Articles & Questions

Every week I publish a fun new article on a money topic I think you’ll find interesting. I also answer a handful of reader questions. Subscribers to my newsletter get to see everything first — but you can browse some of my past articles & questions on this page.

My Best Articles

Not sure where to start? Below I’ve handpicked a few of my favourites. And if you like what you see, don’t forget to subscribe to my free newsletter to get new issues before anyone else!

Search Articles

The Friendliest Store In Town

Last week’s column about the Small Business Debt Helpline was the best one you have ever done! I will be sure to pass this information on to anyone out here in the Kilkivan district who needs it.

Hi Scott,

Last week’s column about the Small Business Debt Helpline was the best one you have ever done! I will be sure to pass this information on to anyone out here in the Kilkivan district who needs it. We need to start looking after small business owners, because no one looks after them, and (as you say) they are our country’s biggest employer. I know — I am one of them. And the constant stress and worry that your family home is directly linked to how many coffees and burgers you sell each day can be crippling.

Katy

Hi Katy

Thanks for writing.

Let me give two plugs:

First, for you: Katy runs the Kilkivan General Store, which she reckons is ‘The Friendliest Store in Town’.

Second, for the Small Business Debt Helpline, who do a bloody good job looking after small business owners doing it tough. They’re independent. They’re free. And they’ll fight for you. Call them on 1800 413 828.

Scott.

Forty grand down the drain

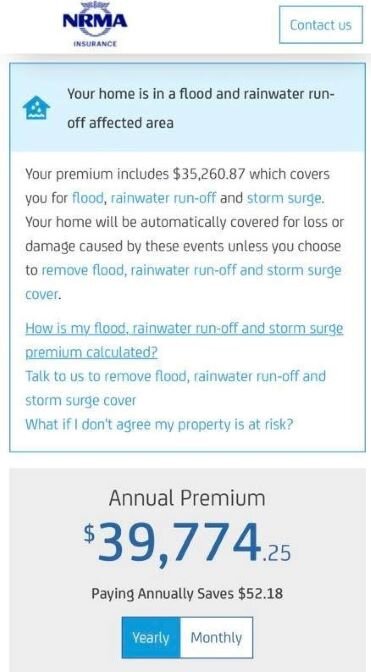

If you’ve been watching the floods, you’ve probably thought to yourself: “That’s no good … but at least they’ve got insurance, right?” Maybe.

If you’ve been watching the floods, you’ve probably thought to yourself:

“That’s no good … but at least they’ve got insurance, right?”

Maybe.

Here’s a quote that was sent to me by a homeowner in a flood-prone area in New South Wales.

That’s something you don’t see every day. Round figures, let’s call it forty big dogs … EVERY YEAR.

Of course, no one can argue that the insurance company is not doing its part: that $52.18 saving for paying annually is a total game-changer.

Seriously, though, a family can’t afford this. So what do they do?

Well, they opt out of flood insurance, which is exactly what the insurance companies want.

Now we could get angry at the insurance companies for doing this.

Or we could get angry at local governments that let developers build on these flood-plain areas.

Yet none of that is worth a squirt when you’re in a ‘once-in-a-century’ natural disaster (which in the Lucky Country comes around roughly once a year).

This is exactly why the floods are an unfolding disaster for many people.

And it’s not just homeowners: three-quarters of renters don’t have any insurance on their contents, according to the Insurance Council of Australia.

Maybe they don’t think they have anything in their house worth insuring … but they do.

The truth is, it’s the battlers who really get screwed when disaster hits — specifically the elderly and those on very low incomes.

Picture someone who counts out their coins each morning. They often go shopping at night when all the unsold meat is marked down.

Then one day water gushes under their door and short-circuits their fridge.

And hundreds of dollars of food — which they can’t afford to replace — starts to rot.

Now that is a disaster.

And right now, as you read this article, there are thousands of Aussies (many elderly, or ill, or young parents) in this situation.

So what can we do?

Thankfully, there are people at Foodbank in NSW and Queensland packing emergency food hampers.

Now during the bushfires, many charities (unfairly) got a bad rap for not spending the money quickly enough for the people who needed it.

Well, it doesn’t get much quicker than providing someone’s next meal. Even better, it’s also a freakishly good return on your money. For every $1 you donate to Foodbank Australia, their scale means they can provide $6 worth of food to battlers.

It’s times like this that we pull together and remember how good we have it.

And it’s times like this that our kids (or grandkids) feel the pride that comes from spending their money on helping others.

To donate, head to foodbankna.org/helpfloods

Tread Your Own Path!

Teenage Terms and Conditions

Recently my 13-year-old son received a letter from the ANZ bank with a new debit card and the promise of a PIN to follow. The problem is, his mum and I knew nothing about it!

Hi Scott,

Recently my 13-year-old son received a letter from the ANZ bank with a new debit card and the promise of a PIN to follow. The problem is, his mum and I knew nothing about it! My son had organised the whole thing by himself, from the initial online application to the in-branch ID verification. We were horrified — how is this possible? So I went with my son to the bank and asked the teller if this was true. They called the manager, who said ‘yes’. I still don’t believe it!

Chris

Hi Chris,

I spoke to the ANZ and they said:

“Customers from 12 years old are able to open an everyday account; however, we only offer EFTPOS cards rather than VISA debit cards for anyone under the age of 14 years.”

In other words, they’re like any business looking for customers. And their aim is to convert these kids into highly profitable customers, which is where the problems begin.

Sure, it would be dandy if all the banks signed a charter that they won’t push products on kids under the age of, say, 21. Yet that’s a pipedream. Besides, there are plenty of other sharks that will bite our kids (hello Nimble).

A more practical approach is to build the financial confidence of every Australian kid before they leave school.

(I’m working on that.)

But, Chris, this isn’t about ANZ. Please don’t make it about them.

This is about your son being a total go-getter.

Seriously.

You should be bragging about his initiative to anyone who listens. Let him overhear how proud you are.

How many parents of a teenager would LOVE to have this problem?

In my book The Barefoot Investor for Families, one of the challenges in the Barefoot 10 — the 10 things you want your kid to do before they leave home — is to set up a low-fee bank account. Another is giving them your utility bills and bank bills and paying them a commission if they can get a cheaper rate.

Embrace it!

Scott.

It’s a Scamski!

My wife is 57 and has invested thousands of dollars into an ‘education investment program’. It is a multi-level marketing program called SkyWay Investment Group (SWIG).

Barefoot,

My wife is 57 and has invested thousands of dollars into an ‘education investment program’. It is a multi-level marketing program called SkyWay Investment Group (SWIG). You buy units (not shares)! In US dollars! Converted into Russian rubles! The lead-in was that they would develop a transportation company that would revolutionise transport. They seem to have strayed away from that, though, as they are now offering cryptocurrency. My wife believes we are going to be rich when all the dividends are paid. I think the truth is fabricated, but she just says “You don’t believe in me”.

Neale

Hi Neale,

It sounds like your wife has made Skyway Investment Group part of her identity.

That’s a problem because, to quote the first line of SkyWay’s Wikipedia page:

“Financial regulators in Germany, Belgium and 15 other countries have banned the sale of financial products from SkyWay or warned the public about a potential scam.”

So what you could do is whip out your phone and say: “See, I told you so!”

Yet this is probably the dumbest thing you could do.

After all, in her mind, when you attack SkyWay you’re attacking her.

So, what to do?

Well, my advice would be to go on a Barefoot Date Night.

The aim of that night is to show her you believe in her, and that you need her help.

The fact is you’re heading towards retirement, and you need to work together to nail your retirement number (see notes in my Barefoot Investor book to work that out). Then you both need to work hard to achieve it.

Personally, I’d never talk about SkyWay again. Don’t poke the bear!

You’ve lost that money. The worst thing that could happen right now is if you lose the faith and confidence of your life partner. You need to build her up so you can focus on the main goal: securing your retirement.

Scott.

A Super Idea?

I have just seen a news item on a proposed policy which could see victims of domestic violence allowed to withdraw up to $10,000 from their super.

Hi Scott

I have just seen a news item on a proposed policy which could see victims of domestic violence allowed to withdraw up to $10,000 from their super. Typically victims of domestic violence are women, and women on average have less super accumulated, due to raising families. I am supportive of any initiative to help victims of violence, but is this likely to help or hinder them financially in the long run?

Theresa

Hi Theresa,

Of course! Raiding your super early will hurt you financially in the long run.

Yet I also agree with Superannuation Minister Jane Hume, who says that it’s simply another tool, and if it encourages women to leave a dangerous, abusive relationship then that’s a good thing.

However, as someone who works in the community sector and has helped women in this very situation, I don’t think accessing 10 grand from super is high on their priority list.

What I think should be on the Government’s priority list is properly funding emergency housing, legislating for paid family violence leave, and doing everything they can to help these courageous women (and their kids) find safety and security.

Yes, there is a cost to properly fund this … yet there is an even bigger cost if we don’t.

Scott.

How to help out a mate

“It’s over ... it has to be.” I just can’t do this anymore. I’ve carried the stress for far too long.” On the other end of the line was Steve, the owner of a struggling retail shop.

“It’s over ... it has to be.”

I just can’t do this anymore. I’ve carried the stress for far too long.”

On the other end of the line was Steve, the owner of a struggling retail shop.

Steve had finally cracked.

And from experience I can say it often takes a small business owner years to reach this point.

Yet in truth I was the wrong person to call: financial counsellors generally don’t advise on business-related debts.

Well, until recently.

In the wake of last year’s tragic bushfires, the Government set up the Small Business Debt Helpline, which is run by Financial Counselling Australia.

It’s long overdue.

After all, Treasurer Josh Frydenberg has said that “small businesses are the backbone of our economy, and they’re going to be a key part of the recovery”.

He’s right:

When you think of businesses, you probably think of the big boys: Woolies, Coles, Telstra, BHP.

Yet only 3% of Aussie businesses employ more than 20 people.

The other 97% are small family operations, and they collectively employ 4.7 million people.

That makes them Australia’s largest employer.

And yet when things get tough they don’t have access to the same funding options that big businesses do.

The truth is that our banks would rather lend money to buy an (inflated) property than chance it on a small business owner. All too often the banks look for reasons not to lend.

So business owners end up getting hit with complex personal guarantees and convoluted legal contracts they don’t understand … or worse, getting bitten by a loan shark.

And that’s where the trouble really begins.

As Steve will tell you, owning a struggling small business can be a lonely, isolating experience.

You wrap up your very identity in the business … and often your family home, and your family’s future.

Could the stakes be any higher?

So I need you to do me a favour:

If you know someone who’s struggling in their own small business — and there are plenty of them right now — let them know they’re not alone.

Get them to call the Small Business Debt Helpline on 1800 413 828.

It could be the lifeline they need.

Tread Your Own Path!

Hyperinflation Coming?

I am one of those 20-something Reddit users who makes some ‘tendies’ off GameStop. Most of my meagre net worth is in a high-interest savings account and an ETF as I save for a home deposit.

Hi Barefoot,

I am one of those 20-something Reddit users who makes some ‘tendies’ off GameStop. Most of my meagre net worth is in a high-interest savings account and an ETF as I save for a home deposit. But I have something that really should get your attention: hyperinflation. It is gaining massive traction on WSB (Wall Street Bets, on Reddit), and it is not your average conspiracy theory. Even Michael Burry (of ‘The Big Short’ fame) is talking about it. They are likening our current financial climate to the hyperinflation seen in post-WW1 Germany. What do you make of it?

Harry

Hi Harry,

I’m not going to rule out hyperinflation.

Heck, after the last 12 months I’m not ruling anything in or out. After all, who would have thought we’d be locked in our homes for the better part of the year?

One lesson I’ve taken from our annus horribilis is to be humble: the world is far too complex for us to accurately predict anything.

Another lesson is to stop reading online articles designed to scare the clicks out of you.

Instead, I’m going to suggest three books for you to read:

The first is When Money Dies. Author Adam Fergusson tells the shocking story that Germany faced post WW1 ... where a loaf of bread skyrocketed from 160 marks in 1922 to 200 million marks by 1923. Fergusson has since reassured readers that no advanced economy will hit hyperinflation anywhere near the level he writes about. Yet it doesn’t have to: even sustained double-digit rates of inflation can ruin people’s lives. And that to me is the message of this book.

The second is The Great Depression: A Diary by Benjamin Roth — one of my all-time favourite books. It’s the actual diary notes of a lawyer living through the Great Depression (what makes it fascinating is that he doesn’t know he is). His writing paints a very different situation to the one we are in now: in the Depression, the average person had next to no money. Today we’re flush with cash.

The final one is The Rational Optimist. Author Matt Ridley convincingly argues that, contrary to the doom-and-gloomers, the world is actually getting better. And it is. The best time to be alive is right now.

Harry, investing and saving — and living — is the ultimate act of optimism. So be bold!

Scott.

Show Me the Money

We have three boys, aged 6, 3 and 0, and I would love to introduce your ‘Jam Jars’ with them. But, once we buy the jars (and polish off the jam), where are all these ‘coins’ coming from in a world of plastic banking? When was the last time you had a wallet full of coins?

Hey Barefoot,

We have three boys, aged 6, 3 and 0, and I would love to introduce your ‘Jam Jars’ with them. But, once we buy the jars (and polish off the jam), where are all these ‘coins’ coming from in a world of plastic banking? When was the last time you had a wallet full of coins?

Brendan

G’day Brendan,

I don’t have a wallet full of coins. In fact I don’t have a wallet — I use my Apple Watch.

However, kids are visual creatures, so nothing works as well as shiny coins that clink as they hit a glass jar.

Now to your question: where do I find these relics?

It’s actually not that hard. Every so often when I’m at the supermarket I’ll get $50 in coins, then store them in a tupperware container at home.

Another tip: you may not need a wallet anymore, but your kids do, and you should keep their wallets in your car. That way the next time they bug you for something they can pull out their wallets, count up their money, and buy it themselves.

Scott.

My secret side hustle revealed

Just in case this ever leaks, I need to make a confession: This year I’ve been doing some ‘side hustle’ work as a garbo.

Just in case this ever leaks, I need to make a confession:

This year I’ve been doing some ‘side hustle’ work as a garbo.

It all began in lockdown when I was looking for an excuse to get out of the house. A mate of mine has a rubbish removal business and asked whether I’d like to tag along on some of his jobs.

How could I say no?

There’s something about hydraulics, a mate to talk rubbish with, and snooping on people’s trash that really revs my engine.

“I could make a killing by selling a paparazzi shot of you picking up rubbish”, teased my mate. “I can see the headline now: ‘Barefoot investor goes broke, becomes a GARBO’.”

Yet there was an ulterior motive: I have been decking out a barn (read: man cave) on the farm, so I was keeping a lookout for any discarded gems.

As we toured the suburbs dropping off giant skip bins, it was clear that a lot of people had been inspired to do a Marie Kondo cleanout over lockdown.

But you know what was really weird?

I was expecting to find loads of old junk. Yet most of the furniture being chucked wasn’t that old … and the people who’d chucked it would have paid a pretty penny for what had quickly become semi-disposable Swedish furniture.

For my man cave I wanted something that would last. So on the weekend I went shopping for a ‘good’ sofa, and I met possibly the most honest furniture salesman in Melbourne.

“Is it leather?” I asked, pointing at a classy-looking chesterfield.

He looked at me, smiled, and shrugged his shoulders.

“Honestly? It’s spat out of a factory in China. It could be made of rat for all I know. But it looks good, right?”

(He was only slightly joking. Consumer group CHOICE says — incredibly — that there is no one definition of leather.)

“Look, mate, no one makes anything here in Australia anymore”, the salesman said to me emphatically. “It’s too expensive. Everything is made in China. EVERYTHING.”

That was like waving a red rag to a ... rat?

Eventually, after much googling, I found a furniture-maker in Melbourne who has spent decades honing his craft. So I gave him a call.

“How can I ensure you’re putting real leather on my sofa?” I quizzed him.

“Well, how about we go pick out the hide together?” he said.

Hard core.

Now I know what you’re thinking: “Not everyone has the coin to get something custom made, Barefoot!”

And I agree — which is why, in addition to getting a sofa made, I’ve also been hunting for restored antique furniture on the cheap off eBay (for the man cave). The sort of stuff that was built in a different era, long before everything was created to be flat-packed on a ship from China.

My thinking: I not only want to be sustainable for the planet, I want to buy something that will outlast me — and support Aussie jobs to boot.

Yes, it will cost more. But, then again, so does paying good money for average stuff and paying two dudes to cart it away every few years.

Tread Your Own Path!

Barefoot, the Fire Starter

Because of you, we started a fire in our neighbour’s yard!

Scott,

Because of you, we started a fire in our neighbour’s yard! We dominoed our debts (18 months ahead of schedule) and burnt our loan statements just like you advised ... which flew over the fence into our neighbour’s yard and started burning. Anyway, thanks to you, we can now put an extra $2,000 a month into our home loan and continue working our way to being debt free. (Side note: our neighbours have now started their Barefoot journey.)

Bec

Hi Bec,

So you did the bill-burning ceremony, congratulations!

We all need to celebrate these achievements (even if it occasionally leads to an arson charge).

A lot of unhappiness comes from trying to keep up with the Joneses … yet not in this case.

Your neighbours are on fire!

Scott.

The HSBC Chicken

Your book arrived out of the blue on my doorstep one day. Reading it, it was painful to realise how bad I was at managing money. So I took action. Just last week I paid off my third and final credit card! For my job as a set designer I needed to make a papier-mâché roast chicken, so I used all my old HSBC bank statements. As I glued each painful piece into the shape of a chicken, the weight of 24 years of debt fell away, and before my eyes the HSBC Chicken was born! Thank you so much — you have helped me turn my life around.

Hi Scott,

Your book arrived out of the blue on my doorstep one day. Reading it, it was painful to realise how bad I was at managing money. So I took action. Just last week I paid off my third and final credit card! For my job as a set designer I needed to make a papier-mâché roast chicken, so I used all my old HSBC bank statements. As I glued each painful piece into the shape of a chicken, the weight of 24 years of debt fell away, and before my eyes the HSBC Chicken was born! Thank you so much — you have helped me turn my life around.

Rose

Hi Rose,

Congratulations! I usually encourage parents to blend their credit cards in front of their kids (a dramatic way of teaching them not to use them). Yet your idea is much more creative.

Winner, winner, chicken dinner!

Scott.

Should I Tell My Boyfriend to Shut Up?

My husband and I are so close to having a 20% deposit for our family home. However, with the prices of houses being so ridiculously high right now, he wants to wait and meanwhile put our house deposit into shares in the hope that we will have more than enough money in a couple of years. Should I listen to my husband or tell him to shut up?

Hello!

My husband and I are so close to having a 20% deposit for our family home. However, with the prices of houses being so ridiculously high right now, he wants to wait and meanwhile put our house deposit into shares in the hope that we will have more than enough money in a couple of years. Should I listen to my husband or tell him to shut up?

Willa

Hi Willa,

My first thought is to tell him to shut up.

My second thought is to get him talking. Here are some clarifying questions you might want to ask:

“You reckon the property market is too high and due for a fall. Why wouldn’t that be the same situation for the share market? They’re both just assets, right?”

Whatever he answers, follow up with this:

“No one can predict what’s going to happen in the share market, or the property market, in the next few years. It could go up, down, or sideways. That being the case, let’s run some scenarios now and see how we’d deal with them:

“What would we do if our shares tank 50%?”

(Wait to get his response. “It won’t happen” is not the right answer. Ask him how he’d feel watching your deposit cut in half. Would he hold his nerve?)

“What would we do if the property market increases while we’re risking our savings in the share market?”

(Again, wait to get his response.)

And, finally, hit him with this: “Are you unsatisfied with what we can currently afford?”

It sounds like that is the root of the problem … and there’s no shame in that at all. In a rampant debt bubble, young people starting out have to make trade-offs. Just make sure you’ve thought them through.

And that’s going to require a lot of talking, and thinking!

Scott.

Barefoot Endorsement, Please

A reputable friend has suggested I invest in a CFX project (cryptocurrency foreign exchange). From what I understand it is kind of like multilevel marketing and a type of cryptocurrency. I have looked into it and it sounds good. However, I am hesitant to pay out my hard-earned cash without some endorsement from someone like you. I am planning a baby as a single woman at 45 and I bought my first home only a year ago, so I am looking at ways to increase my income and secure my future. Thoughts?

Hi Scott,

A reputable friend has suggested I invest in a CFX project (cryptocurrency foreign exchange). From what I understand it is kind of like multilevel marketing and a type of cryptocurrency. I have looked into it and it sounds good. However, I am hesitant to pay out my hard-earned cash without some endorsement from someone like you. I am planning a baby as a single woman at 45 and I bought my first home only a year ago, so I am looking at ways to increase my income and secure my future. Thoughts?

Lilly

Hi Lilly,

You want my endorsement?

Okay, here goes: No. No. No. Lilly, oh god no. No.

Is that emphatic enough for you?

Now, I’m betting your ‘reputable’ friend isn’t a brand-new home owner who is about to become a mature-age single parent. Lilly, you simply can’t afford to get swept up in this rubbish.

If you want to increase your income and secure your future — and that’s an admirable ambition! — work towards a qualification or skill that you can use when you’re at home with your bub.

Scott

You are in a lot of trouble

After hours of crying, our baby finally dropped off to sleep in his mother’s arms ...

… and then her phone rang.

The noise startled our son, and he began wailing.

“ANSWER IT!” she thundered at me.

After hours of crying, our baby finally dropped off to sleep in his mother’s arms ...

… and then her phone rang.

The noise startled our son, and he began wailing.

“ANSWER IT!” she thundered at me.

I dived on her phone and shepherded it out of the bedroom.

“Hello?” I whined.

“A warrant has been issued for your arrest. Press 1 immediately”, said the recorded message.

I was so sleep deprived that I complied, and was promptly transferred to a human.

“We have found a discarded rental car with 20 pounds of cocaine, fraudulent bank statements, and bloodstains on the seats — the car was rented in your name,” announced the man on the end of the line.

“Who is this?” I yelled.

“My name is Richard Solman. I am an Australian Federal Police Officer. My badge number is 78291. Write that down. Your case number is 4859885. Write that down, too. You are potentially in a lot of trouble”, he warned.

For the next few minutes our conversation reminded me of those I’ve had with my three-year-old when it suddenly dawns on her that her brothers are gone and she has my full undivided attention ... so she keeps the story going on, and on, and on, and on ...

Then Richard went in for the kill.

He reminded me that the call was being recorded, and then asked for my ID.

And after I’d given him my (fake) details, he announced that I’d been a victim of identity theft.

“How much money do you have in your main account, Mister Tape?” he asked.

“I have $13,823”, I said precisely.

This got Richard audibly excited.

“I’m sorry to say that your accounts and your tax file number are compromised. All that money is at risk. We think it could be an inside job … a staff member from the ING bank”, said Rich.

Next, he ordered me to get in my car, drive to my nearest bank branch and transfer my money into what he called a ‘safe’ AFP account for 48 hours … while they got to the bottom of the case.

And all the time I was thinking to myself, “Who would ever fall for this rubbish?”

The correct answer, of course, is “enough people to make it more than worth their while”.

(Generally the most vulnerable people in our society — those with mental health issues and the elderly, who can be confused and intimidated. Last year Aussies lost $36 million from spam calls.)

Hold the phone! Here’s my take:

Twenty-five years ago, the internet lowered the cost of sending spam emails to practically zero. And our inboxes got hammered. Well, for a while, that is, until email providers created spam filters to shield us from the 320 billion junk emails sent each day.

Yet the scammers have now doubled down.

Technology has now lowered the cost of calling to basically zero, and spoofing technology makes it look like they’re calling you from a local number. Which explains why Richard and his mates are just so damn busy. They’re making 500 million spam calls around the world each day.

Yet telcos are busy building the phone version of spam filters (with a nudge from the government). Telstra says it’s blocking up to 500,000 spam calls a day.

My prediction?

Spam calls will soon be as rare as spam emails in your inbox.

Until then … if anyone rings you up with a warrant for your arrest, and asks about a discarded rental car with 20 pounds of cocaine, fraudulent bank statements, and bloodstains on the seats ...

Just press 1 … and tell them it was Mister Tape.

Tread Your Own Path!

Shares for Kids

“Dad, do you own shares in … Woolworths?”

“Yes.”

“What about Coles?”

“Dad, do you own shares in … Woolworths?”

“Yes.”

“What about Coles?”

“Sure do, mate.”

“What about … what about ... JOHN DEERE?” screamed my five-year-old, his eyes bulging.

“Oh yeah!” I yelled, and then we high-fived.

Listen, as a father, a finance nerd and a farmer, that moment was a bloody royal flush.

It does not get better than that.

These days my portfolio is basically made up of both local and international index funds:

A couple of ultra-low-cost funds hold literally thousands of companies (well, a sliver of each), including the biggest companies on earth. In other words, you name it, and chances are we own it. (What’s more, when my kids get older and they ask me about the latest hot stock, the automatic adding nature of an index fund will allow me to say, “Yeah, I own that too”).

My kids have nailed the working, saving, spending and giving parts of the Jam Jar Strategy. Now I’m slowly introducing the idea of investing some of that money into shares, and learning about compound interest.

And it’s not just my kidlets.

This week I heard from Will, who asked:

“I am five years old and I want to buy some shares. Am I able to buy a share these days where I actually get a share certificate or something in the mail?”

Well, what I would tell Will is the same thing I’d tell my own kids (and what I’m actually doing with them):

As a parent you can buy shares on your kids’ behalf (in your name, but as a trustee for your child, via an online broker) and then transfer the shares to their name via a simple form when they turn 18, without incurring capital gains tax (CGT), as there is no change in beneficiary.

What shares should kids buy?

Well, when I was a kid, my father decided to pay me my pocket money via one share in BHP.

He said: “You now own a share in one of the biggest companies on earth, and they share their profits with you.”

I never got a share certificate … or the actual share come to think of it!?

Yet that day changed the course of my life.

So for kids I’d seriously consider buying either an Aussie shares index fund or an international index shares fund -- or better yet both. That way they’ll own thousands of the world’s biggest companies. Then parents can print out a list of all the companies they own, and put them on their wall: just for the bragging rights.

Tread Your Own Path!

P.S. Want to really compound the gains? Make sure it’s money your kids have earned themselves fair and square.

Good for My Soul

You copped some flak about your boys’ camping weekend, but I just wanted to say how much that story meant to me. In fact, I cried reading it. The great sadness of screens and possessions is that, too often these days, dads are not around. Hearing your stories of financial freedom and the life you’ve chosen to build is so good for my soul!

Hey Scott,

You copped some flak about your boys’ camping weekend, but I just wanted to say how much that story meant to me. In fact, I cried reading it. The great sadness of screens and possessions is that, too often these days, dads are not around. Hearing your stories of financial freedom and the life you’ve chosen to build is so good for my soul!

Simone

Hey Simone,

I once read, “If you want your children to turn out well, spend twice as much time with them and half as much money”.

That sounds about right to me.

Scott.

I’ve Been Conned — by My Parents

I feel frustrated, confused and taken advantage of. Back when I was just 22 (I am 28 now), my parents could not pay their mortgage and somehow conned me into taking ownership of their house. They promised me money, tax cuts, all the greatness in the world. Stupidly, I said yes and I now have a $500,000 mortgage under my name. They pay for the loan, though they are frequently late, and Mum loves to withdraw from the equity too. I have tried to get my name off the loan but they keep resisting. Worst of all, because I do not live there, I get shafted at tax time. Is there anything I can do?

Dear Scott,

I feel frustrated, confused and taken advantage of. Back when I was just 22 (I am 28 now), my parents could not pay their mortgage and somehow conned me into taking ownership of their house. They promised me money, tax cuts, all the greatness in the world. Stupidly, I said yes and I now have a $500,000 mortgage under my name. They pay for the loan, though they are frequently late, and Mum loves to withdraw from the equity too. I have tried to get my name off the loan but they keep resisting. Worst of all, because I do not live there, I get shafted at tax time. Is there anything I can do?

Zoe

Hi Zoe,

Oh wow.

I’m only getting your side of the story, but let me try and piece together what’s going on:

It sounds like your parents live beyond their means.

And so, to take the pressure off themselves, they decided to make you their landlord … at least on paper.

At which point that pressure transferred onto your shoulders.

So, what should you do?

Well, don’t lose sight of the fact that the most valuable asset in this situation is the relationship you have with your parents.

So your first step is to blame me, the Barefoot Investor.

Tell your parents that you wrote to me and I suggested that you talk to an accountant (one who doesn’t know your parents). Ask the accountant to review the situation and advise what you should do. They may find you have significant equity in the property and you’re getting a great return. Or they may find it’s a money pit and you’d be better off selling (it’s your house, after all!).

Whatever the decision, I’d let your parents know that this is what the accountant has advised. In other words, blame me, blame the accountant, and try to keep your relationship intact.

Scott.

The Virgin Investor

We are pretty excited that our 16-year-old daughter is about to start her first job. Now to work out which super fund for her to join! Following the advice in your book, we have started the process of searching for a low-cost fund. I like the look of Virgin Money Super, which charges a $58 admin fee plus 0.39% of the balance per annum. My concern is that it is a new fund and the investment options are all high risk, not to mention that Virgin Atlantic filed for ‘Chapter 11’ (hopefully not all the Virgin-branded businesses will meet the same fate). Would appreciate your advice.

Hi Scott

We are pretty excited that our 16-year-old daughter is about to start her first job. Now to work out which super fund for her to join! Following the advice in your book, we have started the process of searching for a low-cost fund. I like the look of Virgin Money Super, which charges a $58 admin fee plus 0.39% of the balance per annum. My concern is that it is a new fund and the investment options are all high risk, not to mention that Virgin Atlantic filed for ‘Chapter 11’ (hopefully not all the Virgin-branded businesses will meet the same fate). Would appreciate your advice.

Daniel

Hi Daniel,

Virgin Atlantic is not the same as Virgin Money. It’s just another one of Richard Branson’s many Virgin brand extensions. (He once tried Virgin Brides — a wedding dress business that didn’t survive its honeymoon). Virgin Money is actually owned 100% by the Bank of Queensland.

Which is kind of confusing, right?

Well, try looking at their fee structure!

They’re actually higher than you state: you left off the investment fee (0.116%) and indirect fees (0.09%).

But don’t feel bad for missing these details.

The fact is super is bloody confusing … and that’s exactly how the industry likes it.

You’re an awesome, well-meaning dad trying to help out your kid, and it’s a disgrace that it’s this hard.

Thankfully, in last year’s budget the Government announced they’re building a new comparison tool called ‘YourSuper’ which is slated to be available by 1 July this year.

So, for now, I’d probably stick with her default fund, and then when YourSuper is launched I’d encourage you to cut the apron strings and let your daughter select her own super fund using it.

You could even bribe her with a new pair of shoes if she can find a good high-growth option in a low-cost fund. Because the money she saves getting this right will eventually buy her a whole new wardrobe.

Scott.

You’re a Dog, Barefoot

am 23, a medical receptionist, and have been trading crypto since lockdown — and killing it, especially in DOGE (Dogecoin). I read your article on DOGE, and it was a joke. Who do I trust more, some hack from Australia or THE WORLD’S RICHEST MAN — genius Elon Musk? You don’t get rich buying index funds, loser.

Hey Scott,

I am 23, a medical receptionist, and have been trading crypto since lockdown — and killing it, especially in DOGE (Dogecoin). I read your article on DOGE, and it was a joke. Who do I trust more, some hack from Australia or THE WORLD’S RICHEST MAN — genius Elon Musk? You don’t get rich buying index funds, loser.

Kerrie

Hey Kerrie,

Don’t bite me!

All I was doing was quoting the creator of Dogecoin, who said:

“It doesn’t make sense. It’s super absurd. The coin design was absurd.”

Dogecoin was set up as a joke. It has no tangible value, other than as a gambling chip at a crypto-casino ... which just so happens to have Elon Musk sitting at the table.

Why is he buying Dogecoin?

I have no idea.

Maybe it’s about his insatiable appetite for attention. Perhaps it’s to stroke his own ego. Maybe it’s both.

Yet while Musk is a genius, and the world’s (second) richest man, that doesn’t automatically mean you should take financial advice from him.

After all, his decision to throw millions at Dogecoin is like you or me buying a scratchie.

He’s worth $US190 billion!

He could drop $200 million down the back seat of his Tesla and he wouldn’t even notice it.

Billionaires are different to people like you and me. They don’t have to worry about things like buying a home, or paying off their HECS, or funding their retirement.

Most of us do.

And to achieve them we need to invest intelligently for the very long term. And history has proven emphatically that the most intelligent long-term investment is a broad-based index fund.

No joke.

Scott.

Dirty Rats

“Tick-tick-tick-tick.” Our family wagon was having a moment. The indicator seemed to be hyperventilating, ticking madly at triple speed.

“Tick-tick-tick-tick.”

Our family wagon was having a moment.

The indicator seemed to be hyperventilating, ticking madly at triple speed.

‘Probably nothing’, I thought to myself.

Then a red warning light began flashing: ‘brake light failure’.

Okay, so brake lights are kind of a non-negotiable.

I detoured to the local mechanic’s, just to be on the safe side.

“You got rats!” he announced after popping the bonnet.

“They’ve chewed through nearly all the wiring … I’m surprised you couldn’t smell them.”

I was not surprised. Our family wagon is a house party for a mouse party: half-eaten Cruskits, discarded Vegemite toast, rotting peaches, even the odd nappy. It’s revolting.

So serves us right, right?

Well, our other car — my car — is a strict ‘no food zone’, yet as soon as I got home and opened the door I knew Mickey and his mates had spent the weekend partying there too.

(Life on the farm has its drawbacks.)

Yet what happened next floored us:

The insurance company got the mechanic’s bill to painstakingly strip back both cars and redo all the wiring … and decided it would be cheaper to write off both our cars instead!

So, being the Barefoot Investor, I set off to buy two used cars.

And that was when the real trouble started.

My first call was to a mate who works at a used car dealership in the bush:

“Sorry, I’ve got no stock”, he said. “I sold the last two cars on the lot to a dealer in Perth! He’s transporting them over there for god sakes! In my 25 years in this industry, I have never seen anything like it.”

He was right.

Over the next few weeks, every used car I looked at was priced around 30% higher than Redbook (the industry pricing database) indicated it should be.

What was going on?

Aren’t cars supposed to fall in value?

Normally, yes.

In fact, by as much as 40% over the first five years.

Why?

Well, mainly because we Aussies purchase around 1.1 million brand-new cars each year. (A staggering figure given there’s only 25 million of us on the island!)

Yet in 2020, like most things, the car market had a bingle.

We still wanted to buy cars, especially to escape the great unwashed on public transport.

Yet, because of COVID-related factory closures, the global car industry supplied 23% fewer cars in 2020 than normal. And so demand spilled over to the used car market: Moody’s Analytics found that second-hand car prices increased 36% last year — the biggest on record.

In other words, for the first time ever, the demand for cars outstripped the supply.

So in the end we split the difference and bought both a new and a used car.

Which shows just how fortunate we are.

Spare a thought for young people: not only have they borne the brunt of the COVID layoffs (being part-time and casual workers), but the cost of their first set of wheels has just gone up by a third!

If that’s you, don’t panic.

Truth is, you have a wonderfully long road-trip full of adventure ahead.

And remember, one day that open road may turn into a school run. You’ll find yourself behind the wheel of a people-mover, with cranky kids in the back and a woeful whiff of rotting peaches (and mice droppings) coming through the vents.

Soak in the smell of freedom while it lasts!

Tread Your Own Path!