my super is adding up. But I received my annual superannuation statement and found I am being charged three separate fees: administration fees (0.37%), investment fees (0.25%) and something called ‘indirect costs’ (0.64%). In your book you recommend paying no more than 0.85% in fees on super: does that refer to any type of fee charged, or only administration and investment fees? And do you have any idea what indirect costs are?

Lisa

Hey Lisa,

Good on you for being one of the few people who bothers to look at this stuff.

ASIC defines ‘indirect costs’ as costs “paid by your super fund to external providers that affects the value of your investment. Typically these are costs paid to investment managers.”

Bottom line? It’s another fee. All up, you are being slugged 1.26% of your balance each year.

If you’ve currently got $40,000 in super, that’s around $500 a year.

That doesn’t sound like much.

Yet, as a back-of-the-envelope calculation (6% real return, not factoring in tax), your super will grow to around $720,000 over the next four decades. However, the negative effect of the compounding fees will be roughly $220,000!

You’ve done the hard work by wading through the complicated, boring guff. Now comes the most profitable call you’ll ever make: call your fund and ask them if they have a high-growth, low-cost index super offering ‒ preferably one that charges less than 0.85% in fees, total.

Scott

Should I Go to Cash in My Super?

Dear Barefoot, I am a single working woman, 61 years old, planning to retire in five years. I am now wondering if I should be concerned about my superannuation reducing with the recent share market losses.

Dear Barefoot,

I am a single working woman, 61 years old, planning to retire in five years. I am now wondering if I should be concerned about my superannuation reducing with the recent share market losses. If it is going to crash again, should I be moving to cash rather than shares?

Susan

Hi Susan,

I totally get how stressful it must be.

The truth is that -- if a share market crash coincides in the years leading up to or proceeding your retirement -- it can have a devastating impact on your plans.

Right now, your super contributions are most likely going into a share investment option.

However, I’ve always said that in your last few years of work you should divert some of those super contributions, into a cash or fixed interest option within your super.

How much?

Well, that’s up to you (and your advisor). However a good rule of thumb is having a minimum of two years’ living expenses (less any age pension you’ll receive).

Now, let me be James Blunt: the biggest risk you face isn’t the short-term wobbles of the share market -- it’s running out of money before you die. I see people who find themselves in this situation all the time, and if they’ve given up working there’s nothing they can do.

Susan, right now you have the power to change things. It’s not too late. So make an appointment with your super fund’s financial planner and work out how much you need to retire on. Get a figure to aim at. And hit it.

Scott

Boxing at Retirement Shadows

Hi Scott, We read your book and loved it. However, we got a little confused near the end when talking about superannuation approaching retirement (which we hope to do in two to three years).

Hi Scott,We read your book and loved it. However, we got a little confused near the end when talking about superannuation approaching retirement (which we hope to do in two to three years). My husband and I are each putting away extra super to bring it to 15%. Does the entire 15% need to go in as cash, or just our extra contribution over our employer payments? And will HESTA do this for us?

Mary and Phil

Hi guys,What haunts me is the letters I received back in 2008 from people just like you.They were on the cusp of retirement, and then the Global Financial Crisis pummelled their portfolios.Finance professors call this ‘sequencing risk’. Yet it’s really just bloody common sense: if you’re retiring you should have enough money to ride out a downturn without having to be a forced seller.As Mike Tyson says, “Everyone has a plan, until they get punched in the mouth”.Well, that’s why I believe it’s prudent to build up a cash buffer in the final years before they retire. I like three years of cash (minus any age pension payments). Though I’m conservative.You should call your super fund and ask to speak to one of their financial advisors, who can help you structure your super, so the market doesn’t land a killer blow this close to the final round.

Scott

Helping Out My Mum

Scott, At the age of just 30, I am VERY aware of the importance of super. Here’s why.

Scott,

At the age of just 30, I am VERY aware of the importance of super. Here’s why. My mum is two years off the pension and has $8,000 in super. Yep, not a typo. I am going to ‘gift’ her $200,000 or so from the sale of my house (I have another, so will not be homeless), and she will be able to buy a house on which she will owe nothing. I have two questions for you. How might this ‘gift’ affect us? And how can Mum, who works full time earning $40,000 a year, maximise her super in the two years of work she has left?

Tracy

Hi Tracy

I hope my daughter looks after me as well as you do for your mum!

First up, let’s look at what you’re trying to achieve: you want to put a stable roof over your mum’s head so she has a sense of security and doesn’t have to worry about moving.

If I were in your shoes, I wouldn’t just give her the cash.

Instead, I’d consider buying an investment property in your name and renting it out to her.

There are three advantages to this:

First, when she goes on the age pension she’ll get rent assistance ‒ the maximum payment is $134.80 per fortnight.

Second, as long as it’s an arms-length transaction, you’ll be able to claim the interest and related expenses of the property against your tax, like any other investor can.

Third, it makes things a lot simpler. You should have a written tenancy agreement that sets out who pays for what, and what upkeep she’s expected to do, just like you would for any other tenant. That’s not only going to help you prove this is an arm’s-length transaction, but also manage everyone’s expectations. Also, in the event of her passing, the property is yours and is separate to her estate.

Now, as far as how your mum should manage her money over the next few years before she retires, here’s what I’d suggest if it was my mum:

When she retires she’s going to live on $23,597 per annum (the maximum pension for a single person, not including rent assistance and the health care card, worth at least $1,500 a year).

I’d encourage her to be a ‘practice pensioner’ – by living off that figure now and saving the rest of her wage.

Her aim should be twofold:

First, to have a goal of at least $100,000 in super when she finishes full-time work in five years (not two!).

Second, to never retire … keep working part time at least a day or so a week, and supplement her pension by up to an additional $6,500 a year (which, thanks to the Budget, will increase to $7,800 on 1 July 2019).

The upshot is that you’ll have an investment property with a great tenant. Your mum will have the security of a home, plus $100,000 in super to draw on, and she’ll be earning more in retirement (after tax) than she is right now!

Of course, you should run this past your accountant and financial advisor, but that’s how I’d do it.

Scott

The Big Budget Changes You Missed

Far as I can tell, we’re the only country that goes a little ‘Hollywood’ for the Budget. Other nations just read theirs out on a Tuesday afternoon in parliament, and no one gives a toss.

Far as I can tell, we’re the only country that goes a little ‘Hollywood’ for the Budget. Other nations just read theirs out on a Tuesday afternoon in parliament, and no one gives a toss. Not us. We lock all the journalists up, and give the Treasurer the prime-time razzle-dazzle.

And last week’s Budget was a little … Family Feud. A bit, er, boring.

So what did we learn?

My first takeout is that Australia is the Jay-Z of the world economy … we’re swimming in cash. That’s largely because there’s been an uptick in the global economy, which is boosting the price of our resources. It’s also because unemployment is low. Oh, and also because we’re running a fairly aggressive immigration policy.

This pile of cash is what’s funding the centrepiece of the Budget ‒ a $10-a-week tax cut for low- and middle-income earners. It’s also what ScoMo hopes will fund what is effectively a ‘flat tax’, where 94% of the population pays 32.5% or less.*

*In seven years’ time.

Look, in seven years’ time I plan on living on a Tuscan vineyard so I can drink vino and wear slacks without socks … but I’ll have three kids in primary school by then, so the closest I’ll get to bellissimo is my local, La Porchetta.

Bottom line?

I’m not getting my holiday, and you’re not getting your flat tax.

Anyway, while the tax cuts stole the limelight, the real story ‒ which was largely ignored ‒ was the changes to super.

So here are three things that really deserve prime-time attention:

First, if you’ve been shocked by what you’ve seen at the Royal Commission (and you should be), you can now teach these bozos a lesson, switch your super fund, and not get whacked with an exit fee.

(Still, anyone who’s tried to roll over their super knows it’s harder than breaking up with your high school sweetheart. There’s so much back and forth, so many itty-bitty details and forms … it’s almost like they want you to give up and keep your money there!).

Second, a campaign that I’ve been banging on about for years is the rort of compulsory life insurance through super. Young people collectively pay nearly $200 million a year in life insurance they don’t need. The Government will now force super funds to stop automatically charging young people under the age of 25. That’ll add thousands of dollars to young people’s end balances.

Third, the government is finally moving to protect one of the biggest cash cows of the super industry: the 6 million inactive (read: forgotten) accounts that super funds feast on. The Government has put a fee cap on these low-balance funds and is making it easier to consolidate them.

All in all, it was a terrible night for the super fund lobbyists, which means it was a great night for you and me. In fact, I think the super changes will potentially have a bigger long-term impact than the short-term tax cuts. Just don’t expect to read too much about it. After all, super isn’t very Hollywood, is it?

Tread Your Own Path!

Too Old to Die Young

Scott, Subconsciously I always thought I would die young, as my parents and older sister did. So I have tended to ‘live for the moment’.

Scott,

Subconsciously I always thought I would die young, as my parents and older sister did. So I have tended to ‘live for the moment’. Now that I am still (thankfully) here at 69, I am too old to die young! My husband and I continue to work in our own business, which we enjoy. Our joint taxable income last financial year was $116,000, and we have $750,000 in business loans. If we sell the business and pay off the loans, we should realise about $600,000, but that’s it — no super, no house, no assets. Should we buy something modest, or rent?

Jill

Hi Jill,

You’d be amazed how many people I meet who tell me that retirement ‘just sort of crept up on them’ ...… over 50 years.

But I’ve got a few suggestions that should help you out.

First, talk to your accountant before selling the business, as there are capital gains tax (CGT) exemptions for small business owners who are selling and retiring, especially if they’ve owned the business for 15 years and it has a turnover less than $2 million per year. Depending on your circumstances, it may be more tax efficient to roll the money into super — and then you could take out a lump sum and buy a modest home.

Second, given that you’ve enjoyed your business, why not negotiate with the new owners (once you’ve sold) to continue working in it a day or so a week? It’s good for your transition to retirement, and good for the transition of the business. Best of all, you could earn $20,800 ($13,000 p.a. of work bonus and $7,800 income) before your rate of Age Pension is reduced.

Combined this equates to $35,058 of Age Pension and $20,800 of employment income, for a total of $55,858 p.a. of income. The best part is that it would be tax free — couples can have $28,974 p.a. each of income tax free, thanks to the Seniors and Pensioners Tax Offset (SAPTO).

Scott

Ripping Off a Pensioner?

Hi Scott, My mother received around $300,000 as an inheritance. Being financially illiterate (after a lifetime of illness and living on disability pension), she went to a NAB financial planner, who put her money into a superannuation account with MLC.

Hi Scott,

My mother received around $300,000 as an inheritance. Being financially illiterate (after a lifetime of illness and living on disability pension), she went to a NAB financial planner, who put her money into a superannuation account with MLC. The good part is she is still eligible for her Disability Pension. The bad part is that NAB charges around $2,500 per year for their ‘advice’, and MLC charges around $3,000. Is it a rip-off?

Chantelle

Hi Chantelle,

There is no way anyone on a disability support pension should be paying $2,500 a year ongoing for advice. (Besides, if your mum is under the Age Pension age, whatever she has in super is exempt from the asset test). What she should do is go and see a free Centrelink Financial Information Services Officer (FISO), who will help her maximise her pension -- for free.

As far as the cost of her super goes, it’s about average: over the next decade, she’ll end up paying over $50,000 in fees. (If people paid their super investment bill the same way they do their quarterly power bill, it’d be a bloody outrage, but it’s all out of sight, out of mind.) If she can ‘fight the power’, I’d suggest she switch to an ultra-low-cost industry fund.

Scott

Talking to the Taxman

I have a rather curly question but I hope you can answer it. My husband and I are five years from retiring and, combined, we have just over $620,000 in assets, including an investment property with a mortgage.

I have a rather curly question but I hope you can answer it. My husband and I are five years from retiring and, combined, we have just over $620,000 in assets, including an investment property with a mortgage. My question is, does Centrelink take the mortgage from the investment property off the total of investment assets when assessing us for the Age Pension?

Beverley

Hi Beverley,

In a word, yes. Centrelink only counts the equity in the investment property (less the debt) for the Age Pension asset test. If, however, you have both a mortgage on your home and a mortgage on your investment property, I’d encourage you to focus on paying down your home over the next five years, because its value is totally exempt from the asset test.

Scott

Why are people stealing my book?

Every father wants to be a hero to his son. So, a few weeks back, I took my four-year-old to a bookstore to show him my bestseller.

Every father wants to be a hero to his son.

So, a few weeks back, I took my four-year-old to a bookstore to show him my bestseller.

Only problem? I couldn’t find a single copy anywhere (not even in the bargain bin).

“Your book. It isn’t here, is it Daddy?” he said, consolingly.

This wasn’t going well.

Thankfully a shop assistant recognised me and said “follow me”.

She took us out to the storeroom and showed us a sign pinned to the staff noticeboard (see pic).

“Barefoot Investor … Because of theft, NO copies will be kept on the floor.”

True story.

I didn’t know how to handle this one with the boy: “Daddy’s book is popular … with thieves.”

Yet I’m taking it as a win — even with the pilfered copies, the book has still sold over 300,000 copies!

And its success has meant that I’ve received thousands of follow-up questions on the book, far too many for me to answer individually (though I try!). With that in mind, here are the top questions people ask me.

“Is this really how you manage your money?”

Yes it is.

I’ve lived the nine Barefoot Steps

Liz and I have set up our buckets. We have a shared bank account. We do our Barefoot Date Nights.

And that’s why I believe the book has resonated so strongly with people — I know it works.

The steps won’t make you rich overnight, but they will give you a clear path that will keep you and your family safe.

“You need more than $250,000 to retire on!”

Well, having more money is certainly better

In case you haven’t read my book, my chapter on nailing your retirement sets out my ‘Donald Bradman Strategy’, which says that to enjoy a comfortable retirement you don’t need $1 million … or $2 million.

As a minimum, I argue you need three things to have a comfortable retirement where the money doesn’t run out:

A paid-off home, around $250,000 in super combined (or $170,000 if you’re single), and the ability to continue working a few days a month (which you should do, no matter how much dough you’ve got, to keep the grey matter ticking over and to get you out of the house).

Some people got all ‘Tony Abbott’ about the fact that I advised people to rely on getting the age pension.

Let me defend myself:

First, the average Aussie approaching retirement has around $200,000 in super, so my strategy is giving them something realistic to aim at … rather than simply just throwing up their hands in the air.

Second, let me be very clear: I do not encourage planning to rely on a government handout. In fact, I wrote the rest of the book so you can set yourself up to not need the Donald Bradman Strategy!

“Can’t I just use my offset account for my Mojo account?”

Sure you can.

(I have received literally hundreds of emails from people who tell me they could be $48.50 a year better off by using their offset account for their ‘Mojo’ — my word for savings.)

It’s just not how I do it … but the most important thing is that you have Mojo!

Again, the power of this book is that it’s what I’ve actually done in my life.

And, personally, one of the things that really helped me was giving each of my accounts a name.

There’s power in being intentional about things, and you tend not to dip into an account that has a name on it (the more emotional the better).

When my house burned down, I went to my Mojo account and drained it.

“Should I keep my credit card … just in case?”

You could do that … but it’s like a drunk keeping a beer in the fridge just in case a ‘mate’ comes around.

The truth is that credit card ‘rewards’ for all but the highest spenders are a gimmick … and their value gets eroded with every passing year (some points are worth as little as half a cent each).

Yet showing your kids that Mum and Dad can get through life without relying on someone else’s money?

In the words of the MasterCard ad … priceless

“How do I get my partner on board?”

Right now people all over the country are going out for their Barefoot Date Nights.

If you can’t rope your partner in with the promise of booze and good food, what else can I do?!

“Will you be updating the book?”

Yes. I’ll be updating it every year. In fact I’ve just finished the 2017/18 update, which will be released for Father’s Day.

There’s also an audio book version that I’ve laid down.

And finally …

“What happened to your alpacas?”

I’m pleased to announce that Pedro and Alberto, my two highly protective alpacas, are still very much alive and spitting!

Tread Your Own Path!

Am I Going to Lose Everything?

Hi Scott, About 18 months ago I put a $15,000 deposit on an off-the-plan apartment. The idea was to sell my home for the same amount as the apartment and move in.

Hi Scott,

About 18 months ago I put a $15,000 deposit on an off-the-plan apartment. The idea was to sell my home for the same amount as the apartment and move in. But I have not sold my home and it is now worth less than the apartment. I have been caught by the development finishing six months early, combined with a flat housing market in Perth.

I asked for an extension and got 30 days from settlement, but after that I get penalised. So can I legally get out of this deal, or can they just bankrupt me? I only have my house, my car and a very little super, as I had a stroke in 2002 and used my super then. I also get easily bamboozled due to the stroke.

I work two days a week and am on a disability pension, earning approximately $44,000 per annum. I am 71 (and single), so my ability to get a loan or pay one off are minimal. Please help me -- I cannot see any way out except one, and that would leave a big mess for my children. I would not do that.

Jenny

Hi Jenny

You’re definitely in the dung ... I just don’t know how deep you are.Now, some people believe they can walk away from an off-the-plan development and only lose their deposit.

Yet that’s not always the case.

Ultimately it depends on what’s in the contract you signed, and how desperate the developer is … and given Perth apartment prices are cratering at the moment, I’d wager they’re as desperate as I was at my high-school formal.

The worst-case scenario is that your developer swallows your deposit, hits you with financial penalties for not settling, and then sues you for the losses of on-selling your apartment (when they eventually find a buyer).

But that’s all in the future, maybe.

Let’s you and I just deal with the next 30 days.

It’s highly unlikely you’ll be able to settle in the next month, and it’s also highly unlikely you’ll get bridging finance. So here’s my advice: see a lawyer immediately.

Let me be crystal clear, Jenny. Put down the newspaper. Pick up the telephone. Call a lawyer.

Have them review your contract, then ask their advice on mounting a case for being released from the contract due to your impaired judgement.

What are you doing still reading, Jenny?

Get on the phone. Now!

Scott

We Can’t Sleep at Night

Hello Scott, My husband and I are on the age pension and receive $2,200 per month. We also receive an overseas pension of $700 a month.

Hello Scott,

My husband and I are on the age pension and receive $2,200 per month. We also receive an overseas pension of $700 a month. We have a combined super balance of $32,000 and a home worth $600,000.

We owe $25,000 on our car, $24,000 on our home, and $25,000 on a bank overdraft (we used to have a business but it collapsed). We are considering borrowing $100,000 for debt consolidation, paying off the car and overdraft, putting some into our home loan, and topping up our super with the balance. The payments on such a loan would be $600 per month (based on current interest rates). Please help, as this is leaving me anxious and sleepless at night.

Kathy and Kevin

Hi Kathy and Kevin,

You’re going to struggle to get a $100,000 loan when you’re on the pension, and with good reason:

Pensioners can’t afford to be repaying debts!

If I were in your shoes, I’d downsize your home, pay off all your debts, and keep the money in super as a backstop.

Otherwise you could: withdraw your super as a lump sum and pay off the highest-interest debt. Then both of you could go back to work a day or so a week (combined you can earn $13,000 each before it affects into your Centrelink pension), and possibly rent out a room until you’re debt free.

Good luck.Thanks for reading.

Scott

You’ve Lost the Plot, Barefoot

Hi Barefoot, I always read your column and generally agree with your comments, but I strongly disagree with the thrust of your article on 29 January on ‘How to Retire Comfortably’. I do not dispute your arithmetic, just the logic that a couple need only get to the very bottom rung of the assets ladder (paid-off home plus $250,000 in super), and then rely on a taxpayer-funded pension for the rest of their lives.

Hi Barefoot,

I always read your column and generally agree with your comments, but I strongly disagree with the thrust of your article on 29 January on ‘How to Retire Comfortably’. I do not dispute your arithmetic, just the logic that a couple need only get to the very bottom rung of the assets ladder (paid-off home plus $250,000 in super), and then rely on a taxpayer-funded pension for the rest of their lives. The reasoning is inherently flawed.

I believe people should be encouraged to provide for themselves and strive to live comfortably with NO government assistance. To me, your book seems to lower the standard of human endeavour and will only result in more and more taxpayer money being spent on welfare in future. The age pension is supposed to be a safety net for those who cannot fund their own retirement -- not a guarantee to be factored into retirement plans.

Jason

Hi Jason,

Don’t hate the player, hate the game.

The fact is that 80 per cent of Australians retirees receive either a full or part age pension. And let me raise your blood pressure a little higher: that figure is unlikely to reduce over the next 40 years, according to estimates from Treasury Intergenerational Report.

Having said that, I agree with you that being self-funded is the best way forward. That’s why I spend every other page of my book doing all I can to help people become financially independent. If they follow the Barefoot Steps a little earlier in life, they’ll be comfortably self-funded when retirement day comes.

Scott