Does the Barefoot Investor Still Use ING?

Do I still use the ING Orange Everyday account?

Yes, I do.

Though there are plenty of better accounts on the market at the moment (and they change all the time).

Each offers fee-free banking, buckets (see below), and a decent amount of interest. And, importantly, they’re covered by the Australian Government Bank Deposit Guarantee.

There are plenty more springing up every day, so check sites like www.mozo.com.au and www.finder.com.au to see what the best deals are on offer.

However, rest assured, I’m no ING cheerleader — I’m simply a fellow customer.

In fact, I’m very clear that there are things about ING I don’t like so much.

Case in point: here’s a question I answered on ING recently …

Problems with ING

Hi Scott,

Last week my husband and I were hit by scammers, who ‘ported’ (transferred) all our business mobiles from Telstra.

We contacted Telstra, who assured us that our mobiles could be recovered and that they would report the matter to their fraud department. Little did we know what was to happen next … the scammers found our details on social media, and once they knew our dates of birth and address they hit all our bank accounts.

Thankfully, ANZ and CBA blocked them first go. Yet ING gave them access to all our accounts! With ING, all the scammers needed was to recover the customer number: there were no security questions asked — maiden name, school I attended, favourite pet, nothing!

All our savings, including our redraw facility, were drained within three days: a total of $15,000.

ING does have an ‘online security guarantee’ but they are not honouring it because we did not notify them on the day our mobile was scammed!

I know you are one of their biggest supporters, but after banking with ING for 15 years (and I must admit it’s the best little savings account I’ve ever had) I’ve now lost all respect for them.

Please help me to get ING to upgrade their security. After all, what are the security questions for if you don’t need to use them?

Gina

Hi Gina,

What a horrible situation!

Now let’s get a couple of things clear:

First, I have zero association with ING, other than being a fellow customer.

Second, what you’re talking about is identity fraud, which affects thousands of people (and every major bank).

Still, I called ING and asked them, “Why doesn’t ING ask security questions like the other banks do?”

They told me that they have disabled their online retrieval function, which means that they now force customers to call the contact centre, where they are faced with additional security questions.

They also assured me they have a dedicated team that constantly monitors and updates their security.

Finally, it is totally outrageous that they declined to refund you … so I asked them about that too. Thankfully, they have now agreed to fully reimburse you for your losses. As they bloody well should.So much for my 'love' of ING!

What's more, my ING account is just one part of the big picture, which I call the 'Serviette Strategy'.It’s become kinda famous. Let me tell you about it ...

My Serviette Strategy for Bank Accounts — Barefoot Investor

Date: 1 November 2012

Location: Romsey Pub (Romsey, Victoria)

“Here’s how we’re going to manage our money”, I announced to my wife Liz (on our very own Barefoot Date Night).

“Oh really?” she said, eyebrows raised, head cocked to one side.

See, during the years that Liz and I had been ‘living in sin’ (as my grandmother put it), we’d kept our money separate, splitting things roughly down the middle.

Yet a month out from our wedding I knew it was time to have ‘the talk’.

To succeed over the long term, I knew I had to come up with a simple, hassle-free plan that operated on autopilot (for Liz) yet moved us forward and built our wealth (for me).

“You’re talking about putting us on a budget, aren’t you?” said Liz, folding her arms.

“Well …”

“Let’s get one thing straight right here. I will not have you dictating every last dollar we spend”, she declared, giving me a factor-10 stink eye.

I assured Liz that I wasn’t advocating we cut our own hair or wear acid-wash jeans from Best & Less (though it really is only a matter of time before they come back into style), and I certainly wasn’t suggesting we follow a strict budget.

So I decided to make it so simple that I could draw our plan on the back of a serviette.

Introducing the Serviette Strategy

Before the parma came, but after the calamari rings, we’d agreed on the three things we really wanted from our money.

Top of our list?

To be totally financially secure.

Which made sense. After all, we were about to get hitched and we were already pregnant (scandal!).

And, according to Relationships Australia, the biggest cause of relationship breakdowns is fights about money (and monogamy, but mainly money).

The second thing we valued was the freedom to travel at least once a year, and to enjoy nice dinners out with family and friends.

The third thing was to build our wealth over the long term, so we could wind down working sooner rather than later. (Okay, if I’m being really honest, Liz was kind of ‘meh’ about the exciting world of long-term investing … but she understood it came with the territory when she married the Barefoot Investor.)

It was my time to shine.

With one final swig of Carlton Draught for courage, I pulled out a pen and drew our new financial plan on the back of a pub serviette.

Here’s what I drew:

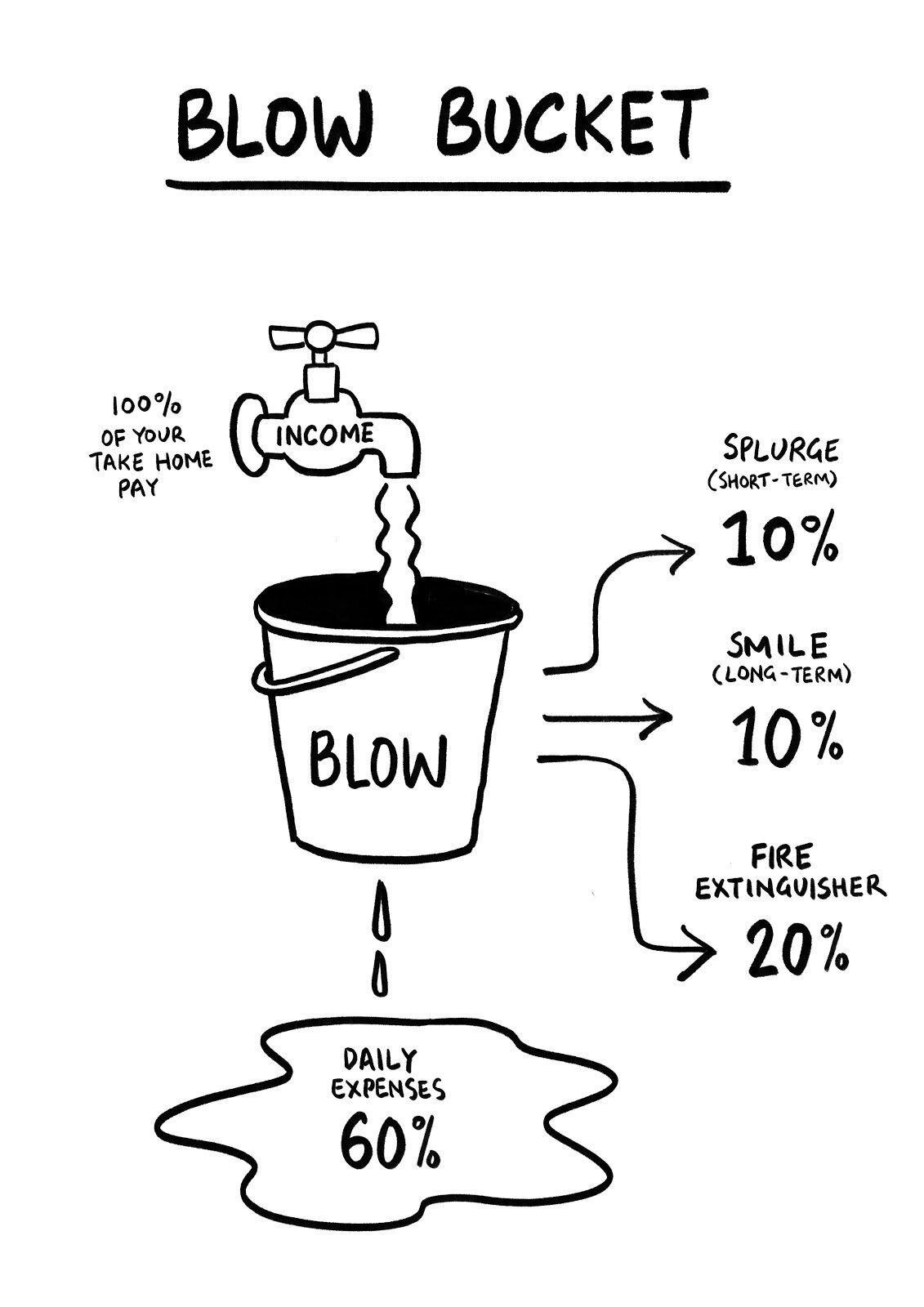

Yes, our entire money management plan consists of dividing our income into three ‘buckets’:

Blow Bucket, for daily expenses, the occasional splurge and some extra cash to fight financial fires

Mojo Bucket, to provide some ‘safety money’, and

Grow Bucket, to build long-term wealth and total security.

Don’t for a moment be fooled by the simplicity of the picture. Liz and I have used this plan to manage our investment property, save for our honeymoon, pay off our mortgage, manage a business that earns income in inconsistent lumps, create a solid-as-a-rock emergency account, and compound our wealth.

Even better: thousands of people of all ages, income levels and sexual orientations have used my Serviette Strategy with stunning success.

Here’s how it works…

The Blow Bucket

Most people only have one money bucket.

If you’re renting, it’s your transaction account. If you own a home, it might be your mortgage. Either way, your pay comes in, money goes out, and you ‘hope’ some is left over to put towards investing and saving.

And then old Fido finally catches that car. D’oh! Vet bills.

And then an unexpected emergency: Christmas. Ho! Ho! D’oh!

There’s nothing systematic about it.

Even worse?

Your Blow Bucket has a hole in it: every dollar of income you pour into it leaks out the bottom.

This is just as true for a uni student blowing their Austudy on a pub crawl as it is for 90s rapper MC Hammer, who squandered his $30 million fortune on fancy (leased) cars, a thirsty entourage and (my personal favourite) gold-plated ‘Hammertime’ gates for his home. (‘U can’t touch this’ — apparently his creditors could.)

The deal with the Blow Bucket is spending more money on the stuff you love and less on the stuff you don’t. Better yet, with this plan you’ll actually allocate some of your pay packet to guilt-free splurges for stuff that’ll put a smile on your dial.

The Barefoot benchmark: live off 60% of your income

So how much does it cost you to keep the lights running and the kids from drinking out of the dog’s bowl? In other words, how much does it cost to run ‘You, Inc.’?

Well, a good yardstick is allocating 60% of your take-home pay (i.e. your after-tax household income) to food, shelter and Netflix — all the things you need to live safely in the suburbs.

I want you to try and live off the Barefoot Benchmark of 60% of your pay. Leave that 60% in your ‘Daily Expenses’ account for, well, daily expenses.

What about the other 40%?

10% Splurge: You are hereby directed to go out and blow 10% of your take-home pay on anything that makes you feel good (shoes, booze, lattes, whatever).

Set up a regular direct transfer to a separate, linked account and make it automatic. Then you can spend it how you like. But remember, when your Splurge money for the month is gone, it’s gone — you can’t cut into your other accounts.

10% Smile: Another 10% of your take-home pay should be automatically transferred to another online savings account.

This is not for splurging when you feel like it; it’s for big goals that will take longer to save up for. Overseas holidays, weddings, divorces — anything that’s going to cost more than a few weeks’ wages.

I call it the ‘Smile’ account because every time you think of what you’re saving up for, you smile.

20% Fire Extinguisher: Finally, allocate 20% of your take home pay to your ‘Fire Extinguisher’ account, also an online savings account. Again, make it automatic with a direct transfer every time you get paid.

You see, you’re going to use it to put out financial fires.

What’s a financial fire?

It could be your crushing credit card debt.

It could be the home deposit you’re saving up for.

It could be paying off your mortgage.

And that’s the point — your Fire Extinguisher account will be used for different financial fires at different times in your life. The 20% amount won’t change, but what you use it for will.

The Mojo Bucket

The aim of the Mojo Bucket is to get your Mojo back, baby.

You know the feeling — it’s a spring in your step that says, “I don’t stress about money”.

Now, you shouldn’t keep your Mojo in an offset account or a redraw facility attached to your mortgage, and you shouldn’t link it to your everyday transaction account. This is a totally separate, high-interest online savings account that I want you to open up with $2,000 (to start with).

You only touch it in emergencies, like losing your job or getting sick … or your house burning down.

(Tickets to Gaga are not an emergency.)

If you don’t have a spare $2,000 to put into your brand-new Mojo account, do whatever you can to find this money. Flog stuff on Gumtree, put in overtime at work, sell your kidney.

The Grow Bucket

The third and final bucket I drew for Liz was the Grow Bucket.

The aim of the Grow Bucket is to get a little wealthier every day.

Every dollar you pour into the Grow Bucket should double every seven to ten years (in boom times it’ll be quicker; in bad times it’ll be slower). It’s not exactly quick, but over your life it can make you incredibly wealthy.

Your Grow Bucket includes your super fund and any other investments you own (like shares, investment property, or education savings for your kids). As we work our way through the Barefoot Steps, the Grow Bucket will take centre stage, but right now it’s more than enough just to have your super sorted.

So that’s what I drew for Liz.

She sat there, surveying the serviette.

“I like it, Mister Pape.”

Success!

Okay, so having explained all that, I’d like to tackle something that really bugs me -- people assuming I'm an ING 'diehard'. I'm not.

Again, I first wrote about this years ago and highlighted the low fees. Today there are better bank accounts on offer. How do I know? Because my readers constantly email me about them! So before you do anything, google the best accounts on offer now.