Articles & Questions

Every week I publish a fun new article on a money topic I think you’ll find interesting. I also answer a handful of reader questions. Subscribers to my newsletter get to see everything first — but you can browse some of my past articles & questions on this page.

My Best Articles

Not sure where to start? Below I’ve handpicked a few of my favourites. And if you like what you see, don’t forget to subscribe to my free newsletter to get new issues before anyone else!

Search Articles

The Millionaire Orphan

When I was 18 my parents passed away, but I was in the privileged position to inherit nearly $1 million. For years I did not want to think about it and felt guilty it was now mine. So I split it across term deposits and online savers and, aside from paying for uni, left it there.

Hi Scott,

When I was 18 my parents passed away, but I was in the privileged position to inherit nearly $1 million. For years I did not want to think about it and felt guilty it was now mine. So I split it across term deposits and online savers and, aside from paying for uni, left it there. After reading your book at 24, I know I should be more proactive and honour this gift, but I am lost and do not want to waste my parents’ hard work. Should I buy a home? Do I put it all in shares? Please help!

Charlotte

Hi Charlotte,

I’m really sorry for your loss.

The thing that almost no one talks about is that having lots of money can be really stressful.

It can cause a lot of self-doubt and fear and angst.

And it’s the big life-changing decisions that you really want your parents’ guidance on, right?

Well, I’d suggest that all your parents would want is for you to be financially safe and secure.

There are four ways to achieve that:

The first is to devote your time to getting a good education and building a career you love.

The second is to always have three months of living expenses in Mojo (savings) you can access.

The third is to own a home — but only if you can afford it.

The fourth is to slowly but surely add to your super over your working life (I suggest topping up your employer’s contribution of 9.5% with your own contributions, up to 15%).

Charlotte, you are honouring your parents by taking the time to learn about money, and I think they’d be very proud of the financial decisions you’re making.

Scott.

Barefooters Dig Deep

I work at Foodbank NSW & ACT, and I just want to say a huge THANK YOU on behalf of our team for the shout-out in your last column! Yesterday alone we received over $135,000 in donations, which we believe is mainly due to your call out. These donations will go a long way in helping us to continue distributing crisis hampers to those affected by the floods across the state. Thank you again!

Hi Scott,

I work at Foodbank NSW & ACT, and I just want to say a huge THANK YOU on behalf of our team for the shout-out in your last column! Yesterday alone we received over $135,000 in donations, which we believe is mainly due to your call out. These donations will go a long way in helping us to continue distributing crisis hampers to those affected by the floods across the state. Thank you again!

Natalie from Foodbank

Hi Natalie,

Our Barefoot Community is amazing!

I’m also hoping you got a lot of very small donations … from kids.

My ‘Jam Jar’ system for pocket money makes ‘giving’ one of the three categories for kids to spend their money on.

Reason being, getting kids to habitually give is one of the most practical ways to raise empathetic, generous adults. And Foodbank is one of the best places to donate their money from their ‘Give Jar’, because, after all, kids understand what it’s like to be hungry (and hangry). It’s tangible, it’s immediate, and it’s badly needed.

Thanks for all the work you do.

To donate, head to foodbankna.org/helpfloods

Scott.

Five podcasts that are on my playlist

“For the last week, I’ve been following a new morning routine. I wake up, meditate, then light a candle and do some affirmations …”, gushed a friend of mine. “It’s been a total gamechanger.”

“For the last week I’ve been following a new morning routine. I wake up, meditate, then light a candle and do some affirmations …”, gushed a friend of mine.

“It’s been a total gamechanger.”

Right.

From the moment the first of our four kids wakes up, it’s on like Donkey Kong.

The amount of noise and tantrums and Vegemite that gets smeared from 6am to 8.20am is an affirmation in itself.

Yet at 9am it’s time for my gamechanger.

I’ll often head out to the farm to do a $20-an-hour job, and listen to a podcast. Spending time listening to intelligent people talk about interesting things leaves me feeling really rich (even as I mindlessly dig a ditch).

And so, as we move into the Easter break, I thought I’d share with you five podcasts that are on my playlist.

Planet Money

Right now we’re living through a giant monetary experiment of historically low rates and money-printing that affects every one of us — whether we understand it or not. Planet Money does an amazing job of explaining it all in simple terms. The show takes complex issues and explains them in a way that anyone can grasp, without dumbing things down and while managing to be entertaining (my wife enjoys the show!). Best of all, despite the fact that economics invariably strays into politics, Planet Money doesn’t have a political agenda.

Best episode: ‘Bond Voyage’.

The Dropout

In 2015 Elizabeth Holmes was the youngest self-made billionaire ever, with a fortune of $4.5 billion. She’d dropped out from Stanford University to develop a blood-testing machine that took a prick of blood from your finger rather than a vial from your arm. She named the contraption Edison (after Thomas) and pranced around in a black turtleneck (after Steve). Two years later her net worth was zero, and now she’s on trial for fraud. This is the story of how a young woman swindled some of the wealthiest, smartest people on earth … and how she got caught.

Best episode: It’s a four-part series, and it’ll hook you in from the moment you start listening.

Cautionary Tales

Tim Harford is a brilliant economist who writes for the Financial Times in the UK. Yet he’s also worked out what most economists haven’t: most people learn best through stories. And Harford’s podcast Cautionary Tales is very good at telling fascinating (and frightening) stories that ultimately help you make better decisions. “We’ve always warned children by telling them unsettling fairy tales. But my Cautionary Tales podcast is for the education of the grown-ups. And my cautionary tales are all true”, says Hartford.

Best episode: ‘Buried by the Wall Street Crash’.

No Feeling Is Final

Trust me, you haven’t heard a podcast like this. Honor Eastly offers up an audio memoir which takes you to the depths of her depression and subsequent psychiatric hospitalisation. It’s raw, heartfelt and addictive. It’s not the easiest thing to listen to, but that’s the point. The six-episode series left me with a better understanding of mental illness and the challenges that many of my clients (and friends) deal with on a daily basis.

Best episode: All of them. There are some rude words, though, so you don’t want to play it in the car with the kids.

Oh, and speaking of which, here’s one that’s on my playlist for the kids:

Wow in the World

I have young boys, and the amount of poo humour per kilometre I’m subjected to on the school run is off the charts. So when I reach my fill I put on Wow in the World. It’s a podcast series aimed at primary-school-aged kids and it explains things about science, tech and the world around them. It’s educational and really funny.

Best episode: ‘Are You Smarter than a Toilet?’

Tread Your Own Path!

Hit Me Baby One More Time?

My four siblings and I have inherited close to $100,000 between us. I am the executor, and am unsure how best to manage the funds.

Scott,

My four siblings and I have inherited close to $100,000 between us. I am the executor, and am unsure how best to manage the funds. At the moment two of my siblings are unaware of the inheritance as, to be honest, they will most likely spend a good amount of it on drugs. Would it be best to divide it individually, or invest it as a whole, or set up trusts for these two? Even with a trust, I don’t know when the best time to release the money would be. Help!

Chris

Hi Chris,

Have you seen the explosive documentary on Britney Spears?

After Britney went off the rails in 2008, her old man took out a court-approved conservatorship. This order essentially makes him her legal guardian and gives him authority over her finances and personal decisions. The controversy is that many of her fans believe the conservatorship is exploiting rather than helping the 39-year-old superstar mum.

So what does all this have to do with you?

Well, you’re acting like Britney’s father … only worse.

I mean, at least he went to court and got an approved order … you’re doing this under your own steam.

Chris, let me be very clear: IT’S NOT YOUR MONEY.

It’s your siblings’ money and, heartbreaking as it is, if they want to blow it on drugs then that’s their business. As an executor you are the servant, not the boss, and you are duty-bound to inform the beneficiaries, and then distribute the money as per the deceased’s wishes.

Now I know you’re a caring brother and you only have your siblings’ best interests at heart.

So you should urge them to see specialist drug counsellors. They can talk through the very serious issue of the money fuelling their drug addiction, and the compounded pain and shame of blowing their inheritance. They may decide to hand over financial power of attorney to you (or someone else they trust). They may not. Either way, it’s their life, and their decision.

If you feel that they are vulnerable and lack the ability to look after their money you can seek an administration order in your State. It’s a legal document that gives a person (called an ‘administrator’) power to make decisions on behalf of another person about financial affairs. This includes money, property and some legal matters. But it is a big responsibility. And it may be opposed.

#FreeBritney.

Scott.

My Wife is Sending Selfies to Russians

I am hoping you can solve a disagreement between my wife and myself. I have just read your answer to Lilly, who got herself tangled up with Skyway Investment in Russia. My wife has invested $1,000 with them too.

Hi Scott,

I am hoping you can solve a disagreement between my wife and myself. I have just read your answer to Lilly, who got herself tangled up with Skyway Investment in Russia. My wife has invested $1,000 with them too. However, they also have a picture of her passport details. Now they are requesting her to take a photograph of herself from various angles so they can confirm who she is. Have you heard of deepfake?! I am concerned they will steal her identity and wipe out our accounts. Thankfully, she has not given them our bank account details, and the credit card number she used for the initial purchase has changed. But I am still concerned. Should I be?

Brad

Hi Brad,

You’re right, Brad, this smells off like a four-day-old beef stroganoff.

(For those of you playing along at home: never, ever, ever email a digital copy of your ID to anyone.)

The job of clearing your name after your identity is stolen takes the average person 27.5 hours.

So let me help save you 27 hours:

First, kiss the $1,000 goodbye. Never communicate with these rogues again in any way, shape or form.

Second, check her credit report and see if anyone has applied for credit in her name.

Third, call the not-for-profit IDCARE on 1800 595 160 and ask their advice on what to do next.

So, Brad, let me raise a glass of vodka to your coming adventure:

Поднимем бокалы за успех!

Scott.

The Friendliest Store In Town

Last week’s column about the Small Business Debt Helpline was the best one you have ever done! I will be sure to pass this information on to anyone out here in the Kilkivan district who needs it.

Hi Scott,

Last week’s column about the Small Business Debt Helpline was the best one you have ever done! I will be sure to pass this information on to anyone out here in the Kilkivan district who needs it. We need to start looking after small business owners, because no one looks after them, and (as you say) they are our country’s biggest employer. I know — I am one of them. And the constant stress and worry that your family home is directly linked to how many coffees and burgers you sell each day can be crippling.

Katy

Hi Katy

Thanks for writing.

Let me give two plugs:

First, for you: Katy runs the Kilkivan General Store, which she reckons is ‘The Friendliest Store in Town’.

Second, for the Small Business Debt Helpline, who do a bloody good job looking after small business owners doing it tough. They’re independent. They’re free. And they’ll fight for you. Call them on 1800 413 828.

Scott.

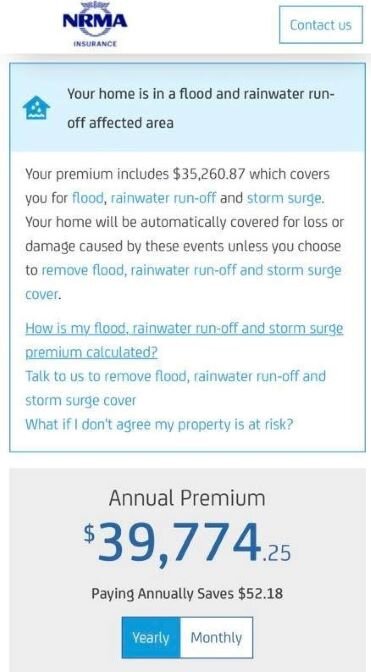

Forty grand down the drain

If you’ve been watching the floods, you’ve probably thought to yourself: “That’s no good … but at least they’ve got insurance, right?” Maybe.

If you’ve been watching the floods, you’ve probably thought to yourself:

“That’s no good … but at least they’ve got insurance, right?”

Maybe.

Here’s a quote that was sent to me by a homeowner in a flood-prone area in New South Wales.

That’s something you don’t see every day. Round figures, let’s call it forty big dogs … EVERY YEAR.

Of course, no one can argue that the insurance company is not doing its part: that $52.18 saving for paying annually is a total game-changer.

Seriously, though, a family can’t afford this. So what do they do?

Well, they opt out of flood insurance, which is exactly what the insurance companies want.

Now we could get angry at the insurance companies for doing this.

Or we could get angry at local governments that let developers build on these flood-plain areas.

Yet none of that is worth a squirt when you’re in a ‘once-in-a-century’ natural disaster (which in the Lucky Country comes around roughly once a year).

This is exactly why the floods are an unfolding disaster for many people.

And it’s not just homeowners: three-quarters of renters don’t have any insurance on their contents, according to the Insurance Council of Australia.

Maybe they don’t think they have anything in their house worth insuring … but they do.

The truth is, it’s the battlers who really get screwed when disaster hits — specifically the elderly and those on very low incomes.

Picture someone who counts out their coins each morning. They often go shopping at night when all the unsold meat is marked down.

Then one day water gushes under their door and short-circuits their fridge.

And hundreds of dollars of food — which they can’t afford to replace — starts to rot.

Now that is a disaster.

And right now, as you read this article, there are thousands of Aussies (many elderly, or ill, or young parents) in this situation.

So what can we do?

Thankfully, there are people at Foodbank in NSW and Queensland packing emergency food hampers.

Now during the bushfires, many charities (unfairly) got a bad rap for not spending the money quickly enough for the people who needed it.

Well, it doesn’t get much quicker than providing someone’s next meal. Even better, it’s also a freakishly good return on your money. For every $1 you donate to Foodbank Australia, their scale means they can provide $6 worth of food to battlers.

It’s times like this that we pull together and remember how good we have it.

And it’s times like this that our kids (or grandkids) feel the pride that comes from spending their money on helping others.

To donate, head to foodbankna.org/helpfloods

Tread Your Own Path!

Teenage Terms and Conditions

Recently my 13-year-old son received a letter from the ANZ bank with a new debit card and the promise of a PIN to follow. The problem is, his mum and I knew nothing about it!

Hi Scott,

Recently my 13-year-old son received a letter from the ANZ bank with a new debit card and the promise of a PIN to follow. The problem is, his mum and I knew nothing about it! My son had organised the whole thing by himself, from the initial online application to the in-branch ID verification. We were horrified — how is this possible? So I went with my son to the bank and asked the teller if this was true. They called the manager, who said ‘yes’. I still don’t believe it!

Chris

Hi Chris,

I spoke to the ANZ and they said:

“Customers from 12 years old are able to open an everyday account; however, we only offer EFTPOS cards rather than VISA debit cards for anyone under the age of 14 years.”

In other words, they’re like any business looking for customers. And their aim is to convert these kids into highly profitable customers, which is where the problems begin.

Sure, it would be dandy if all the banks signed a charter that they won’t push products on kids under the age of, say, 21. Yet that’s a pipedream. Besides, there are plenty of other sharks that will bite our kids (hello Nimble).

A more practical approach is to build the financial confidence of every Australian kid before they leave school.

(I’m working on that.)

But, Chris, this isn’t about ANZ. Please don’t make it about them.

This is about your son being a total go-getter.

Seriously.

You should be bragging about his initiative to anyone who listens. Let him overhear how proud you are.

How many parents of a teenager would LOVE to have this problem?

In my book The Barefoot Investor for Families, one of the challenges in the Barefoot 10 — the 10 things you want your kid to do before they leave home — is to set up a low-fee bank account. Another is giving them your utility bills and bank bills and paying them a commission if they can get a cheaper rate.

Embrace it!

Scott.

It’s a Scamski!

My wife is 57 and has invested thousands of dollars into an ‘education investment program’. It is a multi-level marketing program called SkyWay Investment Group (SWIG).

Barefoot,

My wife is 57 and has invested thousands of dollars into an ‘education investment program’. It is a multi-level marketing program called SkyWay Investment Group (SWIG). You buy units (not shares)! In US dollars! Converted into Russian rubles! The lead-in was that they would develop a transportation company that would revolutionise transport. They seem to have strayed away from that, though, as they are now offering cryptocurrency. My wife believes we are going to be rich when all the dividends are paid. I think the truth is fabricated, but she just says “You don’t believe in me”.

Neale

Hi Neale,

It sounds like your wife has made Skyway Investment Group part of her identity.

That’s a problem because, to quote the first line of SkyWay’s Wikipedia page:

“Financial regulators in Germany, Belgium and 15 other countries have banned the sale of financial products from SkyWay or warned the public about a potential scam.”

So what you could do is whip out your phone and say: “See, I told you so!”

Yet this is probably the dumbest thing you could do.

After all, in her mind, when you attack SkyWay you’re attacking her.

So, what to do?

Well, my advice would be to go on a Barefoot Date Night.

The aim of that night is to show her you believe in her, and that you need her help.

The fact is you’re heading towards retirement, and you need to work together to nail your retirement number (see notes in my Barefoot Investor book to work that out). Then you both need to work hard to achieve it.

Personally, I’d never talk about SkyWay again. Don’t poke the bear!

You’ve lost that money. The worst thing that could happen right now is if you lose the faith and confidence of your life partner. You need to build her up so you can focus on the main goal: securing your retirement.

Scott.

A Super Idea?

I have just seen a news item on a proposed policy which could see victims of domestic violence allowed to withdraw up to $10,000 from their super.

Hi Scott

I have just seen a news item on a proposed policy which could see victims of domestic violence allowed to withdraw up to $10,000 from their super. Typically victims of domestic violence are women, and women on average have less super accumulated, due to raising families. I am supportive of any initiative to help victims of violence, but is this likely to help or hinder them financially in the long run?

Theresa

Hi Theresa,

Of course! Raiding your super early will hurt you financially in the long run.

Yet I also agree with Superannuation Minister Jane Hume, who says that it’s simply another tool, and if it encourages women to leave a dangerous, abusive relationship then that’s a good thing.

However, as someone who works in the community sector and has helped women in this very situation, I don’t think accessing 10 grand from super is high on their priority list.

What I think should be on the Government’s priority list is properly funding emergency housing, legislating for paid family violence leave, and doing everything they can to help these courageous women (and their kids) find safety and security.

Yes, there is a cost to properly fund this … yet there is an even bigger cost if we don’t.

Scott.

How to help out a mate

“It’s over ... it has to be.” I just can’t do this anymore. I’ve carried the stress for far too long.” On the other end of the line was Steve, the owner of a struggling retail shop.

“It’s over ... it has to be.”

I just can’t do this anymore. I’ve carried the stress for far too long.”

On the other end of the line was Steve, the owner of a struggling retail shop.

Steve had finally cracked.

And from experience I can say it often takes a small business owner years to reach this point.

Yet in truth I was the wrong person to call: financial counsellors generally don’t advise on business-related debts.

Well, until recently.

In the wake of last year’s tragic bushfires, the Government set up the Small Business Debt Helpline, which is run by Financial Counselling Australia.

It’s long overdue.

After all, Treasurer Josh Frydenberg has said that “small businesses are the backbone of our economy, and they’re going to be a key part of the recovery”.

He’s right:

When you think of businesses, you probably think of the big boys: Woolies, Coles, Telstra, BHP.

Yet only 3% of Aussie businesses employ more than 20 people.

The other 97% are small family operations, and they collectively employ 4.7 million people.

That makes them Australia’s largest employer.

And yet when things get tough they don’t have access to the same funding options that big businesses do.

The truth is that our banks would rather lend money to buy an (inflated) property than chance it on a small business owner. All too often the banks look for reasons not to lend.

So business owners end up getting hit with complex personal guarantees and convoluted legal contracts they don’t understand … or worse, getting bitten by a loan shark.

And that’s where the trouble really begins.

As Steve will tell you, owning a struggling small business can be a lonely, isolating experience.

You wrap up your very identity in the business … and often your family home, and your family’s future.

Could the stakes be any higher?

So I need you to do me a favour:

If you know someone who’s struggling in their own small business — and there are plenty of them right now — let them know they’re not alone.

Get them to call the Small Business Debt Helpline on 1800 413 828.

It could be the lifeline they need.

Tread Your Own Path!

Hyperinflation Coming?

I am one of those 20-something Reddit users who makes some ‘tendies’ off GameStop. Most of my meagre net worth is in a high-interest savings account and an ETF as I save for a home deposit.

Hi Barefoot,

I am one of those 20-something Reddit users who makes some ‘tendies’ off GameStop. Most of my meagre net worth is in a high-interest savings account and an ETF as I save for a home deposit. But I have something that really should get your attention: hyperinflation. It is gaining massive traction on WSB (Wall Street Bets, on Reddit), and it is not your average conspiracy theory. Even Michael Burry (of ‘The Big Short’ fame) is talking about it. They are likening our current financial climate to the hyperinflation seen in post-WW1 Germany. What do you make of it?

Harry

Hi Harry,

I’m not going to rule out hyperinflation.

Heck, after the last 12 months I’m not ruling anything in or out. After all, who would have thought we’d be locked in our homes for the better part of the year?

One lesson I’ve taken from our annus horribilis is to be humble: the world is far too complex for us to accurately predict anything.

Another lesson is to stop reading online articles designed to scare the clicks out of you.

Instead, I’m going to suggest three books for you to read:

The first is When Money Dies. Author Adam Fergusson tells the shocking story that Germany faced post WW1 ... where a loaf of bread skyrocketed from 160 marks in 1922 to 200 million marks by 1923. Fergusson has since reassured readers that no advanced economy will hit hyperinflation anywhere near the level he writes about. Yet it doesn’t have to: even sustained double-digit rates of inflation can ruin people’s lives. And that to me is the message of this book.

The second is The Great Depression: A Diary by Benjamin Roth — one of my all-time favourite books. It’s the actual diary notes of a lawyer living through the Great Depression (what makes it fascinating is that he doesn’t know he is). His writing paints a very different situation to the one we are in now: in the Depression, the average person had next to no money. Today we’re flush with cash.

The final one is The Rational Optimist. Author Matt Ridley convincingly argues that, contrary to the doom-and-gloomers, the world is actually getting better. And it is. The best time to be alive is right now.

Harry, investing and saving — and living — is the ultimate act of optimism. So be bold!

Scott.

Show Me the Money

We have three boys, aged 6, 3 and 0, and I would love to introduce your ‘Jam Jars’ with them. But, once we buy the jars (and polish off the jam), where are all these ‘coins’ coming from in a world of plastic banking? When was the last time you had a wallet full of coins?

Hey Barefoot,

We have three boys, aged 6, 3 and 0, and I would love to introduce your ‘Jam Jars’ with them. But, once we buy the jars (and polish off the jam), where are all these ‘coins’ coming from in a world of plastic banking? When was the last time you had a wallet full of coins?

Brendan

G’day Brendan,

I don’t have a wallet full of coins. In fact I don’t have a wallet — I use my Apple Watch.

However, kids are visual creatures, so nothing works as well as shiny coins that clink as they hit a glass jar.

Now to your question: where do I find these relics?

It’s actually not that hard. Every so often when I’m at the supermarket I’ll get $50 in coins, then store them in a tupperware container at home.

Another tip: you may not need a wallet anymore, but your kids do, and you should keep their wallets in your car. That way the next time they bug you for something they can pull out their wallets, count up their money, and buy it themselves.

Scott.

My secret side hustle revealed

Just in case this ever leaks, I need to make a confession: This year I’ve been doing some ‘side hustle’ work as a garbo.

Just in case this ever leaks, I need to make a confession:

This year I’ve been doing some ‘side hustle’ work as a garbo.

It all began in lockdown when I was looking for an excuse to get out of the house. A mate of mine has a rubbish removal business and asked whether I’d like to tag along on some of his jobs.

How could I say no?

There’s something about hydraulics, a mate to talk rubbish with, and snooping on people’s trash that really revs my engine.

“I could make a killing by selling a paparazzi shot of you picking up rubbish”, teased my mate. “I can see the headline now: ‘Barefoot investor goes broke, becomes a GARBO’.”

Yet there was an ulterior motive: I have been decking out a barn (read: man cave) on the farm, so I was keeping a lookout for any discarded gems.

As we toured the suburbs dropping off giant skip bins, it was clear that a lot of people had been inspired to do a Marie Kondo cleanout over lockdown.

But you know what was really weird?

I was expecting to find loads of old junk. Yet most of the furniture being chucked wasn’t that old … and the people who’d chucked it would have paid a pretty penny for what had quickly become semi-disposable Swedish furniture.

For my man cave I wanted something that would last. So on the weekend I went shopping for a ‘good’ sofa, and I met possibly the most honest furniture salesman in Melbourne.

“Is it leather?” I asked, pointing at a classy-looking chesterfield.

He looked at me, smiled, and shrugged his shoulders.

“Honestly? It’s spat out of a factory in China. It could be made of rat for all I know. But it looks good, right?”

(He was only slightly joking. Consumer group CHOICE says — incredibly — that there is no one definition of leather.)

“Look, mate, no one makes anything here in Australia anymore”, the salesman said to me emphatically. “It’s too expensive. Everything is made in China. EVERYTHING.”

That was like waving a red rag to a ... rat?

Eventually, after much googling, I found a furniture-maker in Melbourne who has spent decades honing his craft. So I gave him a call.

“How can I ensure you’re putting real leather on my sofa?” I quizzed him.

“Well, how about we go pick out the hide together?” he said.

Hard core.

Now I know what you’re thinking: “Not everyone has the coin to get something custom made, Barefoot!”

And I agree — which is why, in addition to getting a sofa made, I’ve also been hunting for restored antique furniture on the cheap off eBay (for the man cave). The sort of stuff that was built in a different era, long before everything was created to be flat-packed on a ship from China.

My thinking: I not only want to be sustainable for the planet, I want to buy something that will outlast me — and support Aussie jobs to boot.

Yes, it will cost more. But, then again, so does paying good money for average stuff and paying two dudes to cart it away every few years.

Tread Your Own Path!

Barefoot, the Fire Starter

Because of you, we started a fire in our neighbour’s yard!

Scott,

Because of you, we started a fire in our neighbour’s yard! We dominoed our debts (18 months ahead of schedule) and burnt our loan statements just like you advised ... which flew over the fence into our neighbour’s yard and started burning. Anyway, thanks to you, we can now put an extra $2,000 a month into our home loan and continue working our way to being debt free. (Side note: our neighbours have now started their Barefoot journey.)

Bec

Hi Bec,

So you did the bill-burning ceremony, congratulations!

We all need to celebrate these achievements (even if it occasionally leads to an arson charge).

A lot of unhappiness comes from trying to keep up with the Joneses … yet not in this case.

Your neighbours are on fire!

Scott.

The HSBC Chicken

Your book arrived out of the blue on my doorstep one day. Reading it, it was painful to realise how bad I was at managing money. So I took action. Just last week I paid off my third and final credit card! For my job as a set designer I needed to make a papier-mâché roast chicken, so I used all my old HSBC bank statements. As I glued each painful piece into the shape of a chicken, the weight of 24 years of debt fell away, and before my eyes the HSBC Chicken was born! Thank you so much — you have helped me turn my life around.

Hi Scott,

Your book arrived out of the blue on my doorstep one day. Reading it, it was painful to realise how bad I was at managing money. So I took action. Just last week I paid off my third and final credit card! For my job as a set designer I needed to make a papier-mâché roast chicken, so I used all my old HSBC bank statements. As I glued each painful piece into the shape of a chicken, the weight of 24 years of debt fell away, and before my eyes the HSBC Chicken was born! Thank you so much — you have helped me turn my life around.

Rose

Hi Rose,

Congratulations! I usually encourage parents to blend their credit cards in front of their kids (a dramatic way of teaching them not to use them). Yet your idea is much more creative.

Winner, winner, chicken dinner!

Scott.

Should I Tell My Boyfriend to Shut Up?

My husband and I are so close to having a 20% deposit for our family home. However, with the prices of houses being so ridiculously high right now, he wants to wait and meanwhile put our house deposit into shares in the hope that we will have more than enough money in a couple of years. Should I listen to my husband or tell him to shut up?

Hello!

My husband and I are so close to having a 20% deposit for our family home. However, with the prices of houses being so ridiculously high right now, he wants to wait and meanwhile put our house deposit into shares in the hope that we will have more than enough money in a couple of years. Should I listen to my husband or tell him to shut up?

Willa

Hi Willa,

My first thought is to tell him to shut up.

My second thought is to get him talking. Here are some clarifying questions you might want to ask:

“You reckon the property market is too high and due for a fall. Why wouldn’t that be the same situation for the share market? They’re both just assets, right?”

Whatever he answers, follow up with this:

“No one can predict what’s going to happen in the share market, or the property market, in the next few years. It could go up, down, or sideways. That being the case, let’s run some scenarios now and see how we’d deal with them:

“What would we do if our shares tank 50%?”

(Wait to get his response. “It won’t happen” is not the right answer. Ask him how he’d feel watching your deposit cut in half. Would he hold his nerve?)

“What would we do if the property market increases while we’re risking our savings in the share market?”

(Again, wait to get his response.)

And, finally, hit him with this: “Are you unsatisfied with what we can currently afford?”

It sounds like that is the root of the problem … and there’s no shame in that at all. In a rampant debt bubble, young people starting out have to make trade-offs. Just make sure you’ve thought them through.

And that’s going to require a lot of talking, and thinking!

Scott.

Barefoot Endorsement, Please

A reputable friend has suggested I invest in a CFX project (cryptocurrency foreign exchange). From what I understand it is kind of like multilevel marketing and a type of cryptocurrency. I have looked into it and it sounds good. However, I am hesitant to pay out my hard-earned cash without some endorsement from someone like you. I am planning a baby as a single woman at 45 and I bought my first home only a year ago, so I am looking at ways to increase my income and secure my future. Thoughts?

Hi Scott,

A reputable friend has suggested I invest in a CFX project (cryptocurrency foreign exchange). From what I understand it is kind of like multilevel marketing and a type of cryptocurrency. I have looked into it and it sounds good. However, I am hesitant to pay out my hard-earned cash without some endorsement from someone like you. I am planning a baby as a single woman at 45 and I bought my first home only a year ago, so I am looking at ways to increase my income and secure my future. Thoughts?

Lilly

Hi Lilly,

You want my endorsement?

Okay, here goes: No. No. No. Lilly, oh god no. No.

Is that emphatic enough for you?

Now, I’m betting your ‘reputable’ friend isn’t a brand-new home owner who is about to become a mature-age single parent. Lilly, you simply can’t afford to get swept up in this rubbish.

If you want to increase your income and secure your future — and that’s an admirable ambition! — work towards a qualification or skill that you can use when you’re at home with your bub.

Scott

You are in a lot of trouble

After hours of crying, our baby finally dropped off to sleep in his mother’s arms ...

… and then her phone rang.

The noise startled our son, and he began wailing.

“ANSWER IT!” she thundered at me.

After hours of crying, our baby finally dropped off to sleep in his mother’s arms ...

… and then her phone rang.

The noise startled our son, and he began wailing.

“ANSWER IT!” she thundered at me.

I dived on her phone and shepherded it out of the bedroom.

“Hello?” I whined.

“A warrant has been issued for your arrest. Press 1 immediately”, said the recorded message.

I was so sleep deprived that I complied, and was promptly transferred to a human.

“We have found a discarded rental car with 20 pounds of cocaine, fraudulent bank statements, and bloodstains on the seats — the car was rented in your name,” announced the man on the end of the line.

“Who is this?” I yelled.

“My name is Richard Solman. I am an Australian Federal Police Officer. My badge number is 78291. Write that down. Your case number is 4859885. Write that down, too. You are potentially in a lot of trouble”, he warned.

For the next few minutes our conversation reminded me of those I’ve had with my three-year-old when it suddenly dawns on her that her brothers are gone and she has my full undivided attention ... so she keeps the story going on, and on, and on, and on ...

Then Richard went in for the kill.

He reminded me that the call was being recorded, and then asked for my ID.

And after I’d given him my (fake) details, he announced that I’d been a victim of identity theft.

“How much money do you have in your main account, Mister Tape?” he asked.

“I have $13,823”, I said precisely.

This got Richard audibly excited.

“I’m sorry to say that your accounts and your tax file number are compromised. All that money is at risk. We think it could be an inside job … a staff member from the ING bank”, said Rich.

Next, he ordered me to get in my car, drive to my nearest bank branch and transfer my money into what he called a ‘safe’ AFP account for 48 hours … while they got to the bottom of the case.

And all the time I was thinking to myself, “Who would ever fall for this rubbish?”

The correct answer, of course, is “enough people to make it more than worth their while”.

(Generally the most vulnerable people in our society — those with mental health issues and the elderly, who can be confused and intimidated. Last year Aussies lost $36 million from spam calls.)

Hold the phone! Here’s my take:

Twenty-five years ago, the internet lowered the cost of sending spam emails to practically zero. And our inboxes got hammered. Well, for a while, that is, until email providers created spam filters to shield us from the 320 billion junk emails sent each day.

Yet the scammers have now doubled down.

Technology has now lowered the cost of calling to basically zero, and spoofing technology makes it look like they’re calling you from a local number. Which explains why Richard and his mates are just so damn busy. They’re making 500 million spam calls around the world each day.

Yet telcos are busy building the phone version of spam filters (with a nudge from the government). Telstra says it’s blocking up to 500,000 spam calls a day.

My prediction?

Spam calls will soon be as rare as spam emails in your inbox.

Until then … if anyone rings you up with a warrant for your arrest, and asks about a discarded rental car with 20 pounds of cocaine, fraudulent bank statements, and bloodstains on the seats ...

Just press 1 … and tell them it was Mister Tape.

Tread Your Own Path!

Shares for Kids

“Dad, do you own shares in … Woolworths?”

“Yes.”

“What about Coles?”

“Dad, do you own shares in … Woolworths?”

“Yes.”

“What about Coles?”

“Sure do, mate.”

“What about … what about ... JOHN DEERE?” screamed my five-year-old, his eyes bulging.

“Oh yeah!” I yelled, and then we high-fived.

Listen, as a father, a finance nerd and a farmer, that moment was a bloody royal flush.

It does not get better than that.

These days my portfolio is basically made up of both local and international index funds:

A couple of ultra-low-cost funds hold literally thousands of companies (well, a sliver of each), including the biggest companies on earth. In other words, you name it, and chances are we own it. (What’s more, when my kids get older and they ask me about the latest hot stock, the automatic adding nature of an index fund will allow me to say, “Yeah, I own that too”).

My kids have nailed the working, saving, spending and giving parts of the Jam Jar Strategy. Now I’m slowly introducing the idea of investing some of that money into shares, and learning about compound interest.

And it’s not just my kidlets.

This week I heard from Will, who asked:

“I am five years old and I want to buy some shares. Am I able to buy a share these days where I actually get a share certificate or something in the mail?”

Well, what I would tell Will is the same thing I’d tell my own kids (and what I’m actually doing with them):

As a parent you can buy shares on your kids’ behalf (in your name, but as a trustee for your child, via an online broker) and then transfer the shares to their name via a simple form when they turn 18, without incurring capital gains tax (CGT), as there is no change in beneficiary.

What shares should kids buy?

Well, when I was a kid, my father decided to pay me my pocket money via one share in BHP.

He said: “You now own a share in one of the biggest companies on earth, and they share their profits with you.”

I never got a share certificate … or the actual share come to think of it!?

Yet that day changed the course of my life.

So for kids I’d seriously consider buying either an Aussie shares index fund or an international index shares fund -- or better yet both. That way they’ll own thousands of the world’s biggest companies. Then parents can print out a list of all the companies they own, and put them on their wall: just for the bragging rights.

Tread Your Own Path!

P.S. Want to really compound the gains? Make sure it’s money your kids have earned themselves fair and square.