Articles & Questions

Every week I publish a fun new article on a money topic I think you’ll find interesting. I also answer a handful of reader questions. Subscribers to my newsletter get to see everything first — but you can browse some of my past articles & questions on this page.

My Best Articles

Not sure where to start? Below I’ve handpicked a few of my favourites. And if you like what you see, don’t forget to subscribe to my free newsletter to get new issues before anyone else!

Search Articles

Christmas Comes Early

I was planning on giving your new Barefoot Kids book to my eight-year-old daughter for Christmas. Unfortunately, she found it while I was at work.

Hi Scott,

I was planning on giving your new Barefoot Kids book to my eight-year-old daughter for Christmas. Unfortunately, she found it while I was at work. When I got home that night I was amazed that she had already read half the book, letter-bombed the neighbourhood with her new ‘cat sitting’ business, set up her jars with your stickers, and started setting up her jobs board. Then she hit me with her pocket money pitch. My Chrissy surprise is blown, but it’s so good she is fully engaged!

Chris

Hey Chris

How proud should you be of your daughter? The way most parents teach their kids about money is trial and error … a lot of boring lectures … and a lot of nagging, in the hope that some of it sticks. Yet your daughter is building her own money ‘muscle memories’, and creating her own experiences … some of which will stay with her for the rest of her life.

Scott.

Dr Seuss Gives Financial Advice

I’ve been seeing so many ads on Facebook from people spruiking ways to pay off your mortgage in 7 to 10 years. Is there some secret I’m not aware of?

G’day Scott,

I’ve been seeing so many ads on Facebook from people spruiking ways to pay off your mortgage in 7 to 10 years. Is there some secret I’m not aware of? We are a young family with two boys and are worried about our repayments when our fixed interest rate ends. It’s been a challenge to save the last year with prices going up and some health challenges on my part. One of our cars has just died too, so we are pretty stressed. Should we take action?

Tenille

Hi Tenille

Last Saturday morning I was with my kids in the Lego store in Melbourne when I got a text from a friend: “Someone is impersonating you on Facebook and running a scam to fleece your readers!”

Alarmed, I immediately called my assistant, and she was like: “Yeah, that happens all the time, it’s like whack-a-mole, Scott.”

Now the ads you’re looking at aren’t a blatant scam, but they may as well be.

Here’s their pitch, which is as old and smelly as my trusty Gray-Nicolls cricket box:

“So you want to get out of debt, right? Well, if you borrow a heap of money (through me) and buy some Gold Coast apartment (also through me, which I get a $50,000 kickback on), then when it (cough, cough) doubles in value, you’ll be able to pay off your home loan in just 7 to 10 years!”

It’s like a freaking Dr Seuss book.

“To get out of debt you’ve got to get into more debt. Debt, Debt, Debt!”

Tenille, focus on the two things that will really move the dial: getting a lower rate, and making extra repayments. Oh, and delete Facebook.

Scott.

Our Son-in-Law is a Nothing Burger

Our 48-year-old daughter was $2,000 away from paying off her house when her husband of 23 years told her that he had used the redraw facility attached to their housing loan to withdraw $150,000 to invest in a cryptocurrency scam!

Hi Scott,

Our 48-year-old daughter was $2,000 away from paying off her house when her husband of 23 years told her that he had used the redraw facility attached to their housing loan to withdraw $150,000 to invest in a cryptocurrency scam! He has now left her with $5 in the bank and two young boys to support. It seems our daughter was too trusting way back (23 years ago) when the home loan was set up. Even though it was in both names, the redraw facility required only his signature.

It has been extremely stressful and embarrassing, and like a snowball as unpaid bills have rolled in. As retirees we now find ourselves with a second family to support. All avenues for help have been fruitless so far. Can you give us any advice? Also, please alert other trusting young wives that they must have two signatures on a redraw facility or they may find themselves in this same devastating situation.

Tania

Hey Tania

It sounds like your son-in-law is an addicted gambler.

The fact that he was caught up in a crypto scam is neither here nor there – it all ends the same way:

The scammer (or betting company) ends up with all the money, the punter is lumped with the losses, and tragically, as is the case with your daughter, there’s often an innocent partner who becomes collateral damage.

So what advice do I have?

She has two choices: work it out, or kick his arse to the curb.

If she chooses to stay with him, I’d suggest she insist he get professional counselling (call Gambler’s Help on 1800 858 858). If she’s not planning on staying with him, I’d get her to speak to a family lawyer and an accountant and set up plans for life as a single parent.

Yet I’ll tell you one thing that’s totally off the table: getting the money back. The horse hasn’t bolted, it’s dead. No amount of flogging your son-in-law will bring it back. At some point they have to put it behind them and move forward financially (together or apart).

Scott

The eight-year-old who built a school

So this is probably going to get me in trouble, but here goes: To the billions of people living in the developing world … we’re all ‘Karens’.

So this is probably going to get me in trouble, but here goes:

To the billions of people living in the developing world … we’re all ‘Karens’.

“Barefoot! How dare you label me a Karen! I DEMAND to speak to your editor!”

(Trust me, he does not care.)

Yet let me introduce you to someone you should speak to: an eight-year-old girl called Amalia.

Amalia lives in Adelaide with her mum and brothers and sisters. She loves fashion, horse riding and doing her pocket money jobs. Yet there’s something amazing about what Amalia has done with the money she put in her Give Bucket:

She built a school.

Seriously. Amalia and her mum, Susan, built a three-storey school that is now home to 120 primary school students. It’s in Kenya, Africa, in a place called Korogocho.

Korogocho is a Swahili word meaning ‘shoulder to shoulder’ … and that’s how people live in Korogocho. There isn’t much electricity, so it gets dark inside. There are no air-conditioners, and lots of people have to share one tap for water.

The kids Amalia’s age play in a creek that’s polluted with rubbish and sewage. “For fun they find old bike tyres and use them as hula hoops”, says Amalia.

Yes, life in Korogocho is tough. Many kids there can’t afford to go to school, and those who do are stuck in classrooms that can have as many as 150 kids!

Amalia and her mum set out to do something for the kids of Korogocho. They are not rich, but they paid for it all themselves from their Give Buckets.

And now that the school is up and running they are paying the wages for six teachers and three helpers. The kids get cooked lunches and the chance to learn dancing and all the important stuff that kids need to learn.

“I’m proud of our school. If we hadn’t built it, none of those kids would have gotten to go to school”, Amalia tells me. “The reason my Give Bucket is so important to me is that my goal in life is ‘to make the world kinder’.”

Amalia is just one of the kids in my new book, Barefoot Kids.

Talking to kids about money can sometimes feel a little icky … kind of consumerist and capitalist.

But let me tell you a secret: the jam jars aren’t really about money at all … they’re about hard work, kindness, and feeling good inside.

When Amalia’s mum asked her, “what do you want to be now?”

She replied, “everything I already am”.

How good is that?

Tread Your Own Path!

Video Killed the Radio Star

I know it is unlikely I will receive a reply but I feel compelled to let you know what an impact you have had on my 11-year-old daughter, Molly.

Hi Scott,

I know it is unlikely I will receive a reply but I feel compelled to let you know what an impact you have had on my 11-year-old daughter, Molly. Yesterday her aunt gifted her your new book. Molly devoured the book in one evening and by this afternoon had started a small business initiative to make dog treats and raise funds for the homeless.

We are fascinated by her enthusiasm and even more impressed by her presentation on investing (which I have shared with you). Thank you for hitting the nail on the head with this generation. I feel relieved to know that your book is teaching such valuable skills.

Mandy

Hi Mandy,

You not only made it to my inbox, you made it all the way to our family dinner table! We have a strict rule at our house: “No screens at dinner”. So when I sat down with an iPad my kids’ eyes nearly fell out of their sockets. Then I pressed play on Molly’s video … and they cheered for her. Seriously, she explained the concept of investing better than some highly paid investment analysts I know! Thanks so much for sharing it with me and the kids. It made our night.

Scott

The Bitcoin Babe

I have been trying to find a partner and get married for a while. Recently, I was matched with a guy on a dating app and we got to talking. He kept saying money is very important to him.

Dear Scott,

I have been trying to find a partner and get married for a while. Recently, I was matched with a guy on a dating app and we got to talking. He kept saying money is very important to him. He said he’d like a partner who is a ‘digital shepherd’ who would carry his phones and laptops and work from anywhere in the world. I’m an engineer, love my job, and don’t want to be a digital shepherd, yet the idea of having a husband got me interested.

He said he’d teach me to trade crypto, so I put $2,000 of my hard-earned money into the FTX Pro app.

After a while I got suspicious and said I’d like to do it either face to face (I have never met him) or stop and get my money back. He got very defensive and threatening, and told me I’d face consequences and he’d stop talking to me. I have reported him to cyber crime, and reported his profile on the dating app. But my money is still trapped in FTX Pro. How can I get it back?

Shyla

Hi Shyla

There is no way my answer is going to be anywhere near as entertaining as your question!

So, in summary, a random dude you met on the internet who told you he was looking for a shepherd … turned out to be a wolf. Don’t beat yourself up: you’re not the first person this has happened to, nor will you be the last!

Oh, and don’t feel bad about losing money to a scammer, either. Sequoia Capital is a legendary American fund manager that employs the smartest people in the world, including the very best graduates from Harvard, Stanford and Yale.

Well, these geniuses invested $US210 million ($A313 million) into the crypto exchange you used, FTX. FTX is run by 30-year-old Sam Bankman-Fried, hailed as the ‘next Warren Buffett’. Sequoia loved the fact that Sam played video games in their investment meetings instead of listening to them.

Well, it turns out Sam was also a wolf. This week his crypto exchange has collapsed, with billions in customer deposits apparently gone.

Who would’ve thought that a 30-year-old living in the Bahamas with a 10-person “drug-fuelled sexual polycule” (tip: don’t google that term on your work computer) would turn out to be a little wolfy?

Sequoia, meanwhile, has written down their $US210 million investment to $0.

I hope I’m wrong, but I suspect you might need to do the same.

Scott.

Taking on the bullies

Today, I’m going to show you how a kid rose up and beat his bullies.

Levi, 10 years old, was about to have the worst day of his life.

Today, I’m going to show you how a kid rose up and beat his bullies.

Levi, 10 years old, was about to have the worst day of his life.

“Come up to the front and read to the class, Levi”, instructed his teacher.

He froze …

You see, Levi has dyslexia, which makes reading really difficult.

He could hear some of the kids in his class starting to laugh. After trying to get a few words out, he slunk back to his chair and put his head down so he couldn’t see the other kids.

After class, a group of boys cornered him:

“Why can’t you read? What’s wrong with you?”

Levi just stared at them.

“You are so dumb!” teased one of the boys, and then everyone burst out laughing.

But the next day in class something weird happened.

His teacher brought in a plastic ruler that had a blue see-through slit in the middle. Levi had never seen anything like it. She called it a ‘reading ruler’, and it worked like a moving highlighter, helping Levi focus on reading one line at a time.

It was the first thing that had ever really helped Levi read. So that night he rushed home and told his mum the good news.

Levi wanted a reading ruler of his very own, so he googled it. There was only one problem: different colours work better for different kids. And Levi couldn’t find the one he needed.

Frustrated, he turned to his mum and said, “I should get some reading rulers made and sell them to other kids who find reading hard like me”.

And so for the next six months Levi would come home from school and work on his business.

After searching online for ages, he tracked down a factory in China that made reading rulers. He ended up ordering 25 samples to start off with, and paid for them himself using his pocket money.

And then he did something he never thought he’d be able to do:

He built his own website (mydyslexiashop.com.au) and started selling them.

And he’s done pretty darned well; he’s now sold $6,000 worth of reading rulers.

Better yet, for every 10 rulers he sells he gives one away. “I give them away to people who don’t have money to buy them, and also to schools. That way kids who may not have enough courage to admit they need them can try them out”, he tells me.

Yet the most epic thing happened a few weeks after his first sale. Without him knowing it, Levi’s mum had emailed his teacher and told him about his success. So the teacher asked Levi to get up in front of the class and tell his classmates about it.

Guess what happened?

No one laughed.

Instead, everyone cheered and told him “That’s amazing!”

There was even a kid in his class who bought one – and so did his teacher!

Levi is a Barefoot Kid.

And he’s just one of 50 kids (aged 5 to 14) who appear in my new book, Barefoot Kids.

There are young kids. Older kids. Indigenous kids. City kids. Country kids.

I want every kid to be able to open up my book, look at the kids inside, and say to themselves:

“That kid’s just like me, I could do that.”

Tread Your Own Path!

You Got Played, Barefoot!

As an Optus and Medibank customer, I must have read thousands of words on the ‘hacks’.

Hi Scott,

As an Optus and Medibank customer, I must have read thousands of words on the ‘hacks’. Thankfully, you cut through all the BS in your open letter to Financial Services Minister Stephen Jones offering a sensible solution. But I think you got played. You do realise that his response to you – “Sounds good. We’ll take a look.” – was a total fob-off!?

Eric

Hi Eric,

I have very low expectations when it comes to politicians … especially when I’m arguing against the financial interests of three multi-billion-dollar credit bureaus that employ expensive lobbyists. Still, if the Minister doesn’t have the cojones to stare down the lobbyists and stand up for the people who elected him, well, I think he’ll be the one who ultimately gets played.

Scott.

How to be unhackable

This is an open letter to the Federal Minister for Financial Services, Stephen Jones.

This is an open letter to the Federal Minister for Financial Services, Stephen Jones.

Minister,

The cyber hacks on Optus and Medibank have justifiably freaked everyone out.

And as you know the 17 million records that have been stolen in the last month are a drop in the ocean compared to the number of data breaches that never make it into the media.

So today I’m writing to you with a simple solution.

It basically involves putting a ‘lock’ on every Australian’s private financial information – plus an ‘alert’ that lets us know anytime someone comes near our personal data.

In this month’s budget the Government put aside $5 million to investigate the hacks. However, setting my idea up won’t cost the Australian people (or the Government) a single cent.

All you’ll need is to muster up some political ticker, Minister.

Let me explain:

A criminal can hack a person’s ID and then apply for credit in their name.

When the bank gets the criminal’s application, their system automatically checks the customer’s credit file.

Importantly, the customer does not get an alert telling them the bank has checked their credit file.

The criminal can use this to their advantage, often clocking up dozens of credit card and personal loan applications as quickly as they can.

So, the most logical solution would be to put a ‘lock and alert’ system on our credit reports. That is, lock every credit file so no one can see it (without the customer’s consent) and send an immediate alert to the customer if someone tries to access it.

But there’s one problem (or three actually).

There are three credit bureaus in Australia (Equifax, Experian and illion) who keep credit files on practically every Australian adult.

They are owned by large investors, and last year they collectively made $521 million in revenue selling our private data to financial institutions, according to IBISWorld.

The problem is, putting a lock on our credit files would put a lock on their profits. They’re not going to let it happen, and they pay highly paid lobbyists to make sure the government doesn’t allow it.

Those lobbyists will tell you, Minister, that “it can’t be done”.

But it can. In fact, in America, the government has already forced credit bureaus to offer it. And in Australia the ‘lock and alert’ technology already exists, via an app called Credit Savvy.

So, my suggestion is that the government (i.e. YOU, Minister) should force the credit bureaus to automatically lock down our credit files and provide us with an alert service. This will block criminals while still allowing legitimate credit inquiries to be made.

The fact is, Minister, these credit bureaus are like Facebook. Our private data is the product they sell, and their customers will pay handsomely for that data. Let’s be honest: the credit bureaus’ only allegiance is to their shareholders.

Yet your allegiance is to the Australian people you have the honour of representing. So, we need you to stare down these billion-dollar companies and stand up for us.

As the Minister for Financial Services, I know your worst nightmare is that one of our banks will get hacked, which some analysts (like Standard & Poor’s) suggest is only a matter of time.

Right now you have the power to protect all Australians with a stroke of a pen.

Will you?

Tread Your Own Path!

P.S. I invited the Minister to respond (in 140 characters or less). Here is his response:

“Sounds good. We’ll take a look. Stephen”.

Thank You for Coming to Lismore

I came to your Beer with Barefoot session last night – and wow – it was packed!

Hey Scott,

I came to your Beer with Barefoot session last night – and wow – it was packed! I was so excited to get to meet you in person and you bought me a beer and signed my book. It’s been almost nine months since we lost our house and we’re still struggling. I left last night with a clear plan and knowing I had help. Thank you for supporting the community of Lismore, it’s the lift we really needed.

Lauren

Hey Lauren

It was lovely to meet you there. And it was a real pleasure to come to Lismore. After meeting so many people like you who shared heartbreaking stories, I’m blown away by what an amazing, resilient community you have.

A big thank you to the Lismore Book Warehouse, and to the publican at the Metropole for putting on such a great event!

Scott.

Barefoot Kid Refuses to Go to Sleep

I gave my 10 year old son your new book this afternoon … and he can’t put it down.

Dear Scott,

I gave my 10 year old son your new book this afternoon … and he can’t put it down. He’s on page 104! He won’t go to sleep until he finishes it! He says it’s amazing! Loves the ‘little tips’ and stories the most.

Perhaps this book will change his life like Barefoot Investor has changed mine.

Thank You!

Sasha

Hey Sasha,

What a little champion!

And your son’s not alone:

We launched the book on Monday … and by Monday night my inbox was full of kids (and their parents) writing emails to me, bragging that they’d already finished the whole book.

That’s only happened to me once before:

The day I launched the original Barefoot Investor book.

But this time it’s even better … because it’s happening with kids.

I’ve said that Barefoot Kids is the best book I’ve ever written, and I believe it.

So I’m putting it out there early: there is something very special about this book.

Thank you for sharing, Sasha. I look forward to hearing about the epic money adventure your son is now on!

Scott.

Vanguard Super?

I came across an article stating that Vanguard is now in the Superannuation business and will be competing against the likes of Australian Super, HostPlus etc. What is your view on this?

Hi Scott

I came across an article stating that Vanguard is now in the Superannuation business and will be competing against the likes of Australian Super, HostPlus etc. What is your view on this?

Andrew

Hi Andrew

Yes, this week Vanguard officially launched their super fund offering.

They’re charging 0.58% per annum, which is one of the lowest in the market for standard default funds with balances under $50,000.

There are cheaper superannuation index funds available.

Yet here’s what’s interesting about this:

First, Vanguard has said they’ll look to lower their fees over time as they grow. I’m inclined to believe them, because that’s what they have a history of doing.

Second, this ain’t your bog-average super fund.

Research from SuperRatings found there is a “high risk at retirement” for many of the current top-returning super funds. That’s because most of our biggest super funds throw everyone – young and old – into a one-size-fits-all investment pot.

Instead, Vanguard’s offering is a life cycle fund that invests your super based on your age. In simple terms, they automatically reduce the amount of riskier assets, like shares, in your portfolio as you get older and closer to retirement. In all, they make 36 of these adjustments up to your 83rd birthday (with no switching fees), which is far and away the most comprehensive of any Australian super offering.

So what do I think?

I think this is great news for every Australian – regardless of whether you switch to Vanguard or not.

The super fund industry trousers an outrageous $30 billion a year in fees – money that could and should be going towards our retirement.

Hopefully now that one of the world’s biggest fund managers – with a relentless focus on lowering costs – has set up shop, they’ll keep everyone on their toes.

For disclosure, I invest in some Vanguard index funds.

Scott.

FOGO the Radio Waves

So they’re building a nice 40-foot NBN tower in our street. I’m not happy. The health risks and environmental risks are huge, plus property prices are also negatively affected as who wants to live near that?

Hey Scott,

So they’re building a nice 40-foot NBN tower in our street. I’m not happy. The health risks and environmental risks are huge, plus property prices are also negatively affected as who wants to live near that? If we were in the suburbs I might expect this, yet we’re not. We bought 10 acres in the Gold Coast hinterland for the healthy lifestyle, and our street is full of families and kids. Never did I expect an NBN tower to pop up. The guy who’s allowing it on his property will be getting paid a pretty penny for it I’m sure. So what can we do? My initial thought is to sell and get away as quickly as possible. Or do we rent it out to someone who’s brave enough to live near this tower?

Sarah

Hi Sarah,

Seriously?

Look, I’m not going to weigh in on the health risks argument (however, next week I know I’ll get at least 150 emails from people who will).

Yet what I am picking up are your personal radio waves, and it’s clear you’re stressed to the max.

It’s kind of like having Clive Palmer move in next door. He’s probably not going to hurt you, yet watching him drag his overstuffed FOGO bin to the curb each Wednesday night isn’t exactly a selling point for your street.

You’ve said that your initial thought is to “sell and get away as quickly as possible”. That’s your gut talking, and here’s a tip from Clive – you should listen to it.

Look, life is too short to live in a place that brings you constant anxiety.

After all, what’s going to kill you is the stress … not the radio waves.

Scott.

Have a beer with me

Thank you so much for last week’s column about helping the pensioner with the insurance claim. I live in South Lismore and I’m still waiting for my insurance payout, and it is increasingly difficult to get any information from the insurance company.

Hi Scott,

Thank you so much for last week’s column about helping the pensioner with the insurance claim. I live in South Lismore and I’m still waiting for my insurance payout, and it is increasingly difficult to get any information from the insurance company. Your column has given me the much-needed incentive to keep fighting for what I am entitled to, not what they think I should settle for!

Elise

Hi Elise,

You are exactly the type of Lismore local I want to meet this Thursday night!

If you can, please come to my book launch, or my community event at the Hotel Metropole at 7.00pm (RSVPs are required for both, see below). Please spread the word with your friends. As someone who’s lived through a natural disaster myself, I know I can help.

Scott

The $67,000 Insurance Policy?

My husband and I are in our early fifties and earn $100,000 combined a year. We paid $67,000 this year for life insurance, including critical illness and income protection.

Scott,

My husband and I are in our early fifties and earn $100,000 combined a year. We paid $67,000 this year for life insurance, including critical illness and income protection. And we have now been notified that my husband’s super is all depleted as the payments were auto-deducted from his super! We thought everything was okay, as we have been with our financial advisor for 28 years. Now we don’t know where to go to get out of this costly mess. Please help!

Renae and Peter

Hi guys,

You have every right to feel stressed, and as angry as an alpaca!

My advice?

You need to get a bit of alpaca attitude and stomp and hiss and spit until you get this sorted.

On your income – and presumably your super fund balance – it is totally unacceptable to be paying $67,000 for an insurance policy. It’s absolutely ridiculous. It’s simply draining your super fund.

Now I understand I’m only getting your side of the story, but if your financial advisor of 28 years has overseen this – and profited by pocketing thousands of dollars in trailing commissions – they should be held accountable.

Here’s what I’d do if I were in your shoes.

First, gather up all your supporting documents: insurance records, emails from your advisor, statements of advice (SOAs) and payment records.

Second, write about the emotional toll this is having on your family. Be as raw and emotional as you want. Bleed on the page. Get it all out.

Third, bundle it all up via email and take the following four steps: 1) Email it to your financial advisor’s compliance department ‒ you’ll get the contact details in their Financial Services Guide (FSG); 2) Lodge a complaint with the Australian Financial Complaints Authority (AFCA) at afca.org.au; 3) Send it to a good lawyer; 4) Finally, send it to the compliance department of the insurer you paid $67,000 to.

Remember: be an alpaca. Hiss, spit and bite if you have to. Don’t take a backward step.

Scott

Come have a beer with me

I was standing in the middle of the main street, staring up at the tops of the buildings. Locals passed by, giving me strange looks. What I was doing was trying to picture an ocean of water on the very spot where I was standing … because that’s what happened in Lismore in February.

I was standing in the middle of the main street, staring up at the tops of the buildings.

Locals passed by, giving me strange looks.

What I was doing was trying to picture an ocean of water on the very spot where I was standing … because that’s what happened in Lismore in February.

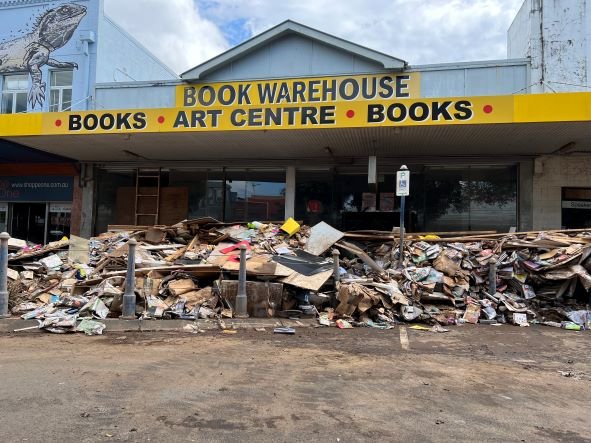

“We were expecting water to reach 1.3 metres”, said Sarah, the owner of the 40-year-old Lismore Book Warehouse, when I met her. “That was the highest the floods had ever reached before.”

This time, the water reached a peak of … 14.3 metres in her store!

That day Sarah lost $215,000 worth of books, none of which were insured.

The next day she got in her boat and started searching for and rescuing people in her community.

“We’re not a rich area, but we stick together”, she says.

Sarah used Google Maps to get around, yet the roads she normally drove on were now as much as 5 metres below her, underwater. “Cows were coming past us with their heads bobbing up and down as they were swept downstream to their deaths.”

It was total, utter devastation.

“You know, at the time, I didn’t know whether Lismore would make it through”, Sarah told me.

And when the water eventually subsided the true scale of the destruction – and the rotting stench – became clear. The place looked and smelled like a rubbish tip for months.

The Lismore library had lost 30,000 books, and has never reopened.

“I knew that Lismore needed a bookshop”, she said.

And so, with the determination of a small business owner with her back to the wall, Sarah and her loyal team spent the next four-and-a-half months slogging away putting the family-owned bookstore back together.

“I’m just really proud we’re here today”, says Sarah.

So when my publishers were drawing up plans for the official launch of my new bestselling book, Barefoot Kids, they asked whether I wanted it to be held in Sydney or Melbourne.

“Neither”, I said. “I want it in Lismore.”

Yes, I’m really proud to say that I will be hosting my official book launch at the Lismore Book Warehouse this Thursday night (Sold out!).

Tread Your Own Path!

P.S. Straight after the book launch at 7 pm, I’ll be heading over to a local pub (Hotel Metropole) to host a “Beer With Barefoot”, with a serious purpose. If you are a local and are struggling financially, please come along and let me (and a few of my financial counsellor mates) help you sort things out. It’s totally free. It’s totally independent. It’s totally confidential. And I’ll totally shout you a beer.

My Deep Black Hole

Five years ago (at age 50), I walked away from an abusive marriage, with my two kids. As I was sinking into a black hole, a friend gave me your book.

Dear Barefoot,

Five years ago (at age 50), I walked away from an abusive marriage, with my two kids. As I was sinking into a black hole, a friend gave me your book. Through using your strategies, I've managed to rebuild my wealth, grow my superannuation to over $500,000, and buy a house for myself and my children to live. Better still, I paid that house off earlier this year - I own it lock, stock and barrel, and it's MY name on the title.

I have close to $50K in the bank and a savings strategy to enable me to retire early at the end of 2024, which will let me be free to spend those precious years with my kids when they need me most. No amount of money can buy that time. Tread your own path? Right on! Here's to you and your buckets, Barefoot. You’re a bloody legend. Thank you, thank you, thank you.

Claire

Hi Claire

Seriously, I have the best job in the world. Claire, thank you so much for sharing your story. You’re an inspiration to every single parent out there living in a dangerous situation.

You Got This!

Scott.

The Reality of the Budget

I really need advice. I’m a single mum of three (14, 12 and three years old). I bought a townhouse when rates were low, and locked in a fixed rate at 1.9%. It was already tight with my budget.

Help!

I really need advice. I’m a single mum of three (14, 12 and three years old). I bought a townhouse when rates were low, and locked in a fixed rate at 1.9%. It was already tight with my budget. But now that rates are rising, I simply won’t be able to afford the mortgage when the fixed rate period ends. So do I sell now and cut my losses? Or do I hold until I am completely broke and wait for the market to recover? I reckon I have three months (six months tops). I feel like I’m gambling with all that I have.

Desperate single mum

Hi desperate single mum,

There are people reading your question thinking “why would a low income earner do this? Surely you knew that rates were going to rise?”

Well, you could ask the exact same thing of our politicians, who have created schemes that incentivise people to get into this sort of situation.

Case in point: in this week’s budget the Treasurer was crowing about their ‘Help to Buy’ program, which allows low-income earners and single parents like you to buy a home with just a 2% deposit.

Now I’m not a gambler, and as a single mother you shouldn’t be either.

Keeping a roof over your kids’ heads is your first, second, and third priority. And it doesn’t matter if it’s rented or owned – just that you have one.

So it sounds like you’re going to have to make some tough decisions, which are best discussed with a financial counsellor (see the number above).

Scott.

Did You See That Post on Facebook?

With all the rumblings in the news and socials about the world economy collapsing, we are a bit worried about our super and savings – we are getting a bit long in the tooth and are ready to retire in 18 months (we’re in our early 60s).

Hi Scott

With all the rumblings in the news and socials about the world economy collapsing, we are a bit worried about our super and savings – we are getting a bit long in the tooth and are ready to retire in 18 months (we’re in our early 60s). My brother keeps saying we should put our money into silver (he buys silver coins). I just don’t know how I can go down to the shop to buy my bread and milk with silver. Is it a viable investment option? What happens to our super and our savings in the bank if it all tanks? (Apparently they can take it all and leave you with nothing, banks included.)

Mia

Hey Mia,

Let’s break down a couple of keywords in your question.

First up, “socials”.

For God’s sake do not get your news from Facebook … or any financial advice for that matter.

Second, “brother”.

Your bro may be a lovely dude, but if he is advising you to put your super into silver I would suggest he’s been reading too much Facebook himself.

Third, “they” (as in “they can take it all and leave you with nothing”).

Who are “they”? The Government? Bill Gates? Jeffrey Epstein?

That sounds like yet another comment on Facebook.

Look, Facebook’s algorithms have one aim: to keep you staring at your screen (and their ads) for as long as possible. So they are programmed to find emotional, scary, and downright crazy posts and amplify them. The end result is that these posts are served up on you and your brother’s Facebook news feed so many times that it feels like everyone is thinking it.

But they’re not.

Oh, and by the way, do not put all your money into silver. No one is going to take all your money and leave you with nothing. The Australian Government guarantees deposits up to $250,000, and it will not go broke.

Instead, here are two things you can do that will make you happier and wealthier:

First, consider starting to build up a cash buffer within your super fund. You could make extra contributions and direct that into cash so you can ride out any pullbacks in the share market when you retire in 18 months’ time.

Second, delete Facebook. Seriously. Stop trading your precious time and attention just to make a billionaire even richer.

Scott.

You are being too harsh with Equifax!

I appreciate you like CreditSavvy, but I think you are being harsh on Equifax, who provide a similar (identical?) facility. And you make it sound like if Optus offered you MILLIONS, you would say “No thanks, I am a good company”. For full disclosure, I work for Equifax.

Hi Scott,

I appreciate you like CreditSavvy, but I think you are being harsh on Equifax, who provide a similar (identical?) facility. And you make it sound like if Optus offered you MILLIONS, you would say “No thanks, I am a good company”. For full disclosure, I work for Equifax.

Jono

Hi Jono

Am I being too harsh with your employer Equifax?

I don’t think so. After all, in 2017 Equifax suffered one of the largest cybercrime breaches in history with the private records of 147.9 million Americans and 15.2 million Brits were compromised.

The reason I suggested people use CreditSavvy (owned by Commbank), is because they offer a free and simple way to lock down your credit file, which will stop scammers from running up credit in your name.

After years of paying for an Equifax subscription to monitor my credit file, I found a way of putting a lock on it, for free. That’s why I shared the details with my readers. It’s a good deal, especially in light of all the hacks going on. Including your own!

Scott.