Articles & Questions

Every week I publish a fun new article on a money topic I think you’ll find interesting. I also answer a handful of reader questions. Subscribers to my newsletter get to see everything first — but you can browse some of my past articles & questions on this page.

My Best Articles

Not sure where to start? Below I’ve handpicked a few of my favourites. And if you like what you see, don’t forget to subscribe to my free newsletter to get new issues before anyone else!

Search Articles

Help me, help them

I’m a teacher, and I have an opportunity to put together a short finance course (10 lessons) for a Year 10 cohort at my school. I want to focus on how to set them up with really achievable, totally practical and easily applied approaches for future financial security.

Hi Scott,

I’m a teacher, and I have an opportunity to put together a short finance course (10 lessons) for a Year 10 cohort at my school. I want to focus on how to set them up with really achievable, totally practical and easily applied approaches for future financial security. There’s so much I want them to understand and so little time. What do you feel are the most critical lessons our teenagers need right now for the years ahead?

Sandra

Hi Sandra,

Kids don’t learn by lectures, but by rolling up their sleeves and doing stuff.

That’s why a few years ago I came up with my Barefoot Ten, which are ten things every kid should do before moving out. And since you need ten lessons, they could be useful inspiration. Here they are:

1. Open a zero-fee, high-interest saving account.

2. Buy and sell something second-hand.

3. Learn to cook at least two low-cost delicious, nutritious meals from scratch.

4. Volunteer in their local community.

5. Save their parents at least $100 on your household bills.

6. Promise to never, ever get a credit card.

7. Get a part-time job from age 15.

8. Earn at least one glowing reference from a boss.

9. Open up an ultra-low cost, high-growth super fund.

10. Set up a savings account for a home deposit (and nickname it even with a buck),

Feel free to steal these or create some of your own.

And if there are any primary school teachers reading … I have a book coming out in November that starts kids really early. I’ve just put the finishing touches on it. After I handed it to my editor, he said:

“This is the best book you’ve ever written.”

Scott.

Should I kick my friend out?

I’m in a difficult situation with my friend. She’s been renting my large family home from me for the last three years, paying $825 a week in rent.

Dear Scott,

I’m in a difficult situation with my friend. She’s been renting my large family home from me for the last three years, paying $825 a week in rent. I recently had a rental appraisal done and the estimated rent for the house is now between $1600-1800 per week! I’ve sent her the agent’s quote and asked her to make a decision within the month. My friend said the agent has overpriced my house and she wouldn’t pay much more than $820 per week. I know there is a housing crisis on at the moment and she has a family to consider. Help! What would be a fair thing to do? She’s already ‘unfriended’ me on Facebook!

Jocelyn

Hi Jocelyn

Thank-you for providing me with reason #784 that I am not on social media.

Look, it’s your money and not my place to judge what you do with it … but we’re not exactly quibbling over ten bucks here: you’re subsidising her to the tune of $50,000 per year!

So, you’ll have to decide whether you want to continue doing that.

If you don’t, I’d recommend hiring an agent to deal with this for you. Yes, it’s an added cost … but then again, so is the emotional cost of being unfriended on Facebook!

My advice?

Be classy, with your head held high. Tell the agent you want to give your current tenant the first right of refusal at the market rate. And if I were in your thongs, I’d be generous about giving her time to find alternate accommodation if she doesn’t want to pay the market rate.

Scott.

You Have ZERO Credibility, Barefoot

Both my sons (age 13 and 15) have read your books and are practising the ‘Buckets’ strategy. They are slowly, slowly building their wealth to financial independence using earnings from weekend chores, part-time jobs and compound interest.

Scott,

Both my sons (age 13 and 15) have read your books and are practising the ‘Buckets’ strategy. They are slowly, slowly building their wealth to financial independence using earnings from weekend chores, part-time jobs and compound interest. However, I now question your credibility and moral compass. Your misguided publication of your cringe-worthy response to the unbelievable letter claiming “my hard-working 13-year-old has saved $200,000” has left me flabbergasted. Was this a joke? What 13-year-old saves $200,000? Hardworking? Probably. Lucky and the beneficiary of an inheritance or family trust fund? Definitely. This is a slap in the face to every Aussie battler. Sadly, Scott, you have lost a reader here.

Anthony

Hi Anthony,

Congratulations, you have won my reader ‘spray of the year’ award!

So the kid in question did make the $200,000 on their own … they’re actually in the entertainment business. (However, at the parents’ request I’m not being any more specific than that.)

Yet the real issue here isn’t with the kid, it’s with you.

It sounds like you have a lot of hang-ups about wealth. Now, Anthony, your concrete is set, and you’re unlikely to change. But you don’t want your sons to inherit your anger-envy. After all, it’s totally unproductive.

Fact is, they’re going to meet wealthy people who’ve gotten money from their family. That’s life. Not everyone is equal. Not even you. (Just try comparing your salary to an average Indonesian’s.) But your sons can control one thing: the amount of effort they put in.

Scott.

Lost in Space

I am a new investor swept up in a crazy world of shares and crypto (and insane house prices). I put $5,000 in the share market using the Spaceship app, and then the market crashed!

Hey Scott,

I am a new investor swept up in a crazy world of shares and crypto (and insane house prices). I put $5,000 in the share market using the Spaceship app, and then the market crashed! Now whenever I look at my portfolio I feel queasy and want to pull it all out. Is Spaceship worth the hype, or have I thrown away my savings? And is my gut feeling to pull it out and invest in an ETF right, or should I hold on through this ‘bear market’?

Alison

Hi Alison,

Let’s you and I jump in the DeLorean and go back in time.

This time last year you were probably suffering major FOMO hearing your friends boasting about how much fast money they were making betting on Dogecoin, hot stocks and NFT-ape jpegs.

So you looked at all the investing apps and chose the one that had delivered the highest short-term returns, Spaceship. The reason it shot the lights out was because it was investing in red-hot growth stocks that investors seemingly couldn’t get enough of.

And then … investors changed their minds, sending growth stocks deep into the red. This year Apple is down 18%, as is Amazon (-35%), Tesla (-40%), Facebook’s Meta (-53%), and Netflix (-70%).

This explains why Spaceship’s flagship portfolio is down 35%.

Yet what you want to know is: where does it go next?

Honestly, I have no idea. I totally suck at market forecasts (as does every other human). And that’s why I don’t forecast. Instead, I invest in index funds that own shares in business across a range of industries. They really are set-and-forget investments, and when you combine them with low fees on many of these apps they’re great.

Scott.

Help, My Daughter Is Blackmailing Me

My adult daughter, her partner and one-year-old son are renting in a regional area and cannot afford a home loan deposit. I have offered to have them live with me rent free for six months while they save.

Dear Scott,

My adult daughter, her partner and one-year-old son are renting in a regional area and cannot afford a home loan deposit. I have offered to have them live with me rent free for six months while they save. But they want me to take it a step further and go guarantor for them. I did consider it, but as a single parent with three teens at home and a mortgage already I’m not comfortable with the risk. The problem is they are insistent that it is their only way of owning a home and that I am the only person who can help them. They have told me it will be my fault if they are homeless. I feel like they are blackmailing me. What would you do, Barefoot?

Valerie

Hi Valerie,

I’m with you.

Know this: parents all over the country are having this conversation with their kids.

It’s frustrating, because you might really want to do it. However, as they say on the plane, you need to fit your own oxygen mask before helping others. Besides, six months free rent is a bloody generous offer already!

If you feel your daughter is emotionally blackmailing you now, can you imagine what she’d do if prices continue to fall and she finds herself in a financial pickle?

Remember, as a single woman with three kids, statistically you are at the highest risk of being homeless.

Scott.

How much do you REALLY need to retire?

Let me tell you about the worst speech I’ve ever given in my life. It happened five years ago when a friend asked if I’d speak about retirement at a lunch for his men’s group.

Let me tell you about the worst speech I’ve ever given in my life.

It happened five years ago when a friend asked if I’d speak about retirement at a lunch for his men’s group.

“They’re lots of fun”, he said with a smile.

As I drove up to the gates, I realised this was no ordinary bunch of blokes: it was an exclusive private club in a wealthy suburb of Melbourne.

Specifically, two hundred slightly sozzled old guys.

I started on safe ground, talking about the state of the sharemarket.

Then I let one slip through to the keeper, explaining my Donald Bradman Strategy:

“If you own your own home, get the aged pension, and you’re willing to do a bit of paid work, you could comfortably retire on as little as $250,000”, I said matter-of-factly.

Talk about leg before wicket …

“BULLDUST!” yelled one angry multi-millionaire.

“That’s less than I paid for my yacht!” blasted another.

The crowd erupted, and basically bounced me off stage.

Howzat?!

Clearly I’d hit a nerve. After all, the number one question every pre-retiree wants to know is this:

“How much do I need in super to retire on?”

And until now there’s only been one number that everybody quotes: the Association of Superannuation Funds of Australia (ASFA) standard: $545,000 for a single and $640,000 for a couple to have a comfortable retirement.

There are two problems with this.

First, it’s out of reach for most people: the ABS says that the median super balance on retirement is $250,000 for men and $200,000 for women. So for an average working Aussie, why bother trying?

Second, the people who calculate the ASFA figure are … the super fund lobby. It’s a bit like asking old Dr Kellogg, “What’s the most important meal of the day?” (Breakfast, of course!)

Yet for years theirs was the only retirement figure available.

Until now.

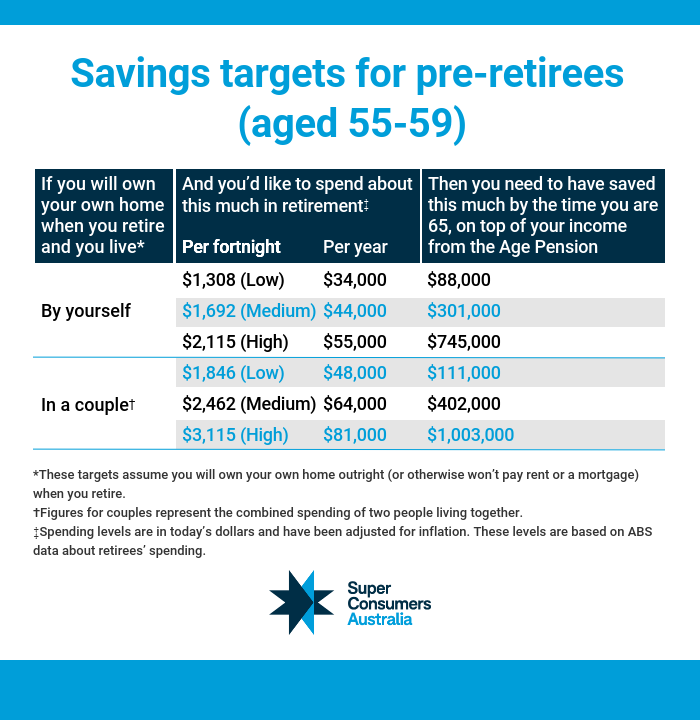

A group called Super Consumers Australia (a partner of CHOICE) has done the research and come up with their own figures — and given me a sneak peek.

Not only are their figures much more attainable, they’re based on ABS research on what Aussie retirees actually spend.

So what’s their number for a comfortable retirement in these inflation-stressed times?

The newest figures are $302,000 for a single and $402,000 for a couple in a middle-income household, again assuming they don’t pay rent or a mortgage.

(This is, admittedly, a little higher than my Don Bradman figure, but that’s mainly because I encourage retirees to keep working at least a day a fortnight to supplement their income.)

Either way, for far too long the super industry has played to the millionaires in the members’ stand. What these figures do is give the average Aussie a fighting chance at scoring 100 (not out!).

Tread Your Own Path!

Scammers Got the Lot

My daughter recently clicked on a text message from scammers saying they were from ANZ. She entered her login details and gave the scammers full access to her account.

Hi Scott,

My daughter recently clicked on a text message from scammers saying they were from ANZ. She entered her login details and gave the scammers full access to her account. I’m worried about what will happen next. I’ve googled it a bit and have seen that scammers can change your postal address and steal your identity. Is there anything my husband and I can do to help her work through this and protect her from what they might do with her info?

Kellie

Hi Kellie,

Grab your phone. Grab your daughter. Dial 1800 595 160.

That’s the number for IDCARE, Australia’s national identity and cyber support service. Their hotline is manned by specialist identity and cybersecurity counsellors who will give your daughter free advice.

Tell your daughter not to beat herself up too much. These things happen a lot. In fact, 2.1 million Aussies experienced one or more types of personal fraud in 2021, according to the Australian Bureau of Statistics (ABS). Yet, shockingly, only half of those who experienced a scam said they reported it to an authority.

Don’t let them get away with it!

Scott.

I’M FREAKING OUT!

I’m sitting here watching my portfolio plummet. The stock market is down 4.75%, and my portfolio is down 5%. IN ONE DAY. I have only been investing for a couple of years and I am freaking out. What should I do?

Hi Scott,

I’m sitting here watching my portfolio plummet. The stock market is down 4.75%, and my portfolio is down 5%. IN ONE DAY. I have only been investing for a couple of years and I am freaking out. What should I do?

Louise

Hi Louise

I feel your pain.

Now, as Warren Buffett would say … actually bugger that! All the Mr B quotes in the world can’t prepare you for your first drop in the market.

Here’s how I deal with it.

First, I don’t invest any money in the share market that I think I’ll need in the next five years.

Yes, the interest rate I’m getting sucks, but not as much as seeing the money I need evaporate in a sell off, right when I need to spend it. If you put short-term money in stocks or (god help you) crypto, you really need some time in the contemplation corner.

Second, I have come to think of my share portfolio like my farm. It’s there to provide me with a golden harvest of dividends over my lifetime. Some years there will be bumper crops, other times there will be droughts. That’s just how the world works. Yet over the long term, owning the farm makes sense (especially when I don’t have to drive a tractor to get the income!).

Finally, how do I react to savage sell offs like we had last Monday?

Well, I don’t. I feel the same way about shares falling as I do reading a newspaper headline that says ‘farm prices are down 5%’. Sure, it’s a bummer, but what can I do about it?

Call up a real estate agent and sell?

They’d be very happy to claim the commission, but would I be any better off?

Of course not!

I’m now invested in broad based, low cost index funds, and my golden rule is this: ‘never sell the farm’.

And so if I never plan on selling, what do I care about the price?

Scott.

I Have Tears in My Eyes

Six years ago we were in deep trouble. I hadn’t worked for years as I’d been looking after our young daughter, who had cancer. We’d been living on one income and had car loans, credit cards, store credit, unpaid phone bills, erratic repayment history, and a mortgage.

Hi Scott,

Six years ago we were in deep trouble. I hadn’t worked for years as I’d been looking after our young daughter, who had cancer. We’d been living on one income and had car loans, credit cards, store credit, unpaid phone bills, erratic repayment history, and a mortgage. Having enough money to cover everything seemed like a mysterious process that was only for rich people.

Well, the most incredible thing happened to us yesterday. Six years after buying your book, we have paid off our home loan and have no debt at all. It’s the most secure, calm feeling, and I am so damn proud of us.

We now have Mojo, holiday savings, shares and enough money to cover our daily expenses while still having dinners out. We’ve taught our children some massive lessons about money, and now the eldest will have her house paid off in five years.

Scott, it’s been life-changing and I write this with tears in my eyes. I’m so grateful for your book. We are ordinary people and you spoke to us in a way we could understand. The daughter who had cancer is now healthy and will soon be going for her L’s – she is busting to reach an age where she can work too! ‘Thank you’ isn’t enough but I wanted you to know it’s the best freedom I’ve ever felt and I wouldn’t have known how to get here if you hadn’t shown us the way.

Linda

Hi Linda,

Wow. Just wow. You did great!

It’s kind of amazing to me that almost seven years after I wrote my book there are still people like you coming back and telling me about their journey.

For anyone else out there who’s still working through the Barefoot Steps, I hope Linda’s story gives you some motivation. Your story is next.

Scott.

Why I Quit Drinking

It’s been almost a year since I decided to stop drinking. It all started when we headed off in the RV on our ‘lap around the map’ adventure.

It’s been almost a year since I decided to stop drinking.

It all started when we headed off in the RV on our ‘lap around the map’ adventure.

I decided – on a whim – that I didn’t really want to drink around the kids (and, besides, hangovers with four kids in a seven-metre-long van would have driven me off the road).

So I nervously announced my major life decision to Liz.

She just frowned and said:

“But you don’t even drink that much anyway!”

(She’s my rock.)

Truth be told, I always thought I’d resume drinking when I got home from our RV trip. After all, I live in the country, and when we have a boys’ night out we organise a bus to drive us both to and from the boozer. (Think about that: there’s not even the slightest thought that we’d have a light beer and drive ourselves home. Oh no, it’s on like Donkey Kong.)

So my mates think I’m weird, but I think I’m ahead of the trend.

‘Non-alcoholic drinks’ is the fastest growing drinks category in Australia. Sales of alcohol-free sauce at Dan Murphy’s have increased by more than 100% in the past two years. Perhaps that’s why when Dan Murphy’s opened their first ever bar they decided to not serve any grog. That’s right, their bar in Melbourne is called ZERO%; it serves 30 zero-alcohol drinks on tap and offers more than 200 others to take home.

Yes, being off the booze is just so hot right now. The movement even has a name – ‘Sober Curious’ – which makes me want to get rolling drunk. For me it’s right up there with Gwyneth Paltrow’s $75 vagina candle (which actually sold out, so maybe it really is a thing).

There are two factors driving this long-term trend:

First, young people are drinking more responsibly than any generation before them. According to the Centre for Alcohol Policy Research, the number of 18- to 24-year-olds who don’t drink has doubled in the past 20 years.

Second, and most importantly, non-alcoholic drinks are getting a lot better.

So my favourite beer … isn’t actually a beer. It’s called ‘Hop Valley H20’ by the Heads of Noosa Brewing Co. It’s a mix of soda water and hops, and it’s the absolute bomb. It has zero sugar, zero calories and zero alcohol. Even my old man, a seasoned drinker, likes it.

And what about wine?

Well, last month I went to see Crowded House.

When I headed to the bar, I looked up and realised that the first five drinks were all non-alcoholic. So I ordered a glass of non-alcoholic red wine and took a sip … and it blew my Barefoot socks off.

“That is the BEST non-alcoholic red wine I’ve ever tasted!” I yelled at the barman.

“That’s because it’s red wine … sorry, I must have misheard you”, he said sheepishly.

Back to the Ribena for me!

Tread Your Own Path!

From Homeless to Hero

I’m a single woman in my fifties. Not long ago I was homeless and in debt. Then I came across your book, read that apparently “I’ve Got This”, and was determined to get myself out of the hole I had dug for myself.

Hi Scott,

I’m a single woman in my fifties. Not long ago I was homeless and in debt. Then I came across your book, read that apparently “I’ve Got This”, and was determined to get myself out of the hole I had dug for myself. And I did. A couple of years on I have paid off my credit card debt, triumphantly (quietly) phoned my bank to close that account, signed a lease for a very beautiful home, bought $10,000 in ETFs, and saved $15,000 in Mojo (which gives me a huge sense of peace and freedom while I am between jobs and have no income). A big, warm thank-you for giving me and so many others such strength and hope, without shame and guilt for being in a financial mess.

Now I am wondering what people like me, who don’t have enough life left to accomplish ‘Step 4: Buy Your Home’, should do. Or have I got this too?

Sarah

Hi Sarah,

Before I get into your question, let me address the elephant in the room.

Some people would be reading your story and be shocked that you could be homeless.

However, you and I know that it’s actually pretty normal. In fact, around 400,000 women over the age of 45 are at risk of homelessness, according to a report from Social Ventures Australia.

Why?

Because older women who don’t own a home and have very little savings often end up falling through the cracks, and don’t even have access to social housing.

So should you consider taking up the Government’s Help to Buy scheme and buy with just a 2% deposit?

Heck, no!

By all means keep saving like a woman possessed. And who knows — when the time is right, you may be able to afford to comfortably buy your own home. Understand that you have already achieved financial security against all the odds … so never trade it away.

Finally, it’s human nature to forget how far you’ve come.

You went from being homeless to being debt free, owning shares and having an emergency fund behind you. Stop for a moment and celebrate it. You, Sarah, are incredible!

Keep going, you got this!

Scott.

Am I Funding the Invasion of Ukraine?

Wally, my long-suffering editor, knows he has a hot question when it’s written in ALL CAPS. Here’s one that landed last week: “AM I FUNDING THE INVASION OF UKRAINE?”

Wally, my long-suffering editor, knows he has a hot question when it’s written in ALL CAPS.

Here’s one that landed last week:

“AM I FUNDING THE INVASION OF UKRAINE?”

Wally leaned in … and it went on … and on, and on, and then took some weird tangents about Bill Gates. (Why is it always about Bill Gates?)

Anyway, the gist of the person’s question was this: he didn’t want his super to be funding war criminals (or Windows 97).

And fair enough too!

Yet, while I’ve got the tin-foil hat on, let me tell you that for well over a decade the super industry fought tooth and nail against laws that required them to disclose to investors where they were investing their money.

“Seriously, just trust us, we’re good guys!” Uh-huh.

Thankfully, the disclosure laws have now been passed, so you can see where your money is invested.

Here’s the deal. There are two ways to invest ethically within super: by choosing a dedicated ethical fund, or by selecting an ethical investment option within your existing fund.

Just understand a couple of things: first, the term ‘ethical’ is about as loose as an over-28s nightclub, so you need to dig in and see what they’re actually investing in, and whether it fits with your worldview.

Second, the fees for ethical funds and options are often much, much higher than for general investment options … which will eventually detract from your returns.

Regardless, there’s a very good chance your super fund has dumped any Russian assets it was holding. Since the start of the crisis, most funds have written off hundreds of millions of dollars of Russian investments. Yet the only way to be really sure is to call your fund and ask them.

Tread Your Own Path!

Bill Now, Pay Later?

As I was scrolling through my Facebook newsfeed drinking my morning coffee, I spotted an ad for Deferit. There are lots of ‘buy now, pay later’ schemes these days, but this is the first I’ve spotted for paying bills and splitting them into instalments.

Hi Barefoot,

As I was scrolling through my Facebook newsfeed drinking my morning coffee, I spotted an ad for Deferit. There are lots of ‘buy now, pay later’ schemes these days, but this is the first I’ve spotted for paying bills and splitting them into instalments. Although I don’t use these types of services myself, I know a growing number of people who do — so curiosity got the better of me and I had a look at what they claim to do. They claim to have no interest or late fee charges. They pay your bill up front and get you to pay it back in four equal fortnightly instalments. It appears they only charge a monthly fee when you utilise their service. My question is: is it really that transparent or is there a catch?

Sarika

Hi Sarika,

They’re basically Afterpay with a different logo.

Yet, instead of splitting $150 to get some bro-tox (why should the ladies have all the fun?), they’re suggesting you do it with your day-to-day bills.

Ding! Ding! Ding!

All these fintech bros have convinced themselves they’re saving the world. Heck, Afterpay still claims they’re a ‘budgeting app’, and so does Deferit.

Bulldust!

They’re out for themselves. The reason they encourage people to use money to pay for things is because their business model relies on it.

True budgeting advice – say, from a free financial counsellor – would get to the guts of the matter by sitting down with you, working through your budget, and looking at your capacity to pay your bills.

And this may reveal that you’re in over your head and need more than a fortnightly bandaid. Or it may help you negotiate a short payment plan with your billers so you can pay your bills with cash on time. And that will allow you to stand strongly on your own two feet.

Scott.

I’m Dying to Leave

My sister was unfortunately diagnosed with a terminal illness three years ago – added to that, she now wants out of her marriage.

Hi Scott,

My sister was unfortunately diagnosed with a terminal illness three years ago – added to that, she now wants out of her marriage. Suffice to say it is not a healthy environment for her to be in. Her three children are all at university and have part-time jobs, but my sister (who was a nurse) really can’t do much anymore. She would leave her husband but is worried that he would string out selling the house for 12 months, and she wants to travel while she can. She has a lot of superannuation but has been told she can’t access it until she has 24 months to live. Seriously, how does anyone know this without a crystal ball? What can she do to get some of her super, as it is her money?

Nicola

Hi Nicola,

What a heartbreaking situation.

Your sister is battling a life-threatening illness, a divorce and financial issues, all at the same time.

For her the clock is ticking, and she understandably wants to get out and live while she still can.

So you should encourage her to see a family lawyer immediately. You could go along to the meeting with her, and consider offering to be her Enduring Power of Attorney (POA). That way you can deal with the boring details while she gets on with living her best life.

She should also consider updating her will to bypass her husband, if she chooses to leave him. It’s usually a 12-month journey to get a divorce, but the property settlement can be done at any time. Again, see a lawyer: they can provide advice, while you can provide love and support to see her through.

Good luck.

Scott.

Out of the Cesspool

Two years ago, my wife and I had five credit cards topping $70,000 and seemingly no way out. After following the Barefoot Steps we have not only paid this cesspool completely off, we now have $100,000 in the bank.

Hi Scott

Two years ago, my wife and I had five credit cards topping $70,000 and seemingly no way out. After following the Barefoot Steps we have not only paid this cesspool completely off, we now have $100,000 in the bank. Right now we are on a Gold Coast holiday for five nights with the kids and are pinching ourselves that we got here!

So it’s time for the next step. I’m a builder and my wife and I want to buy land and then build in 12 months’ time. I pay my wife a wage for her work in the business, but not me. We are not sure how to approach a bank. Any suggestions?

Nick

Hi Nick,

You went from seventy grand in the hole to a hundred bones in the bank in just two years?

Congratulations, you two are on fire!

As far as getting a home loan is concerned, it’s worth chatting to your accountant to make sure your business and personal finances are sorted and clearly separated. Once that’s done, it’s time to go see a bank. The big thing a bank is looking for is that you have the ability to build your savings and pay down your debts – and you have been doing both.

You Got This!

Scott.

Tarzan Feeds Six People

My 58-year-old husband is the sole breadwinner, and we have six adults at home. We have a beautiful new house built on the site of our old home and a mortgage of about $350,000, which is currently interest only and consequently never seems to reduce.

Hi Scott,

My 58-year-old husband is the sole breadwinner, and we have six adults at home. We have a beautiful new house built on the site of our old home and a mortgage of about $350,000, which is currently interest only and consequently never seems to reduce. Given that everyone has started running around like headless chooks yelling “inflation!”, and my hubby’s super has plummeted again, should he stop putting the extra $750 a month into super and instead put an extra $500–$600 onto the mortgage? Obviously – God willing and no World War Three – the funds will pick up again, but we would really like to own our home fully while he’s still able to work. It seems like a reasonable strategy to us, but we’d really appreciate your advice.

Jane

Hi Jane,

There’s a lot to unpack here.

First, if you’ve elected to pay interest only on your home loan, you’re not actually paying off the principal, only the interest. If you want to pay down the debt, you’ll need to reconfigure your loan.

Now let’s talk about the monkey in the jungle:

Jane, you said there are six adults living in your house, and just one Tarzan providing for them all?

Talk about swinging from the branches! I’d suggest you hold a meeting around the campfire and get everyone to start pitching in to help pay down that debt.

Scott.

Here’s How Much You Should Have in Super Right Now

“You look different in real life than you do on the cover of your book”, said the waitress.

“You’ve lost a lot of weight.”

It’s true, over the past few months I’ve dropped roughly 13 kilos.

“You look different in real life than you do on the cover of your book”, said the waitress.

“You’ve lost a lot of weight.”

It’s true, over the past few months I’ve dropped roughly 13 kilos.

How did I do it?

Liposuction! Just kidding. I banished biscuits from the house and set up a gym in the shearing shed.

That’s the thing about being tubby: you can’t hide it (especially if your mug is printed on millions of books). Yet when it comes to wealth it’s the opposite. Plenty of people are hiding their financial flab in a leased Lexus.

So, for a moment, let’s you and I get naked and compare our financial bits. Here’s a table from the Association of Superannuation Funds of Australia (ASFA) that breaks down how much the men and women have in super on average by age.

So ask yourself: “Am I flabby or fit?”

Remember, it’s just an average.

It depends on how much you earn, and how long you take off to raise kids. That being said, if you’re following the Barefoot Steps long term, you’ll almost certainly end up with more than the average.

As I say in Barefoot Step 5, once you’ve bought a home (though not yet paid it off), boosting your pre-tax super contributions from 10% to 15% will make a hell of a difference. As will switching to a growth investment option if you’re under the age of 45. And lowering your fees will give you a huge boost at any age (remember, you’ll pay the majority of your fees after you retire, because that’s when your balance is the biggest).

Don’t be flabby … be financially fit!

Tread Your Own Path!

Getting Out of Here

With borders now open and people enjoying the luxury of travel again, what do you think is the best option for money access overseas?

Hi Scott,

With borders now open and people enjoying the luxury of travel again, what do you think is the best option for money access overseas? Should I get a prepaid foreign currency card, and if so is there one you recommend? Or should I just use my Australian account and take the fees and exchange rate as they come?

Thanks, Sandiego

Hi Sandiego,

This is the first travel money question I’ve received in years!

Personally, I think travel money cards that the banks and currency operators offer are as dated as travellers’ cheques and thumbing through a four-inch-thick Lonely Planet guide to Bali.

These days most decent transaction accounts offer free international transactions, and they don’t mark up the wholesale interest rates offered by Visa or Mastercard. So that means you can use your own account without getting legged.

The only thing to watch out for is when you’re overseas and the machine gives you the option of paying in AUD. Always click “NO” and pay in the local currency, or you’ll be ripped off with a higher currency conversion than the rate your bank will charge you.

Scott.

Thirty Years of Marriage Ended in One Minute

My husband of 30 years left me in February this year with a one-minute phone call.

Scott,

My husband of 30 years left me in February this year with a one-minute phone call. Throughout our marriage I have been the main income-earner, supporting him through his small business and paying the mortgage and all living expenses. He would give me money here and there. The home is in my name but the mortgage is in both, though he has never paid a cent to it. The house is worth $200,000 with a $150,000 mortgage, and I have other debts that I took out to support him. His parents’ estate was settled in January and he was due to receive over $600,000 in inheritance. It was delayed for a month so that I couldn’t make a claim on it. I’m not being greedy, I just want the mortgage paid out. Do I have a claim?

Carol

Hi Carol,

Your marriage may have ended in one minute, but it sounds like your ex spent many hours planning his departure.

Now you could go to the Family Court about this.

However, a word of warning if you do: the Family Court is a little like a mother at the end of her tether trying to sort out a fight between her kids … everyone gets a clip around the ear!

The Court could look at your husband’s trick of delaying probate on his parents’ estate and order him to give a chunk of it to you. Or, it could order you to pay off the mortgage and transfer the property to him. More likely it will be somewhere in the middle.

So, just like warring siblings, you should do everything you can to avoid being dragged into the fight: because it’s going to be rough … and potentially very, very expensive.

Yet if it does come to that, my advice is the same as rocker Tex Perkins:

“Better get a [family] lawyer son, you better get a real good one.”

Scott.

Bullying the Banks

With more equity in the house this year, I built up the courage to contact our bank, CBA, and request a better deal. With little hassle they dropped their rate by 0.15%.

Hi Scott,

With more equity in the house this year, I built up the courage to contact our bank, CBA, and request a better deal. With little hassle they dropped their rate by 0.15%. I mentioned a much more appealing rate at a rival with a $4,000 cashback offer, yet the best they could do was a further 0.02%.

So we started the refinancing route. After we’d filled out a multitude of forms through a broker, our friends from the CBA were in contact asking why we wanted to discharge our loan. I politely indicated we made them aware of this before deciding to pursue the better offer. The CBA has now offered to reduce our rate below the rival rate and thrown in $2,000 in cash to reward us for being a loyal customer. Thank you for everything you do!

John and Suzie

Hey guys,

Oh, I love, love, love this. You bullied the banks!

And it doesn’t stop there. Putting that $2,000 against your loan is going to have a compounding effect over the years, slashing the time it takes you to become debt-free.

Having said that, I’d be tempted to take at least a few hundred bucks and have a fancy-pants dinner. You deserve it!

Scott.