Articles & Questions

Every week I publish a fun new article on a money topic I think you’ll find interesting. I also answer a handful of reader questions. Subscribers to my newsletter get to see everything first — but you can browse some of my past articles & questions on this page.

My Best Articles

Not sure where to start? Below I’ve handpicked a few of my favourites. And if you like what you see, don’t forget to subscribe to my free newsletter to get new issues before anyone else!

Search Articles

Bridget Jones Scores $900

Hi Scott,

I love your columns and still use your buckets 10 years after reading your book. I’ve saved and paid off my debts, but your email today was perfect timing.

Hi Scott,

I love your columns and still use your buckets 10 years after reading your book. I’ve saved and paid off my debts, but your email today was perfect timing. Last week, I put on my Bridget Jones big girl pants, called my insurance company, and questioned a $500 premium hike. After seven years of loyalty I was ready to switch, and they offered me a $900 discount – cheaper than any other quotes I had. I danced around my kitchen with joy! Thank you for empowering me to question big companies and say, “That’s not good enough, I want to pay less”.

Kathryn

Hey Kathryn, You, my friend, just pulled off the ultimate power move – pants on, phone in hand – and now you’re $900 richer. And you’re not alone – I’ve been inundated with stories of people saving hundreds with my five-minute call. Now, a quick Public Service Announcement (PSA): Some readers pointed out that turning off auto-renew could mean forgetting to renew altogether. Don’t stress – your insurer will remind you. Yet, just to be safe, set a phone reminder for 11 months from now so you can rinse and repeat the savings next year.

Scott

Are You Okay?

“Are you okay? If you need a hand with anything, call.”

I stared at the text while I stood ankle-deep in a kiddie pool, orange juice in hand.

“Are you okay? If you need a hand with anything, call.”

I stared at the text while I stood ankle-deep in a kiddie pool, orange juice in hand.

I was at a kids’ birthday party. The sender? A farmer who lives 20 clicks from me.

Then Liz came out with her party hat on and said:

“There’s an out-of-control fire near the farm … and the wind is blowing in the wrong direction.”

I nervously sipped my juice while my family gave me my marching orders:

I was told to go home and collect a stuffed cheetah, two teddy bears, and a prized poster of Kysaiah ‘Kozzy’ Pickett. Oh, and the passports. (“Dont’ forget the the damn passports!”)

I’ll be honest, as I drove back to the farm I was slightly freaked out.

Still, a lot of people all over Australia have been feeling this way lately: with the cyclone, floods and fires (thankfully the fire near our place was eventually contained). And even if you haven’t – you sure as hell have been burned by your insurer. As one Barefooter wrote to me recently:

“Our home Insurance has tripled – from $400 per month to over $1,200. Why is no one talking about this?! You can't even get a mortgage without having insurance, so there is no way out!”

Sheizenhowzen!

Over a third of insurers have increased prices by more than 15% in the last year (the worst hikers according to CHOICE were Kogan, RAC and Honey).

Now that doesn’t sound too bad right?

Well, hold my OJ:

In a recent ‘shadow shop’, CHOICE found the biggest price difference between identical home and contents insurance policies wasn’t double or even triple … it was TWENTY TIMES.

Blitzenschnauzer!

Okay, so here’s what I want you to do.

First, load up Mr Inbetween on Binge (thank me later), grab your preferred brew, get your phone out of your pocket, and take prime position on the La-Z-Boy. We’re going to do some multi-tasking.

1. Grab your home and contents policy (or just contents if you’re renting) and find your ‘sum insured’ – that’s the total amount you’re covered for. Write it down.

2. Next, google three quotes.

3. Right-yo, it’s time to get off the recliner. Grab your phone and film your place like you’re making a true-crime doco – open cupboards, dig through drawers, and don’t forget the garage. If you ever need to claim, this footage will be worth its weight in gold.

4. Then walk outside and act like a meth-head casing the joint: Do you have a yappy dog? Deadbolts on the door? Security cameras? Note down anything you’ve done to Fort Knox your home.

5. Then call your insurer and follow this script:

You: “Hi, my name is [Your Name] and I’m really struggling to afford my home and contents insurance policy. I’d like to discuss how we can reduce my premium. My policy number is XYZ.”

Insurer: “I’d be happy to help.”

You: “After a lot of research, I’ve found comparable coverage from other insurers at more competitive rates. Additionally, I’ve implemented several safety measures in my home, such as [consult your meth-head list]. Given these factors, I’m seeking a reassessment of my premium.”

Insurer: “Let me review your policy and see what adjustments we can make.”

Cue condescending loop of a voiceover woman saying “Your call is important to us".

Insurer: “Thank you for your patience. Based on the information provided, we can offer a premium reduction of [amount].”

You: “I appreciate that. However, considering the competitive quotes I’ve received, plus the safety enhancements I’ve made, I believe there’s room for a more substantial reduction. Additionally, I’m willing to increase my excess, which should further lower my premium by at least an additional 10%.”

Insurer: “I understand. Let me see what more we can do.”

James Blunt’s “You’re Beautiful” plays.

Insurer: “After further review, we can offer an additional discount, bringing your new premium to [new amount].”

You: “Now we’re talking. Send me that in writing and we’re good.”

Insurer: “Done! Anything else?”

You: “Yes, please cancel my auto-renew immediately.”

Insurer: “Are you sure? That’s how we screw you next year.”

In the time it takes you to watch the first episode of Mr Inbetween, you should be able to save yourself hundreds and potentially thousands of dollars.

There’s only one thing left to do. My final instruction is to send me an email at scott@barefootinvestor.com and tell me how much you saved. I’ll report back next week.

Tread Your Own Path!

I’m Absolutely Traumatized

While I was away for two weeks, a packet of chicken thigh fillets somehow ended up under the driver’s seat of my car (from a grocery shop before I left). I came back to an exploded packet of horrific, rancid, smelly chicken, maggots, and an absolute disaster.

Hi Scott,

While I was away for two weeks, a packet of chicken thigh fillets somehow ended up under the driver’s seat of my car (from a grocery shop before I left). I came back to an exploded packet of horrific, rancid, smelly chicken, maggots, and an absolute disaster. I tried to clean it myself with my boyfriend, and even paid someone from AirTasker to steam clean it, but it just made everything worse—the smell is unbearable. I have tried doing it myself as a Jim’s Cleaning guy came over and quoted me a whopping $570. At this point I'm considering setting my car on fire to claim insurance and never smell the horrific mess again (just kidding... but also...). The whole situation feels way out of my depth financially, and I have no idea where to start. Do insurers even cover this kind of thing? Is there a way to fix this without spending a fortune? And most importantly, how do I stop something like this from totally derailing me again? I know you’re a busy guy, but I’d really appreciate any advice you can share but this situation has thrown me for a loop.

Tina

Hi Tina

I actually read this out to my kids over dinner, (granted, possibly not the best timing), to show them how good they’ve got it with only a farting kelpie.

(It didn’t work).

So, to answer your questions.

I wouldn’t go with the insurance fraud option, that’s an entirely different stink that will really cost you. That being said you should check your policy: it’s highly unlikely but some comprehensive policies cover interior damage from unforeseen events.

What would I do?

I’d wind down the windows and bloody well get on with it!

Umm, no I wouldn’t.

I’d reframe the situation: think of it as a $570 mechanics bill you need to pay to get it back on the road.

(I’d also ring around local detailers and get their advice about a professional deep clean with an ozone treatment, which may end up being much cheaper (and possibly more effective) than old Jimbo).

If you’ve followed the Barefoot Steps, hopefully you have some money in your Mojo account. Rancid exploding chicken thigh fillets are one of the reasons you’ve got it.

Good luck!

Scott.

Barefoot … You’re a Vulgar, Right-Wing, Nutjob

You are a piece of work. The problems in the private health insurance industry have been ongoing for years, and Labor has been in power since the middle of 2022.

Hi Scott

You are a piece of work. The problems in the private health insurance industry have been ongoing for years, and Labor has been in power since the middle of 2022. That didn’t bother you! Instead you chose a cheap political hit-job on a very hardworking minister (Mark Butler). For all your spin, the facts are the facts: the more people we have in private health insurance, the less strain on the public system. In the future, keep your vulgar right-wing comments to yourself.

Linda

Hi Linda,

Given we’re talking about healthcare, I suggest you check your blood pressure (it might be a smidge high). A few weeks ago I was accused of being a Greens Party shill – this week you’re saying I’m to the right of John Howard. So I must be doing something right.

Now the hardworking minister got caught in my squirrel grip because he’s the guy in charge who can make changes. Fact is, the Government whacks people with a stick to buy private health insurance, but does nothing to rein in the deliberately confusing way it’s sold to us.

That’s not just my opinion: this week I was inundated with readers’ responses (many from workers in the industry!) telling me how unaffordable it is, how confusing it is, the gaps and the gotchas, and generally how terrible the industry is.

And to your point, a research paper by Melbourne University set out to answer whether private health insurance cuts public hospital waiting lists. They found it barely made a dent. Right, left or Green, the message is clear: the industry needs a bloody shake-up.

Scott.

The man with no balls

Federal Health Minister Mark Butler wants you to know that he has balls of steel. You see, each year private health insurers must go cap in hand to him to increase their prices. And this year they wanted to deliver their biggest premium hike in six years – but he rejected it.

Federal Health Minister Mark Butler wants you to know that he has balls of steel.

You see, each year private health insurers must go cap in hand to him to increase their prices. And this year they wanted to deliver their biggest premium hike in six years – but he rejected it.

Bam!

Instead he’ll soon announce that he’s allowing a much smaller increase in your annual private health insurance premium.

Pow!

The truth?

The truth is the Minister doesn’t have the balls to tell you it’s a total farce.

But I do. So let me tell you how the game is really played … and how you are getting robbed:

While it’s technically true that private health insurers can only increase their prices once a year, and that old Steely Balls has to sign off on it, it’s also true that health insurers can close down existing policies and simultaneously release new, much more expensive policies at any time.

Let me give you a very personal example:

My family has gold-level, hospital-only cover with insurer Health Partners. (I don’t pay for extras or combined cover, because it’s generally a rip-off for most people.)

Ten years ago, this was one of the best-value products on the market. Actually it was too good – Health Partners have now closed this product to new customers.

And here’s the rub: today, if a new customer wants the same cover as me it would cost them $2,360 more than I’m currently paying per year.

And it’s not just Health Partners that are engaging in this shifty practice. CHOICE recently found that insurers have increased their gold hospital cover by about 31.5% in the past three years, much more than the Government-mandated increases.

Look, private health insurance is intentionally confusing.

There are 26,000 different policies, and so many exclusions and out-of-pocket gotchas that it makes it almost impossible to work out how to get a good deal … which is exactly how the health funds like it.

This explains how they were able to lift their profits by more than 110% in the last financial year (to $2.2 billion) while their customers lived through a cost of living crisis!

So what can you do?

Well, think about whether you actually need private health insurance, for one.

That being said, the Government has a gun to our head and effectively forces 11 million of us to take it out, or smashes us with an extra tax. (And if we wait too long to sign up, we’re slugged with a further penalty based on our age.)

So your only option to save a buck is to consider downgrading your cover. CHOICE did the numbers and found that you could save up to $1,870 by switching your hospital insurance to a cheaper gold, silver or bronze policy – which admittedly limits or totally excludes coverage for childbirth (snip, snip!), knee or hip replacements (no limbo dancing!) or mental illness (stay happy!), among other things.

And when you’re comparing, avoid the churn-and-burn bucket shops like Comparethemarket and iSelect, which only show you policies they get a kickback from. Instead, head to the Government’s search engine Privatehealth.gov.au, which lets you compare every policy on the market.

If Mark Butler really had balls of steel, he’d stop playing political theatre with the health funds and do some serious surgery on the entire industry, because it’s an absolute disgrace.

Tread Your Own Path!

Who You Gonna Call?

My partner and I are looking at combining our insurance now we are moving in together. He has always used an insurance broker, I never have.

Hi Scott,

My partner and I are looking at combining our insurance now we are moving in together. He has always used an insurance broker, I never have. He says it gives him peace of mind in case something happens, but I don’t know if I can justify paying an extra $250 a year. Are brokers worth it?

Gabe

Hi Gabe,

So this is controversial. However, like your partner, I get almost all my insurance through a single insurance broker, who charges me a commission.

Yes, I pay a bit more than I would going direct. Yet, as someone who’s lost a home, crashed multiple cars, had flood damage and more (you name it, I’ve claimed it), I’ve found that insurance is all about claims management.

And when something goes wrong my broker really earns his money. I just pick up the phone, call him, and let him sort everything out. Reading policies, understanding what I’m covered for, talking to insurance companies, sorting replacements, handling claims ‒ he does it all for me.

However, only you can decide whether you’re willing to pay the extra ‘insurance’ for claims management.

Scott

Have a beer with me

Thank you so much for last week’s column about helping the pensioner with the insurance claim. I live in South Lismore and I’m still waiting for my insurance payout, and it is increasingly difficult to get any information from the insurance company.

Hi Scott,

Thank you so much for last week’s column about helping the pensioner with the insurance claim. I live in South Lismore and I’m still waiting for my insurance payout, and it is increasingly difficult to get any information from the insurance company. Your column has given me the much-needed incentive to keep fighting for what I am entitled to, not what they think I should settle for!

Elise

Hi Elise,

You are exactly the type of Lismore local I want to meet this Thursday night!

If you can, please come to my book launch, or my community event at the Hotel Metropole at 7.00pm (RSVPs are required for both, see below). Please spread the word with your friends. As someone who’s lived through a natural disaster myself, I know I can help.

Scott

The $67,000 Insurance Policy?

My husband and I are in our early fifties and earn $100,000 combined a year. We paid $67,000 this year for life insurance, including critical illness and income protection.

Scott,

My husband and I are in our early fifties and earn $100,000 combined a year. We paid $67,000 this year for life insurance, including critical illness and income protection. And we have now been notified that my husband’s super is all depleted as the payments were auto-deducted from his super! We thought everything was okay, as we have been with our financial advisor for 28 years. Now we don’t know where to go to get out of this costly mess. Please help!

Renae and Peter

Hi guys,

You have every right to feel stressed, and as angry as an alpaca!

My advice?

You need to get a bit of alpaca attitude and stomp and hiss and spit until you get this sorted.

On your income – and presumably your super fund balance – it is totally unacceptable to be paying $67,000 for an insurance policy. It’s absolutely ridiculous. It’s simply draining your super fund.

Now I understand I’m only getting your side of the story, but if your financial advisor of 28 years has overseen this – and profited by pocketing thousands of dollars in trailing commissions – they should be held accountable.

Here’s what I’d do if I were in your shoes.

First, gather up all your supporting documents: insurance records, emails from your advisor, statements of advice (SOAs) and payment records.

Second, write about the emotional toll this is having on your family. Be as raw and emotional as you want. Bleed on the page. Get it all out.

Third, bundle it all up via email and take the following four steps: 1) Email it to your financial advisor’s compliance department ‒ you’ll get the contact details in their Financial Services Guide (FSG); 2) Lodge a complaint with the Australian Financial Complaints Authority (AFCA) at afca.org.au; 3) Send it to a good lawyer; 4) Finally, send it to the compliance department of the insurer you paid $67,000 to.

Remember: be an alpaca. Hiss, spit and bite if you have to. Don’t take a backward step.

Scott

The Cocaine Mumma

I’m a happily married mother in my mid-thirties, with two kids under four. We’ve been Barefooting for seven years, and I went to a financial advisor to sort all my insurances out so my family is financially safe in the event of something bad happening to me.

Hi Scott

I’m a happily married mother in my mid-thirties, with two kids under four. We’ve been Barefooting for seven years, and I went to a financial advisor to sort all my insurances out so my family is financially safe in the event of something bad happening to me. However, I made a terrible error of judgment. When I first filled out my "health" summary I did not even think to mention ad hoc trying of some recreational drugs in my early 20s. Yet during the 1.5 hour interview Zurich asked some specific questions and I answered honestly (as I was told I must by law!), and now I've just received an email saying my insurance request has been declined and that no one is likely to insure me given my past recreational drug use!

Given the statistical facts in Australia around "have you ever tried a recreational drug" it must mean people DEFINITELY lie when answering those questions, and so now I just feel really really STUPID for being honest. If no one will insure me, how do I protect my family in the event of my TPD or death? I'm so scared. I won't sleep knowing they will suffer from their stupid mum and her stupid youth, and my poor husband if he's left with the mortgage. And the final insult: the financial planner has hit me with a bill for $750!

Natalie

Hi Natalie,

I doubt you got knocked back for smoking a doobie.

(Sorry for my bluntness, that’s just how I … roll).

Fact is, most insurers are going to ask you about your drug use – because most people downplay it – even Presidents: Bill Clinton once said ‘I smoked weed but didn’t inhale’.

Uh-huh. Sure Bill.

What most insurance underwriters are looking for is evidence of using hard drugs (heroin, speed, cocaine, and meth), which correlates to a higher chance of risky behaviour, self-harm, permanent injury and death (and therefore a higher chance of them having to pay out).

So if I were in your shoes, I’d be mad as hell at your financial advisor.

They should have alerted you to the fact that this question would be asked, and pre-prepared back-up documentation to give to the insurer, which explains it happened over ten years ago, that you’ve been drug free since then (if you have!), and that you are now a responsible mother with no intention of dropping an ecstasy tablet and dancing to the Wiggles on a Thursday afternoon playdate.

However, now that you’ve been rejected by an insurer it will make it very difficult for you to get insurance anywhere. So I’d make sure you have basic default insurance cover via your super fund, and tell your financial advisor to stick their $750 fee in a pipe and smoke it.

Scott.

Counting my blessings

I know you probably get a million emails but I am hoping this one gets to you. I was around 30 when I read your book (7 years ago now) and I took your advice and set up my insurances through my super.

Hi Scott,

I know you probably get a million emails but I am hoping this one gets to you. I was around 30 when I read your book (7 years ago now) and I took your advice and set up my insurances through my super, upped them accordingly, and set up a good health insurance policy for my family. Fast forward 7 years and I have had cancer twice. The health insurance recommended to me by the government website has been excellent, they paid over $150K worth of surgery and chemo for me. I managed to claim my life insurance so I can invest it for my kids and I also have a decent income through the income protection insurance. Because of you my 2 young kids have a property each and I have a share portfolio which is paying for their school fees and any holidays we take. I can't thank you enough and think of you often when counting my blessings, of which I can still count many!

Tiana

Hi Tiana

In my book I wrote about facing your financial fire … you’ve done it twice! Your kids have not only grown up seeing their mum make smart financial decisions, they’ve watched you face the toughest challenges and win. What a legacy to leave for your kids!

Save my mum, please!

Help, Help, Help please. I need to save my mum from certain death! I know this sounds dramatic but the situation is dramatic.

Scott,

Help, Help, Help please. I need to save my mum from certain death! I know this sounds dramatic but the situation is dramatic. Last June, my parent’s house was damaged by a storm and it’s still not fixed. My elderly mother’s been suffering massive panic attacks since this enormous tree fell on their house and then in January my father suddenly passed away, adding to her stress. Do you have any advice on how to get RACV Insurance to deliver the service my parent’s have paid for? My siblings and I fear the stress will kill her and soon!

Cathy

Hi Cathy,

I understand.

The RACV should have assigned your mother an assessor, a claim number, and contact details.

I would take what you’ve written to me – though put it in her words – and have her email it to the RACV, and request an urgent review and response within ten business days.

If she doesn’t get an adequate response, email me back, and I’ll take it on for her.

Scott.

Someone call the doctor

I opened my mail and felt a cold stethoscope to my nether regions: My health fund was giving me a tickle. It happens every year. Over the past decade, consumer prices have grown 20% … but health insurers have jacked up their premiums by 54%.

I opened my mail, and felt a cold stethoscope to my nether regions:

My health fund was giving me a tickle. It happens every year. Over the past decade consumer prices have grown 20% … but health insurers have jacked up their premiums by 54%.

Oh, that’s cold!

If you pay for private health insurance you know that around this time each year your fund sends you out their ‘drop your dacks and hold your acorns’ letter. Spoiler alert: next week they’re going to jack up your annual premiums – with some funds hiking by as much as 5%!

So let’s talk about what you can do about it.

First, if you can afford it, most funds allow you to pre-pay your premium and lock in the old rate.

Yet let’s be honest: health insurance is bloody expensive, so it’s worth your while to spend an hour or so checking to see if you’re getting the best deal … or if you even need it (if you’re under the age of 31, or you’re earning under $90,000 a year as an individual or $180,000 as a family, you may not need it).

So here’s what I do for my family:

First, I purchase top-level comprehensive private hospital insurance.

Second, I don’t purchase extras or combined healthcare cover. Reason being, most extras policies cost you hundreds of bucks extra per year … whether you claim or not. Don’t believe me? Ring your fund and request an annual claim statement. Then ask, “If I switched to a comparable hospital-only policy, how much would I save each year?”

Third, I do my research on privatehealth.gov.au. That’s the government website and it’s weirdly good. It allows you to compare your current policy against others. Most importantly, it compares every fund on offer – unlike those comparison sites (like iSelect and Comparethemarket) which only list funds that pay kickbacks.

So this week it’s time to turn the tables on your fund, and get them to bend over and show you how flexible they really are.

Tread Your Own Path!

Anti-Vaxxer Worries About Getting Sick

I have been fired due to vaccination mandates. I wonder how this will impact my insurance within my superannuation? Will I lose my insurance? Or will it affect my permanent disability insurance? What advice do you have for those of us out of work?

Hi Scott,

I have been fired due to vaccination mandates. I wonder how this will impact my insurance within my superannuation? Will I lose my insurance? Or will it affect my permanent disability insurance? What advice do you have for those of us out of work?

Alex

Hi Alex,

Great question. Just being fired doesn’t stop your insurance within super.

However, by law, super funds will cancel insurance on accounts that haven’t received a contribution for at least 16 months. They’ll write to you before they do it, but it’s good to be on the front foot. If you want to keep your insurance, you’ll need to call your super fund and/or make a contribution to your account.

Scott

Are You Feeling Lucky, Punk?

When it comes to insurance, I am struggling to find the line between ‘necessary’ (like life insurance) and ‘unnecessary’ (like do I want to gamble my hard-earned money on whether my house will burn down?). If one of us were to die, I don’t think the life insurance money would console the surviving partner. Yet they may face financial hardship without it. So do I gamble, or bite the bullet and just accept it for what it is?

Hey Scott,

When it comes to insurance, I am struggling to find the line between ‘necessary’ (like life insurance) and ‘unnecessary’ (like do I want to gamble my hard-earned money on whether my house will burn down?). If one of us were to die, I don’t think the life insurance money would console the surviving partner. Yet they may face financial hardship without it. So do I gamble, or bite the bullet and just accept it for what it is?

Fred

Hi Fred,

Playtime is over.

It’s time for you to put down your twinkies so we can do some adult-ing.

You need insurance.

Listen, I’m no shill for the insurance industry but, as someone who’s lost their home and contents to a fire (and two cars to rats!), I can tell you the only gamble you’re taking is not having enough.

Here’s my rule of thumb: only insure against things that will financially knock you out.

Example 1: You’re worried that your $30 Kogan hand wand blender could start smoking while you’re whipping up your famous fried twinkies. Should you pay $9 for the extended warranty insurance?

Answer: No.

Example 2: An electrical fault occurs and your $450,000 home, along with $60,000 in household contents (including your hand wand), burns to ashes. Should you pay $100 a month for house and contents insurance?

Answer: Hell, yes.

Final example: The average Aussie will earn $2.07 million over their working life ($2.9 million if they have a degree). What will life look like for your partner if you lose that income?

Answer: Bad.

So let me give the last word to infamous insurance salesman Dirty Harry:

“You’ve got to ask yourself one question: Do I feel lucky? Well, do you, punk?”

Scott.

Forty grand down the drain

If you’ve been watching the floods, you’ve probably thought to yourself: “That’s no good … but at least they’ve got insurance, right?” Maybe.

If you’ve been watching the floods, you’ve probably thought to yourself:

“That’s no good … but at least they’ve got insurance, right?”

Maybe.

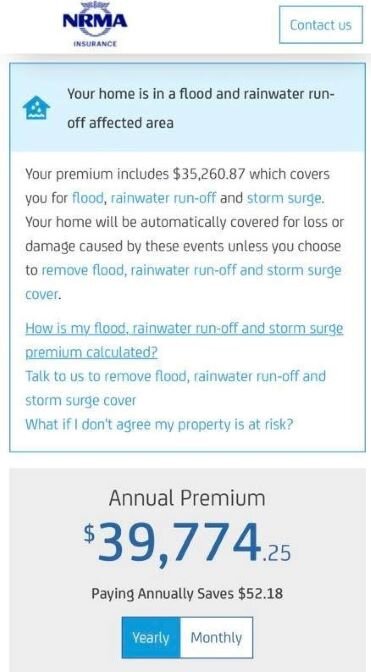

Here’s a quote that was sent to me by a homeowner in a flood-prone area in New South Wales.

That’s something you don’t see every day. Round figures, let’s call it forty big dogs … EVERY YEAR.

Of course, no one can argue that the insurance company is not doing its part: that $52.18 saving for paying annually is a total game-changer.

Seriously, though, a family can’t afford this. So what do they do?

Well, they opt out of flood insurance, which is exactly what the insurance companies want.

Now we could get angry at the insurance companies for doing this.

Or we could get angry at local governments that let developers build on these flood-plain areas.

Yet none of that is worth a squirt when you’re in a ‘once-in-a-century’ natural disaster (which in the Lucky Country comes around roughly once a year).

This is exactly why the floods are an unfolding disaster for many people.

And it’s not just homeowners: three-quarters of renters don’t have any insurance on their contents, according to the Insurance Council of Australia.

Maybe they don’t think they have anything in their house worth insuring … but they do.

The truth is, it’s the battlers who really get screwed when disaster hits — specifically the elderly and those on very low incomes.

Picture someone who counts out their coins each morning. They often go shopping at night when all the unsold meat is marked down.

Then one day water gushes under their door and short-circuits their fridge.

And hundreds of dollars of food — which they can’t afford to replace — starts to rot.

Now that is a disaster.

And right now, as you read this article, there are thousands of Aussies (many elderly, or ill, or young parents) in this situation.

So what can we do?

Thankfully, there are people at Foodbank in NSW and Queensland packing emergency food hampers.

Now during the bushfires, many charities (unfairly) got a bad rap for not spending the money quickly enough for the people who needed it.

Well, it doesn’t get much quicker than providing someone’s next meal. Even better, it’s also a freakishly good return on your money. For every $1 you donate to Foodbank Australia, their scale means they can provide $6 worth of food to battlers.

It’s times like this that we pull together and remember how good we have it.

And it’s times like this that our kids (or grandkids) feel the pride that comes from spending their money on helping others.

To donate, head to foodbankna.org/helpfloods

Tread Your Own Path!

Here’s what could happen in 2021

Let’s discuss what could go wrong in 2021, and what you can do about it. Of course, newspapers are chock-full of experts making predictions about “what’s in store for the next year”, so, before I throw my hat in the ring, let me shake the sauce bottle:

Let’s discuss what could go wrong in 2021, and what you can do about it.

Of course newspapers are chock-full of experts making predictions about “what’s in store for the next year”, so, before I throw my hat in the ring, let me shake the sauce bottle:

How many smart sausages this time last year wrote, “We predict that a pandemic will sweep the planet and lock many of us down in our homes. Our recommendation: stockpile toilet paper in February.”

That’s the err, rub, right?

Well, for what it’s worth, my view is that the next few years could be financially brutal for many businesses, for those workers who are laid off or underemployed, and for retirees who have had their investment income slashed.

However, it’s because of all this misery that things in 2021 could actually get a little … loose.

Here’s the two-hander:

The Reserve Bank has set rates at (effectively) zero to stop you from saving and encourage you to borrow up BIG.

The Government is even attempting to scrap responsible lending laws to get the party in full swing.

Heck, the RBA has given us a timeframe, having all but promised donut rates for the next three years.

What could possibly go wrong?!

Well, lots actually.

Like it or not, we’re living through a giant financial experiment: never has the world had so much debt. Never have interest rates been this low (they’re at thousand-year lows, according to Merrill Lynch).

And so the lesson I’m taking out of 2020, our annus horribilis, is this:

Life is unpredictable.

The truth is we spend most of our lives stressing about things that never happen. And then one day a bat flies the wrong way, and the next day people are going the biff over bog roll.

Think about it: the riskiest things — the ones that knock you on your backside — are often a bolt out of the blue.

For my family it was a fire that burned basically everything we owned.

For others it could be a relationship breakdown. Or an illness. Or an economic meltdown. Or a global pandemic.

So how can you and I prepare for them?

By asking yourself the following questions, today.

Barefoot’s Top Five Questions For 2021

1) “Is my money safe?”

Here’s the bolt out of the blue: you need to access your money quickly, but all your investments have tanked.

If you have money that you need to draw on in the next five years invested in anything other than a bank savings account or term deposit,you may well lose a chunk of it.

Like what?

Like property funds that offer a high rate of interest, or the share market, or cryptocurrency, or any other type of managed investment.

(The share market is not a safe place to hold your money in the next five years. However, it’s arguably the safest place to invest your money over decades, as it will outrun inflation.)

Here’s what you can do about it:

Keep any money you’ll need to spend in the next few years in a bank account (or term deposit) that is covered by the government deposit guarantee (up to $250,000).

Yes, that may sound like overkill, especially with interest rates this low. However, it’s not about the interest you earn (which is pitiful), it’s the sleep-easy factor of knowing you’ve got a backstop. That’s worth more to me and my mental health than any gain I could make in the market.

2) “How long could I last if I lost my job?”

Here’s the bolt out of the blue: your boss calls you into his (virtual Zoom) office on Friday … you’re being laid off.

It’ll never happen to you, right?

Well, I believe the lasting legacy of COVID is to radically change the concept of what we call work.

Think about it: employers have been thrown in the deep-end of the productivity pool this year. Many have had to deal with a reduced workforce who are working from home.

And, now things are getting back to normal, I wonder how many will look at last year and think to themselves:

“Maybe I don’t need all the staff I once had. And, even if I do, if they’re all working remotely … maybe I can hire cheaper workers somewhere else in the world?”

And yet one in five of us Aussies has less than $1,000, according to ME Bank’s latest biannual Household Comfort Report.

Here’s what you can do about it:

Follow the Barefoot Steps; after you’ve set up your buckets, domino-ed your debts and bought your first home (but not yet paid it off), the next Barefoot Step is to boost your Mojo savings to three months of living expenses.

I had a woman write to me in September telling me she thought having three months of Mojo was a total overkill. Yet, when they both lost their jobs, she said, “It was the most important thing in our world. It allowed us to breathe.”

3) “Am I covered?”

Here’s the bolt out of the blue: your house burns down, and you’re not fully covered.

Statistically, if you’re a normal little vegemite you will be underinsured. And the moment you’ll find out is after the fire, or the car accident, or the illness, or … the rats.

(Yes, one of the downsides to living on a farm is rodents. They somehow managed to get into both our cars and eat through $35,000 of interior and electrical work).

Here’s what you can do about it:

Dig out your insurance policies and check what you’re covered for you may need to increase it. If you’re unsure, call your insurer and ask them to review your policy. Life is full of dirty rats, so just make sure you’re fully covered for anything.

4) “Is my partner on the same financial page?”

Here’s the bolt out of the blue: your partner walks out on you.

Relationships Australia tells us the number one reason for relationship breakdowns is fights about money.

Here’s what you can do about it:

The monthly Barefoot Date Night is the cornerstone of my entire plan.

Making a monthly ritual of getting on the same financial page as your partner — and working through the Barefoot Steps — is the most powerful thing you can do to ensure you don’t end up losing half your assets.

If you don’t schedule it, you won’t do it. (We have ours on the first Tuesday of every month, which coincides with the monthly Reserve Bank meeting: how hot is that?)

And remember, money talk goes better with a wine (or taco) in your hand.

5) “If I got hit by a bus, would my family be able to put everything together?”

Here’s the bolt out of the blue: you leave your loved ones with a financial Rubik’s cube of frustration.

Picture your partner (or parents) sitting alone, distraught and grieving, trying to piece together your financial life.

They have no idea how to access your bank accounts, the password to your email and social media, your funeral wishes or even where your will is.

Here’s what you can do about it:

Spend an afternoon getting everything in one place.

At Barefoot we call it the Fearless Folder, and once it’s done you lock it away in a secure safe.

The feedback I get from people who have done it is that it’s Marie Kondo-cathartic to have it all sorted.

What’s more, it’s the final way you’ll say “I love you” to your loved ones.

And there you have it.

Each and every week, I show up and answer your questions.

Yet to really prepare for 2021 you need to ask yourself the right questions, and get the right answers for you.

Tread Your Own Path!

A Magical Mystery Tour

I’m a Kids Superhero Magician - taxable income about $80K a year … or I WAS until Covid GRRR. After reading your last column about that smart single mum with cancer who set her life insurance in place, I followed your advice and have been looking at raising my life and TPD through my living super insurance - but the premium was $5600 a MONTH! Is there a good life insurance place that you would recommend? Any advice around this topic?

Ben,

I’m a Kids Superhero Magician - taxable income about $80K a year … or I WAS until Covid GRRR. After reading your last column about that smart single mum with cancer who set her life insurance in place, I followed your advice and have been looking at raising my life and TPD through my living super insurance - but the premium was $5600 a MONTH! Is there a good life insurance place that you would recommend? Any advice around this topic?

Steph

P.S - I went into Woolies last month and your book was half price - I went to the counter and the price on the tills was wrong so I told them AND GOT YOUR BOOK FOR FREE (Woolworths weird policies).

P.P.S - I love you! But don't tell my partner snoring next to me.

Hi Steph,

First, I have no idea who Ben is, but I’ve been called worse (like Magoo), so let’s go with that.

Second, it’s common to get ‘bill shock’ when you attempt to increase your insurance. You should call your super fund and see what options they have where they can offer financial advice and wholesale rates (without the hefty commissions). This is one area where you really want to pay to get expert advice that is specifically tailored to your situation.

Finally, let’s talk about that ‘smart single mum with cancer’ who inspired you to boost your insurance: Emma.

As a recap: Emma wrote to me a few weeks ago, thanking me for reminding her to boost her TPD insurance. She explained that just last year she was ‘a fit and healthy 42 year old single mum with two boys aged 10 and 7’ … yet she’d been diagnosed with cancer, and her insurance really helped her out.

I found out last week that Emma died.

The greatest respect I can give Emma is to put her story in front of my community of Barefooters. And I’ll say it again this week. Check your insurance. Make sure you have enough. Do it for Emma. Do it for your kids. Do it TODAY.

A Mother with a Message

A year ago I was a fit and healthy 42-year-old single mum with two boys aged 10 and seven. Your book has helped me get on top of my finances, and every year I re-read it (well, listen to it on my commute)

Hi Scott,

A year ago I was a fit and healthy 42-year-old single mum with two boys aged 10 and seven. Your book has helped me get on top of my finances, and every year I re-read it (well, listen to it on my commute). When I read it in October 2019, I realised my death and TPD insurance wasn’t anywhere near the 10 times annual salary you recommend, so I bumped it right up.

And I am so glad I did. Last December I was diagnosed with a rare terminal cancer, and my insurer has now paid out nearly $1 million. I have been able to pay for specialist treatment not covered by Medicare, see off the mortgage, and set up a trust to support my boys when I am not here. So much of how well I am doing is because I have the financial freedom to just live. Everyone should have this freedom. So thank you, Scott, for the work you do — you are saving lives.

Emma

Hi Emma,

Just wow.

The greatest respect I can give you is to put this in front of my community of Barefooters.

If you’re a parent, you need to follow Emma’s lead and act on this.

The ‘10 times your salary’ figure is a very rough guide of course — you should speak to your super fund’s financial advisor (in the first instance) about what’s right for their family.

Do it for Emma. Do it for your kids. Do it TODAY.

They’re Coming Out of the Woodwork

I’ve just read your article entitled “The Horses”. My wife was tricked into buying an almost identical funeral insurance policy from Insuranceline. We estimate we have paid $35,000 in premiums since 2007, with a payout cover of just $6,000 each.

Hi Scott,

I’ve just read your article entitled “The Horses”. My wife was tricked into buying an almost identical funeral insurance policy from Insuranceline. We estimate we have paid $35,000 in premiums since 2007, with a payout cover of just $6,000 each. My wife and I are now in our seventies, with the age pension as our only income. And, as you know, they keep increasing premiums as we get older. I’m stressed. What can we do?

Ted and Eileen

Hello Ted and Eileen,

I’m used to getting a lot of emails.

Yet I’ve been blown away by the number of people who’ve written to me in a similar situation to you.

Your wife entered into this financial transaction not out of greed but out of kindness and selflessness:

She didn’t want to be a financial burden on her family.

Sadly, too many insurance companies manipulate this emotion for their own gain.

The problem is that, in some cases, if you stop paying the rising premiums you can lose your cover (though you should definitely check the wording in your policy, or call a financial counsellor on 1800 007 007 to help you with it).

Yet if you keep paying you may not be able to afford to travel and see your grandkids. Or do Christmas presents.

The irony is that if you were to speak to your family, you’d find they’d rather you spend the money enjoying yourself than living your final years being stressed out about money.

Besides, a private funeral typically costs around $4,000 for a basic cremation, or up to $15,000 for a more elaborate burial, according to ASIC’s MoneySmart.

I’d encourage you to make a formal complaint to the insurer in writing, and if you don’t get an appropriate outcome take it up with the Australian Financial Complaints Authority (ACFA) on 1800 931 678.

The Horses

My mother-in-law took out funeral insurance way back in 2004. Since then she has paid approximately $29,000 ($72 per fortnight), but if she were to die the payout would be $17,700. I cannot find a legal way to get them to stop taking more of her money. They will stop when she is 90, but sadly she is 70 and has Parkinson’s. Any ideas?

Dear Scott,

My mother-in-law took out funeral insurance way back in 2004. Since then she has paid approximately $29,000 ($72 per fortnight), but if she were to die the payout would be $17,700. I cannot find a legal way to get them to stop taking more of her money. They will stop when she is 90, but sadly she is 70 and has Parkinson’s. Any ideas?

Sarah

Hi Sarah,

You know what I dislike more than those mindless morning television shows?

The ads that pay for them.

A big infomercial flogger is funeral insurance, and they really press on your emotions to ‘not be a burden to your family’. The Royal Commission showed that the companies that sell this type of insurance are the WORST.

Let me count the ways:

First, you often end up paying more in premiums than the value of the cover.

Second, the premiums often rise as you get older, when you can least afford them.

Third, if you stop paying, in most cases, you won’t get your money back.

Fourth, if your mother-in-law had invested $72 a fortnight into a low-cost index fund for the last 16 years, she’d have $63,000 by now. That could afford a helluva funeral (she could even have Daryl Braithwaite tow her coffin out on a horse while singing The Horses).

So what can she do?

Well, these products are often sold by slick salespeople with predatory practices. If that happened to her, she may be entitled to a resolution.

You’re thinking “but my mother-in-law is a pensioner with Parkinson’s, she won’t stand a chance”. And that’s why I want you to put me in contact with her this week, and I’ll take this on personally.

It’s time to whip these nags!