Articles & Questions

Every week I publish a fun new article on a money topic I think you’ll find interesting. I also answer a handful of reader questions. Subscribers to my newsletter get to see everything first — but you can browse some of my past articles & questions on this page.

My Best Articles

Not sure where to start? Below I’ve handpicked a few of my favourites. And if you like what you see, don’t forget to subscribe to my free newsletter to get new issues before anyone else!

Search Articles

What’s the Catch?

Hi Scott,

Long time reader, first time writer! After comparing super funds I was contacted by Sue from (FINANCIAL PLANNING FIRM’S NAME DELETED BY BAREFOOT’S LAWYERS)

Hi Scott,

Long time reader, first time writer! After comparing super funds I was contacted by Sue from (FINANCIAL PLANNING FIRM’S NAME DELETED BY BAREFOOT’S LAWYERS) and after answering a lot of questions they’ve suggested I move my $70k Rest super (growth index) to an AMP super where they say they can manage it and improve my return from 9% (500k retirement) to approx 15% (1M+ retirement) due to the larger variety of investing options. The only catch is a one off transfer fee of $3,300 and I’m certain they mentioned another fee of about 1.65% which I believe was recurring. What do you think?

Barry

Barry,

No. No. No.

Barry, just … no.

We are not doing this. Not on my watch. You haven’t been reading me for this many years to get screwed by some cocker spaniel cold caller.

They are lying to you.

The catch isn’t just the $3,300 one off fee. That’s gerbil feed in the scheme of things.

The real snatch is that they are TRIPLING your annual fees. That will end up costing you hundreds of thousands of dollars over your working life.

From your super account to Sue’s savings account.

Barry, stick with your low cost industry fund.

If you want to boost your returns, cut your fees. You could consider moving your current investment option to high growth index funds.

Don’t take the call, make the call: to your super fund.

Scott

Don’t Make Me Google

Hi Scott,

I was recently contacted by an investment company called Caprion Group, which operates in the UK, Australia and New Zealand. Caprion’s account manager is encouraging me to invest $20,000, claiming they only risk 1% per trade and that most trades are profitable. I’m unsure whether this is legitimate or wise.

Hi Scott,

I was recently contacted by an investment company called Caprion Group, which operates in the UK, Australia and New Zealand. Caprion’s account manager is encouraging me to invest $20,000, claiming they only risk 1% per trade and that most trades are profitable. I’m unsure whether this is legitimate or wise. I’m a retired woman living on a government pension, with HESTA as my super fund. With recent market volatility, my super has dropped significantly. On top of that, I’ve just discovered HESTA has frozen all transactions until early June, with no clear explanation. Should I leave my super where it is, and can you tell me if Caprion Group is trustworthy?Jenny

Hi Jenny,

Your question reminds me of a discussion I had with my son just this morning.

“Hurry up! We’ve got to go to your game. Why don’t you have your footy guernsey on?”

“I can’t find it”, he whined.

“Have you looked in your cupboard?” I asked.

“Yeah …”, he said unconvincingly.

I gave him my ‘dad’ stare.

“Oh … kay, I’ll have another look”, he humpfed.

A minute later he came back with it on.

Now, to your question.

First, I googled “Caprion Group + Scam”.

The very first listing was the ASIC MoneySmart website under their ‘investment scam alert’ list.

Their advice? “If it’s on the list, don’t take the risk.”

Jenny, Caprion was on the list.

Next, I googled “HESTA frozen transactions”, and hundreds of articles appeared.

The first article read: “Members of HESTA will be unable to access most services until June, as the superannuation fund undertakes a planned outage to change its administration provider.”

Jenny, as a member of HESTA there’s no need to worry (you’ve only lost access for a while, not your money.) However, if I were the CEO of HESTA, I’d be very worried. The fact that one of the biggest super funds in the country could screw this up so badly is totally unacceptable.Scott

Should I Switch to Vanguard Super?

Hi Scott,

A while back you wrote about Vanguard Super’s upcoming entry onto the Australian scene. I was hoping you could share your thoughts on their performance so far.

Hi Scott,

A while back you wrote about Vanguard Super’s upcoming entry onto the Australian scene. I was hoping you could share your thoughts on their performance so far. All the comparison websites are unable to give more than one year’s worth of data, but that one year is looking pretty impressive, and combined with the low fees it’s hard to ignore. Is this enough information to confidently make the switch?

Linda

Hi Linda,

I’ll be honest, when Vanguard Super launched back in November 2022, I considered switching. After all, I was sure the revolution had arrived: finally someone was going to kick down the door of the $30-billion-a-year super fee racket!

Unfortunately, it’s been less ‘bust the door down’ and more a polite ‘tappity tap tap’: “Oh, excuse me … mind if we join in?”

You see, the truth is that most big funds – AustralianSuper, Hostplus, Cbus, etc – are still partying like it’s 1999: one-size-fits-all aggressive portfolios, bloated fees, and active management that’s basically professional dart-throwing which ultimately leads to much lower returns than index funds over the long term.

The big funds ignore this, because admitting it would mean firing most of their investment manager mates, cancelling the ‘research’ trips to Switzerland, and actually competing on fees. And where’s the fun in that?!

Yet here’s where Vanguard falls down: the fees. It charges 0.58%.

Low? Sure.

Lowest? Not even close.

Ironically, you can get cheaper index options from the same big funds that Vanguard set out to disrupt.

But I’ll let you into a secret: most of the big funds don’t promote their index offerings. Instead, they make you go digging through their investment menus like you’re ordering off the secret Macca’s menu. My guess is they only added them to stop their smart investors jumping ship to Vanguard.

So, yes, I like Vanguard. I own their ETFs. But I haven’t switched my super, because I can get the same index exposure, for less, from the dinosaurs they were meant to replace.

Scott

Should I Go to Cash?

I’m sure you'll get a million questions to this effect, but what should we do with our super based on Warren Buffett’s indicator? Do we move our super investments to more conservative options (cash, etc)?

Hi Scott,

Love your emails!

I’m sure you'll get a million questions to this effect, but what should we do with our super based on Warren Buffett’s indicator? Do we move our super investments to more conservative options (cash, etc)?

Hayley

Hi Hayley

I can’t tell you what you should do, but I can tell you what I’m doing:

Nothing.

Here’s the problem with converting to cash ahead of a crash:

You have to be right twice.

As in, you not only have to pick the right time to sell your shares and move to cash … but you have to pick the right time to buy in again, just before the market recovers.

And, as my wife will tell you, I’m rarely right once … let alone twice!

When you look at the long-term track record of the markets, things have turned out exceedingly well if you follow another piece of advice from Buffett:

“The trick is, when there is nothing to do, do nothing.”

And that’s good enough for me!

-Scott.

Is My Super Genocidal?

Own up, Barefoot, you support the war machine. I have often wondered why my super investments in a fund like Australian Ethical have not grown as much as others.

Own up, Barefoot, you support the war machine. I have often wondered why my super investments in a fund like Australian Ethical have not grown as much as others. It’s because people like you (who I respect) tell them to invest in the fund that will make the most money, rather than the fund that will be best for us as people on this planet. Vanguard enables genocide, mate. Find a well-performing alternate super fund that doesn’t decimate entire populations.

Sandra

Hi Sandra,

I presume you are referencing a report from 2017 where activist investors wanted Vanguard (and other index funds) to dump their shares in PetroChina, Asia’s largest oil and gas provider, because of accusations of genocide.

Vanguard’s MSCI Index International Shares fund contains 1,439 companies (Apple, Nike, Netflix, etc), yet as of today it does not own shares in PetroChina.But it does raise a good point: an index fund simply owns the largest businesses – it doesn’t put an ethical lens on them.

It’s the investment equivalent of a sausage: when you’re at Bunnings on the weekend you don’t ask if the snags are beef, pork or sawdust, right? (“You get what you get and you don’t get upset”, say my kids, who love a bit of sawdust on a Saturday.)

So the solution is ethical investing, right?

Well, that’s like buying an expensive free-range chipotle instead of the humble snag … but you still need to know what goes into it.

Case in point:

AustralianSuper’s ‘Socially Aware’ investment option was found to have money invested in the coal, oil and gas industries, and to own shares involved in nuclear weapons.

Mercer claimed its ethical fund didn’t invest in booze or gambling companies, though it was holding shares in Heineken and Crown Resorts.

Thankfully the regulator is trying to enforce the claims made by fund managers: last month Vanguard copped a record multimillion-dollar fine for misleading investors about the green cred of its own ethical funds.

Enjoy the sausage sizzle!

Scott.

I don’t want this to happen to you

The stock market is flirting with all-time-record highs …

… and that’s my cue to cock my leg and pee all over your portfolio.

You see, I still have PTSD from the GFC, when retirees would write to me in tears as they watched their super balance crater. They had no idea how much risk they were taking in their super fund ... until it was too late.

The stock market is flirting with all-time-record highs …

… and that’s my cue to cock my leg and pee all over your portfolio.

You see, I still have PTSD from the GFC, when retirees would write to me in tears as they watched their super balance crater. They had no idea how much risk they were taking in their super fund ... until it was too late.

I don’t want that to happen to you.

Here’s the problem: while the best-performing super funds label their default flagship funds as ‘balanced’ options, the reality is that they’re often quite unbalanced. They have a large portion of their funds devoted to shares and other growth investments … which juices their returns and helps them win awards.

In other words, if your super fund is consistently one of the top performers, it’s likely they’re taking more risks than the funds they’re competing against.

Now, taking on more risk is great for an 18-year-old dish pig with 50 years of work ahead of him, but it’s potentially disastrous for a 63-year-old executive chef who’s about to light the flame on his last flambé.

Bottom line: Australia’s biggest super funds use an aggressive ‘one-size-fits-all’ strategy which might not work if you’re nearing retirement.

Yet there is an alternative. They’re called ‘target-date funds’ (or ‘lifestyle funds,’ same thing), and they’re becoming more popular, with a large amount of funds offering one.

Here’s the gist:

You pick a target date fund based on your age, and it automatically adjusts your investments as you approach retirement. So, when you’re younger, it invests heavily into growth investments like shares (because you have plenty of time to ride out the ups and downs). As you age, it gradually shifts you into more conservative stuff, like cash and fixed interest.

These funds are a great hands-off option, especially if they’re built with ultra-low-cost index funds.

My advice?

Call your super fund and speak to one of their financial advisors (your first appointment should be fee-free and obligation-free). Ask them to review the asset mix you’re invested in, and have them compare it to the asset mix of an index target-date super fund for your age. Then ask them what they’d recommend, and why.

Tread Your Own Path!

Best Returning Super Funds

I was reading about the best performing super funds, which were Mine Super, Colonial FirstChoice, and IOOF – all of which earned over 10% and easily beat my super fund (AustralianSuper).

Hey Scott,

I was reading about the best performing super funds, which were Mine Super, Colonial FirstChoice, and IOOF – all of which earned over 10% and easily beat my super fund (AustralianSuper). Have you looked at these super funds in detail, and would you consider switching if you were me?

Russell

Hi Russell

I view annual super fund returns tables like I do a tacky beauty pageant:

Fake tans. Fake nails. And the winning fund managers strutting around in evening dresses, posing for investors. Pass me the vomit bag!

The truth is that you do not want to be in the latest ‘hot’ fund.

Why?

Because statistics show that the lucky fund this year is just as likely to be next year’s dog.

Standard and Poor’s looked at the top-performing share fund managers two years ago and found that only 2% of them remained top performers today.

That explains why, over the past five years, 95% of Aussie share fund managers have underperformed an equivalent index fund ETF, after fees.

That’s why I think we should rejig the current super fund table – and instead rank them on fees. Any super fund charging its members over 1% should be made to get in a bikini and parade down Martin Place.

Scott.

What you’re about to read is going to get me into trouble

What you’re about to read is going to get me into trouble.

So I’m going to cut to the chase: to all the marketing managers of the products I’m about to mention, please email my assistant: idontcare@barefootinvestor.com

What you’re about to read is going to get me into trouble.

So I’m going to cut to the chase: to all the marketing managers of the products I’m about to mention, please email my assistant: idontcare@barefootinvestor.com

When I was a kid, I used to try and hide my school report from my parents, hoping they’d simply forget (this was in the days before email, and helicopter parenting).

Yet my plan was always foiled by my older sister, who was the dux of her class, and waited in anticipation all year for her brief bath in the parental sunshine.

Mole.

Well, the Government just released a (long, confusing, boring) report card on your super fund card - it’s called the APRA External Report (www.apra.gov.au), and the worst super funds are hoping that you never read the report.

So let’s dig in.

OnePath was like my Year 8 report card: a total and utter sh…earing show (as my father would say). OnePath was singled out by the regulator for having no less than 33 dud super funds.

Thirty-three!

OnePath was joined in veggie maths by BT Funds Management, Colonial First State, Auscol (Mine Super), Perpetual Super, MLC Super – whose report cards revealed “significantly poor performance”.

Some of the funds that were singled out for charging high admin fees include Verve Super (who market to women), Spaceship Super (who target millennials), Student Super (who need a detention), and the ironically named Cruelty Free Super (well, except for their barbaric admin fees).

And last but not least, Equity Trustees appear to be really struggling with their pencil grip, after being singled out by the regulator for both high fees and poor returns.

Am I being too harsh?

I don’t think so.

There is currently around $10 billion of our retirement savings sitting in underperforming funds. Many of them are not taking on new customers – because, well, who the hell would actively choose to join them?! However, they’re still more than happy to continue milking their existing customers with high fees and/or poor performance.

Why?

Because, unlike their customers, the people that run the funds are making seriously good profits!

Their only way of keeping this going is to hide their report card, and hope you forget to ask.

Don’t let them.

Tread Your Own Path!

*&^%$^* the Labor Government

I’m writing on behalf of my mum, who is distressed about the upcoming changes to superannuation. She is a widower who has worked hard all her life, saving like crazy to ensure she had a secure retirement (believing it was her responsibility not to be a burden to society via the pension) and to leave a tidy nest egg for her kids.

Hi Scott,

I’m writing on behalf of my mum, who is distressed about the upcoming changes to superannuation. She is a widower who has worked hard all her life, saving like crazy to ensure she had a secure retirement (believing it was her responsibility not to be a burden to society via the pension) and to leave a tidy nest egg for her kids.

Mum has been advised by her accountant that she is a smidge over the $3 million cap; once he wraps his head around the changes he will, I’m sure, offer her excellent advice on how to proceed. But here is my question: what the *&^%$^* is the Labor Government thinking about attacking the little nest eggs of ordinary Australians? And what the **&^^% is anyone doing about it? It appears that, despite negative press attention, the changes are going full steam ahead. It’s just not fair! Thanks for listening, Scott, as no-one else seems to be hearing our small voices of protest.

Linda

Hi Linda

I’m sure your mum must feel like she’s being unfairly targeted … and her only ‘crime’ was that she worked hard, saved harder, and made savvy financial decisions! After all, she could have just peed all her money against the wall and retired on the full pension, right?

Well, that’s true.

Yet what’s also true is that your mother is not “an ordinary Australian” and she does not have a “little nest egg”. She’s got more cheese stuffed in her super than 99.5% of the population!

And besides, as you’ve said, she has access to an accountant who will dutifully work out a way to siphon that ‘smidge’ of the tax-affected part of her $3 million balance into another low-tax environment.

So she’s going to be absolutely fine.

However, what most Australians are really worried about – and what the media have jumped on – is whether this move by the Government is the ‘thin edge of the wedge’.

So, is the media right? Is the Government really aiming to come after your super?

Bloody oath they are!

Yet that’s hardly breaking news. After all, with each passing year, politicians – on both sides – have made super less attractive. Especially for higher income earners. They’ve deliberately limited the amount you can put in each year and how much you can keep in there, and now they’re upping the taxes.

My take?

They’ll keep doing it.

Reason being, Australia has a rapidly aging population. Looking after old people is expensive. As are programs like the NDIS. Someone needs to pay for it, and the heavy lifting will come from the wealthiest people in our country.

So to your question: what’s the Labor Government doing attacking the little nest eggs of ordinary Australians?

They’re not.

It’s just that the Government isn’t in the business of providing a tax haven for wealthy people.

Or helping your mum provide a tax-effective inheritance for you.

The Government’s end game is for super to (hopefully one day) take some heat off the age pension.

So let’s talk about the “little nest eggs of ordinary Australians”:

The median super balance for Aussies aged 60–64 is just $139,056 for women and $180,928 for men … and many of these people will have to use their super to pay off their home loan when they retire!

Now that’s tough!

Scott

Help, My Dentist Wants My Super!

We have been blessed with seven kids, some of whom have unfortunately not been blessed with straight teeth. Blimey, $7,500 for braces is no walk in the park, especially when you start multiplying it by three, four or more!

Hi Scott,

We have been blessed with seven kids, some of whom have unfortunately not been blessed with straight teeth. Blimey, $7,500 for braces is no walk in the park, especially when you start multiplying it by three, four or more! Apparently, in some cases you can gain early access to your super for compassionate reasons. Do straight teeth fall into this category? Otherwise, unless I sell a kidney, there is no way I can come up with the cash. I’m 40 and have about $265,000 in super. Is it worth accessing my super early?

Dennis

Hi Dennis,

Right now I’ve got my mouth open and I’m saying “aaaah”.

The rules for a compassionate release of super are as follows:

To treat a life-threatening illness or injury, or

Alleviate acute or chronic pain, or

Alleviate an acute or chronic mental illness.

That all seems fair enough, but I don’t know how little Benny’s braces would apply to any of these.

However, I spoke to the ATO (which administers the applications) and they told me that last year 9,700 individuals applied for compassionate release of super for dental treatment expenses, and 82% were approved. Out of those approved, 9% were for a dependent child’s dental treatment, which could include braces.

Uh-huh.

So what are my thoughts?

First, with seven kids you know you’re setting an expensive precedent: if one kid gets a Hollywood smile, they all do, right?

Second, each time you dip into your super, you’re killing off the power of compound interest (plus potentially paying tax on the lump sum). In the end, it’s not going to cost you $7,500, it’s going to be something likely $30,000, or even more.

Finally, this question has given me a serious toothache.

Ultimately it’s your decision, but I’d look at every other option than raiding your super. And if you do, steer clear of these groups that have sprung up to help people access their super. Some of them charge as much as $800 to “help” you apply for the compassionate release of super. Yet it’s a basic friggin’ form that anyone can fill out in the time it takes to floss!

Keep smiling.

Scott

Vanguard Super?

I came across an article stating that Vanguard is now in the Superannuation business and will be competing against the likes of Australian Super, HostPlus etc. What is your view on this?

Hi Scott

I came across an article stating that Vanguard is now in the Superannuation business and will be competing against the likes of Australian Super, HostPlus etc. What is your view on this?

Andrew

Hi Andrew

Yes, this week Vanguard officially launched their super fund offering.

They’re charging 0.58% per annum, which is one of the lowest in the market for standard default funds with balances under $50,000.

There are cheaper superannuation index funds available.

Yet here’s what’s interesting about this:

First, Vanguard has said they’ll look to lower their fees over time as they grow. I’m inclined to believe them, because that’s what they have a history of doing.

Second, this ain’t your bog-average super fund.

Research from SuperRatings found there is a “high risk at retirement” for many of the current top-returning super funds. That’s because most of our biggest super funds throw everyone – young and old – into a one-size-fits-all investment pot.

Instead, Vanguard’s offering is a life cycle fund that invests your super based on your age. In simple terms, they automatically reduce the amount of riskier assets, like shares, in your portfolio as you get older and closer to retirement. In all, they make 36 of these adjustments up to your 83rd birthday (with no switching fees), which is far and away the most comprehensive of any Australian super offering.

So what do I think?

I think this is great news for every Australian – regardless of whether you switch to Vanguard or not.

The super fund industry trousers an outrageous $30 billion a year in fees – money that could and should be going towards our retirement.

Hopefully now that one of the world’s biggest fund managers – with a relentless focus on lowering costs – has set up shop, they’ll keep everyone on their toes.

For disclosure, I invest in some Vanguard index funds.

Scott.

We're overdue for a stock market crash ...

We are well overdue for a stock market crash. They happen, after all, on average every 10 years, and the last one (discounting the Covid-induced flash-crash) was 14 years ago. And I still have PTSD from the GFC. People on the verge of retirement wrote to me in tears as they watched the value of their super dissolve in front of their eyes.

Hi Scott,

We are well overdue for a stock market crash.

They happen, after all, on average every 10 years, and the last one (discounting the Covid-induced flash-crash) was 14 years ago.

And I still have PTSD from the GFC. People on the verge of retirement wrote to me in tears as they watched the value of their super dissolve in front of their eyes. They had no idea how much risk their super fund was taking … until the market crashed.

So now is a very good time to talk about what’s going on with your super fund. And a word of warning: it’s not good news if you’re in one of the large, top-performing funds …

New research from SuperRatings has found there is a “high risk at retirement” for many of the current top-returning super funds.

Huh?!

Aren’t we supposed to pick a super fund with high returns?

So what makes these funds so risky for older workers?

Well, it’s generally because they are invested more aggressively than the funds they’re competing against. That is, after all, how they get to the top of the performance tables: by taking more risks. There is no free lunch in finance, so tattoo this on your arm: “The higher the returns, the higher the risks!” Of course, taking on more risk is fine for a 17-year-old apprentice … but it’s not so sweet for a 64-year-old chef.

Still, that’s how most of our biggest super funds roll: they throw everyone – young and old – into a one-size-fits-all investment pot.

However, there is another type of super fund. It’s called a ‘target date super fund’.

These super funds invest based on your age. In simple terms, they automatically reduce the amount of riskier assets, like shares, in your portfolio as you get older and closer to retirement.

It works like this: our 17-year-old apprentice would start out aggressively invested in shares to build her nest egg, and then throughout her working life the fund would gradually – and automatically – become more conservative to protect her nest egg by beefing up her defensive assets like cash and fixed interest as she nears retirement.

It’s a simple, elegant and almost set-and-forget solution.

I say ‘almost’ because most of the current funds have their target date set at age 65, when you retire. (If I was a cynic I’d say it’s set at that age so you go see a financial planner.)

Enter Vanguard Investments.

Last month they received regulatory approval to launch a super fund. They're still fine tuning things, but later in the year they expect to launch a target date index super fund that will automatically adjust your portfolio all the way through to your 85th birthday.

The older I get, the more I value simplicity in my life – especially when it comes to investing.

I don’t like my returns being eroded by high fees, so I invest my super solely in low-cost index funds.

And I really like the idea of not having to meddle with my super as I get older.

So let’s hope the top-performing funds – who collectively invest for millions of Aussies both young and old – take heed of this new type of offering and build something even better for their members.

Tread Your Own Path!

Disclosure: I invest in some Vanguard index funds but not their super fund (because it doesn’t exist yet!).

So about last week ...

Wow-wee! Last week’s column – on how much you need to retire – triggered an avalanche of reader responses. “That’s WAY TOO LOW!”

Wow-wee!

Last week’s column – on how much you need to retire – triggered an avalanche of reader responses.

“That’s WAY TOO LOW!”

“Are they eating baked beans in retirement?”

“You need AT LEAST $1 million to do anything half decent in retirement!”

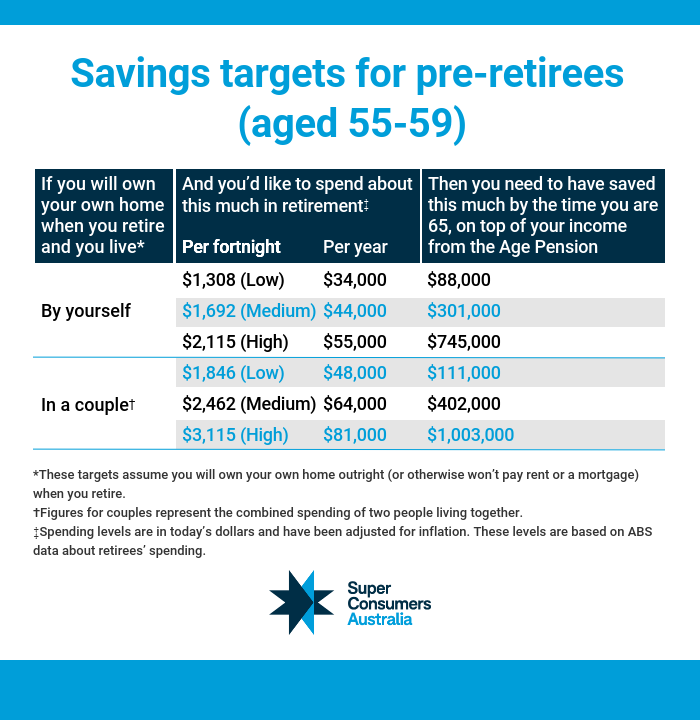

Let’s recap:

Super Consumers analysed the actual spending data of retirees, and concluded that the average home owning Aussie couple in their late 50s needs $402,000 to fund a comfortable retirement. And to be clear, that figure takes into account the rising cost of inflation, medical expenses and aged care costs.

That figure shocked a lot of readers.

‘Why was it so much less than the ‘magical million’ that always gets bandied about?’ they asked.

Well, it’s because that ‘million dollar’ retirement figure has been largely influenced by the super funds lobby ASFA (Association of Superannuation Funds of Australia), who calculate their figure for a comfortable retirement at $640,000 for a couple and $545,000 for a single.

Yet that’s not a realistic figure for the average Aussie.

In fact, according to Super Consumers, that ASFA figure is only achievable for the top 20% of retirees. And that also explains why the government’s independent Productivity Commission advised policymakers to simply ignore it!

However, the media has not ignored it – it has instead entrenched it. And in doing so it’s created a much bigger problem that affects millions of retirees, both wealthy and poor: they spend the little time they have left worrying about money, and hoarding it, instead of enjoying it.

My view?

The million dollar retirement number is a myth. It’s basically like telling a thirty-five year old, “look I’ve crunched the numbers, and if by now you’re not earning $200,000 a year, well I’m sorry but you’re going to live a crap life”.

Bugger off!

As long as you own your own home, you can live a meaningful, purposeful, retirement with much less money. After all, we have the amazingly good fortune to be living in the greatest country on earth, with a strong social safety net based on the aged pension plus subsidised medical and aged care.

And the truth is that whether you’re 35 or 65, once you’ve comfortably covered the basics, having more money won’t necessarily make you any happier.

Case in point, I spoke to a retiree this week who admitted he’d spent the best years of his life working in a job he hated so that he had ‘enough’ money to retire. Now, five years into retirement, he told me the things that really made him happy are: catching up with his daughter, watching the footy with his son, walking along the beach at low tide, and sitting on the porch in the afternoon sun. And none of them cost him a cent.

Tread Your Own Path!

How much do you REALLY need to retire?

Let me tell you about the worst speech I’ve ever given in my life. It happened five years ago when a friend asked if I’d speak about retirement at a lunch for his men’s group.

Let me tell you about the worst speech I’ve ever given in my life.

It happened five years ago when a friend asked if I’d speak about retirement at a lunch for his men’s group.

“They’re lots of fun”, he said with a smile.

As I drove up to the gates, I realised this was no ordinary bunch of blokes: it was an exclusive private club in a wealthy suburb of Melbourne.

Specifically, two hundred slightly sozzled old guys.

I started on safe ground, talking about the state of the sharemarket.

Then I let one slip through to the keeper, explaining my Donald Bradman Strategy:

“If you own your own home, get the aged pension, and you’re willing to do a bit of paid work, you could comfortably retire on as little as $250,000”, I said matter-of-factly.

Talk about leg before wicket …

“BULLDUST!” yelled one angry multi-millionaire.

“That’s less than I paid for my yacht!” blasted another.

The crowd erupted, and basically bounced me off stage.

Howzat?!

Clearly I’d hit a nerve. After all, the number one question every pre-retiree wants to know is this:

“How much do I need in super to retire on?”

And until now there’s only been one number that everybody quotes: the Association of Superannuation Funds of Australia (ASFA) standard: $545,000 for a single and $640,000 for a couple to have a comfortable retirement.

There are two problems with this.

First, it’s out of reach for most people: the ABS says that the median super balance on retirement is $250,000 for men and $200,000 for women. So for an average working Aussie, why bother trying?

Second, the people who calculate the ASFA figure are … the super fund lobby. It’s a bit like asking old Dr Kellogg, “What’s the most important meal of the day?” (Breakfast, of course!)

Yet for years theirs was the only retirement figure available.

Until now.

A group called Super Consumers Australia (a partner of CHOICE) has done the research and come up with their own figures — and given me a sneak peek.

Not only are their figures much more attainable, they’re based on ABS research on what Aussie retirees actually spend.

So what’s their number for a comfortable retirement in these inflation-stressed times?

The newest figures are $302,000 for a single and $402,000 for a couple in a middle-income household, again assuming they don’t pay rent or a mortgage.

(This is, admittedly, a little higher than my Don Bradman figure, but that’s mainly because I encourage retirees to keep working at least a day a fortnight to supplement their income.)

Either way, for far too long the super industry has played to the millionaires in the members’ stand. What these figures do is give the average Aussie a fighting chance at scoring 100 (not out!).

Tread Your Own Path!

Am I Funding the Invasion of Ukraine?

Wally, my long-suffering editor, knows he has a hot question when it’s written in ALL CAPS. Here’s one that landed last week: “AM I FUNDING THE INVASION OF UKRAINE?”

Wally, my long-suffering editor, knows he has a hot question when it’s written in ALL CAPS.

Here’s one that landed last week:

“AM I FUNDING THE INVASION OF UKRAINE?”

Wally leaned in … and it went on … and on, and on, and then took some weird tangents about Bill Gates. (Why is it always about Bill Gates?)

Anyway, the gist of the person’s question was this: he didn’t want his super to be funding war criminals (or Windows 97).

And fair enough too!

Yet, while I’ve got the tin-foil hat on, let me tell you that for well over a decade the super industry fought tooth and nail against laws that required them to disclose to investors where they were investing their money.

“Seriously, just trust us, we’re good guys!” Uh-huh.

Thankfully, the disclosure laws have now been passed, so you can see where your money is invested.

Here’s the deal. There are two ways to invest ethically within super: by choosing a dedicated ethical fund, or by selecting an ethical investment option within your existing fund.

Just understand a couple of things: first, the term ‘ethical’ is about as loose as an over-28s nightclub, so you need to dig in and see what they’re actually investing in, and whether it fits with your worldview.

Second, the fees for ethical funds and options are often much, much higher than for general investment options … which will eventually detract from your returns.

Regardless, there’s a very good chance your super fund has dumped any Russian assets it was holding. Since the start of the crisis, most funds have written off hundreds of millions of dollars of Russian investments. Yet the only way to be really sure is to call your fund and ask them.

Tread Your Own Path!

Here’s How Much You Should Have in Super Right Now

“You look different in real life than you do on the cover of your book”, said the waitress.

“You’ve lost a lot of weight.”

It’s true, over the past few months I’ve dropped roughly 13 kilos.

“You look different in real life than you do on the cover of your book”, said the waitress.

“You’ve lost a lot of weight.”

It’s true, over the past few months I’ve dropped roughly 13 kilos.

How did I do it?

Liposuction! Just kidding. I banished biscuits from the house and set up a gym in the shearing shed.

That’s the thing about being tubby: you can’t hide it (especially if your mug is printed on millions of books). Yet when it comes to wealth it’s the opposite. Plenty of people are hiding their financial flab in a leased Lexus.

So, for a moment, let’s you and I get naked and compare our financial bits. Here’s a table from the Association of Superannuation Funds of Australia (ASFA) that breaks down how much the men and women have in super on average by age.

So ask yourself: “Am I flabby or fit?”

Remember, it’s just an average.

It depends on how much you earn, and how long you take off to raise kids. That being said, if you’re following the Barefoot Steps long term, you’ll almost certainly end up with more than the average.

As I say in Barefoot Step 5, once you’ve bought a home (though not yet paid it off), boosting your pre-tax super contributions from 10% to 15% will make a hell of a difference. As will switching to a growth investment option if you’re under the age of 45. And lowering your fees will give you a huge boost at any age (remember, you’ll pay the majority of your fees after you retire, because that’s when your balance is the biggest).

Don’t be flabby … be financially fit!

Tread Your Own Path!

All Clear from COVID

We stupidly made the decision to withdraw the maximum $20,000 from my husband’s super when it was on offer due to Covid. Now we want to give it back. Is it as simple as depositing it back into his super account?

Barefoot,

We stupidly made the decision to withdraw the maximum $20,000 from my husband’s super when it was on offer due to Covid. Now we want to give it back. Is it as simple as depositing it back into his super account?

Narelle

Hi Narelle,

Good idea.

Almost five million people have withdrawn a combined $37 billion in early release Covid payments. And, given there were no conditions on how the dough was spent, some of it ended up being spent on boob jobs and Botox.

The good news is that the ATO has given an update, saying “individuals can now recontribute their COVID-19 early release payments without it counting towards their non-concessional (after-tax) contributions cap”.

Oh-kay.

Basically, it means you won’t be penalised for injecting the money back into your super, rather than into your lips. Give your fund a call and tell them your plan. They may need you to fill out a form before you BPay the dough.

Scott.

A Super Confession

My husband and I have been with Christian Super Fund for the past 20 years. Today they sent us a letter saying that they’ve been underperforming and that we should change funds. My husband is 61 and I’m 59. We don’t have much super. Should we be worried about this?

Hi Scott,

My husband and I have been with Christian Super Fund for the past 20 years. Today they sent us a letter saying that they’ve been underperforming and that we should change funds. My husband is 61 and I’m 59. We don’t have much super. Should we be worried about this?

Jenny

Hi Jenny,

So it’s confession time at Christian Super:

“Forgive me, member, for we have sinned … we have consistently underperformed other super funds.”

For background, earlier this year 13 super funds were named and shamed by the regulator. The Government then forced these dud funds to write a letter to their (combined 1.1 million) members and not only confess their sins but recommend they switch to a better product using the Government’s YourSuper comparison tool.

Can you imagine if you had to do this to your girlfriend?

“Jenny, it’s come to my attention that I’m a jerk. I’ve underperformed for so many years that I’m writing to you today to suggest you go on Tinder and find someone who can truly listen, get along with your mother, and meet your needs without being passive aggressive.”

Personally, as a strictly low-cost index fund investor, I have very little sympathy for super funds that underperform the benchmarks over the long term. Even so-called ethical funds like Christian Super. Fact is, there are low-cost index funds that will screen out unethical companies. Use them instead. Then donate the extra money you make to causes that you’re passionate about.

Scott.

Your super, your choice

I got absolutely belted for last week’s column.My crime?Innocently suggesting that people with uncomplicated tax affairs (read ‘employees’) could save themselves the $400 they spend on an accountant, and instead lodge via the ATO app on their phone, which does the job in a few minutes.

I got absolutely belted for last week’s column.

My crime?

Innocently suggesting that people with uncomplicated tax affairs (read ‘employees’) could save themselves the $400 they spend on an accountant, and instead lodge via the ATO app on their phone, which does the job in a few minutes.

This did not go down well in accounting circles.

Neil, a suburban accountant, wrote to me saying: “You’re nothing but a government stooge for promoting their tools. You should be ashamed of yourself. You disgust me.”

WHAM! Neil sure wants to give me a bit of negative gearing alright, SMACK BANG in the kisser!

(On second thoughts, maybe Neil’s the accountant you want. He’ll FIGHT for every deduction.)

So, while I have Neil’s attention, let’s put another pot on the stove and get his blood boiling.

This week the Government has released another tool, this time for superannuation.

And you know what? It’s pretty darn good.

It’s called ‘YourSuper’ (ato.gov.au/yoursuper) and it helps you compare super funds.

Actually, its real value is that it’ll tell you whether you’re in a dud fund.

And that one bit of information is incredibly valuable: it can stop you from having hundreds of thousands of dollars of your retirement savings smoked by high fees and poor performance.

The fact that it took the Government 30 years to create a website that tells consumers this vital information is absolutely outrageous. Still, credit to Senator Jane Hume for pushing it through and finally getting it done.

If you access it through your myGov, you can check for lost super, consolidate your accounts, and shop for a cheaper fund (costs are the one thing that investors can control).

It’s another nail in the coffin for hopeless funds that should have been shut down long ago … and that’s good news in my book. It’s not perfect, and only covers MySuper products at this stage (more funds will be added over time). And the data on the dud funds won’t be out until later in the year … but it’s a great first step.

So here’s my tip: when you’re lodging your return in a month’s time, check out YourSuper … after all, it’s the same site, right Neil?

Tread Your Own Path!

A Super Idea?

I have just seen a news item on a proposed policy which could see victims of domestic violence allowed to withdraw up to $10,000 from their super.

Hi Scott

I have just seen a news item on a proposed policy which could see victims of domestic violence allowed to withdraw up to $10,000 from their super. Typically victims of domestic violence are women, and women on average have less super accumulated, due to raising families. I am supportive of any initiative to help victims of violence, but is this likely to help or hinder them financially in the long run?

Theresa

Hi Theresa,

Of course! Raiding your super early will hurt you financially in the long run.

Yet I also agree with Superannuation Minister Jane Hume, who says that it’s simply another tool, and if it encourages women to leave a dangerous, abusive relationship then that’s a good thing.

However, as someone who works in the community sector and has helped women in this very situation, I don’t think accessing 10 grand from super is high on their priority list.

What I think should be on the Government’s priority list is properly funding emergency housing, legislating for paid family violence leave, and doing everything they can to help these courageous women (and their kids) find safety and security.

Yes, there is a cost to properly fund this … yet there is an even bigger cost if we don’t.

Scott.