Articles & Questions

Every week I publish a fun new article on a money topic I think you’ll find interesting. I also answer a handful of reader questions. Subscribers to my newsletter get to see everything first — but you can browse some of my past articles & questions on this page.

My Best Articles

Not sure where to start? Below I’ve handpicked a few of my favourites. And if you like what you see, don’t forget to subscribe to my free newsletter to get new issues before anyone else!

Search Articles

Have a beer with me

Thank you so much for last week’s column about helping the pensioner with the insurance claim. I live in South Lismore and I’m still waiting for my insurance payout, and it is increasingly difficult to get any information from the insurance company.

Hi Scott,

Thank you so much for last week’s column about helping the pensioner with the insurance claim. I live in South Lismore and I’m still waiting for my insurance payout, and it is increasingly difficult to get any information from the insurance company. Your column has given me the much-needed incentive to keep fighting for what I am entitled to, not what they think I should settle for!

Elise

Hi Elise,

You are exactly the type of Lismore local I want to meet this Thursday night!

If you can, please come to my book launch, or my community event at the Hotel Metropole at 7.00pm (RSVPs are required for both, see below). Please spread the word with your friends. As someone who’s lived through a natural disaster myself, I know I can help.

Scott

The $67,000 Insurance Policy?

My husband and I are in our early fifties and earn $100,000 combined a year. We paid $67,000 this year for life insurance, including critical illness and income protection.

Scott,

My husband and I are in our early fifties and earn $100,000 combined a year. We paid $67,000 this year for life insurance, including critical illness and income protection. And we have now been notified that my husband’s super is all depleted as the payments were auto-deducted from his super! We thought everything was okay, as we have been with our financial advisor for 28 years. Now we don’t know where to go to get out of this costly mess. Please help!

Renae and Peter

Hi guys,

You have every right to feel stressed, and as angry as an alpaca!

My advice?

You need to get a bit of alpaca attitude and stomp and hiss and spit until you get this sorted.

On your income – and presumably your super fund balance – it is totally unacceptable to be paying $67,000 for an insurance policy. It’s absolutely ridiculous. It’s simply draining your super fund.

Now I understand I’m only getting your side of the story, but if your financial advisor of 28 years has overseen this – and profited by pocketing thousands of dollars in trailing commissions – they should be held accountable.

Here’s what I’d do if I were in your shoes.

First, gather up all your supporting documents: insurance records, emails from your advisor, statements of advice (SOAs) and payment records.

Second, write about the emotional toll this is having on your family. Be as raw and emotional as you want. Bleed on the page. Get it all out.

Third, bundle it all up via email and take the following four steps: 1) Email it to your financial advisor’s compliance department ‒ you’ll get the contact details in their Financial Services Guide (FSG); 2) Lodge a complaint with the Australian Financial Complaints Authority (AFCA) at afca.org.au; 3) Send it to a good lawyer; 4) Finally, send it to the compliance department of the insurer you paid $67,000 to.

Remember: be an alpaca. Hiss, spit and bite if you have to. Don’t take a backward step.

Scott

Come have a beer with me

I was standing in the middle of the main street, staring up at the tops of the buildings. Locals passed by, giving me strange looks. What I was doing was trying to picture an ocean of water on the very spot where I was standing … because that’s what happened in Lismore in February.

I was standing in the middle of the main street, staring up at the tops of the buildings.

Locals passed by, giving me strange looks.

What I was doing was trying to picture an ocean of water on the very spot where I was standing … because that’s what happened in Lismore in February.

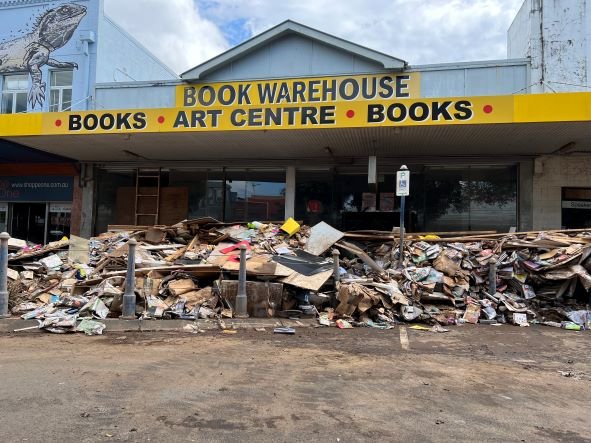

“We were expecting water to reach 1.3 metres”, said Sarah, the owner of the 40-year-old Lismore Book Warehouse, when I met her. “That was the highest the floods had ever reached before.”

This time, the water reached a peak of … 14.3 metres in her store!

That day Sarah lost $215,000 worth of books, none of which were insured.

The next day she got in her boat and started searching for and rescuing people in her community.

“We’re not a rich area, but we stick together”, she says.

Sarah used Google Maps to get around, yet the roads she normally drove on were now as much as 5 metres below her, underwater. “Cows were coming past us with their heads bobbing up and down as they were swept downstream to their deaths.”

It was total, utter devastation.

“You know, at the time, I didn’t know whether Lismore would make it through”, Sarah told me.

And when the water eventually subsided the true scale of the destruction – and the rotting stench – became clear. The place looked and smelled like a rubbish tip for months.

The Lismore library had lost 30,000 books, and has never reopened.

“I knew that Lismore needed a bookshop”, she said.

And so, with the determination of a small business owner with her back to the wall, Sarah and her loyal team spent the next four-and-a-half months slogging away putting the family-owned bookstore back together.

“I’m just really proud we’re here today”, says Sarah.

So when my publishers were drawing up plans for the official launch of my new bestselling book, Barefoot Kids, they asked whether I wanted it to be held in Sydney or Melbourne.

“Neither”, I said. “I want it in Lismore.”

Yes, I’m really proud to say that I will be hosting my official book launch at the Lismore Book Warehouse this Thursday night (Sold out!).

Tread Your Own Path!

P.S. Straight after the book launch at 7 pm, I’ll be heading over to a local pub (Hotel Metropole) to host a “Beer With Barefoot”, with a serious purpose. If you are a local and are struggling financially, please come along and let me (and a few of my financial counsellor mates) help you sort things out. It’s totally free. It’s totally independent. It’s totally confidential. And I’ll totally shout you a beer.

My Deep Black Hole

Five years ago (at age 50), I walked away from an abusive marriage, with my two kids. As I was sinking into a black hole, a friend gave me your book.

Dear Barefoot,

Five years ago (at age 50), I walked away from an abusive marriage, with my two kids. As I was sinking into a black hole, a friend gave me your book. Through using your strategies, I've managed to rebuild my wealth, grow my superannuation to over $500,000, and buy a house for myself and my children to live. Better still, I paid that house off earlier this year - I own it lock, stock and barrel, and it's MY name on the title.

I have close to $50K in the bank and a savings strategy to enable me to retire early at the end of 2024, which will let me be free to spend those precious years with my kids when they need me most. No amount of money can buy that time. Tread your own path? Right on! Here's to you and your buckets, Barefoot. You’re a bloody legend. Thank you, thank you, thank you.

Claire

Hi Claire

Seriously, I have the best job in the world. Claire, thank you so much for sharing your story. You’re an inspiration to every single parent out there living in a dangerous situation.

You Got This!

Scott.

The Reality of the Budget

I really need advice. I’m a single mum of three (14, 12 and three years old). I bought a townhouse when rates were low, and locked in a fixed rate at 1.9%. It was already tight with my budget.

Help!

I really need advice. I’m a single mum of three (14, 12 and three years old). I bought a townhouse when rates were low, and locked in a fixed rate at 1.9%. It was already tight with my budget. But now that rates are rising, I simply won’t be able to afford the mortgage when the fixed rate period ends. So do I sell now and cut my losses? Or do I hold until I am completely broke and wait for the market to recover? I reckon I have three months (six months tops). I feel like I’m gambling with all that I have.

Desperate single mum

Hi desperate single mum,

There are people reading your question thinking “why would a low income earner do this? Surely you knew that rates were going to rise?”

Well, you could ask the exact same thing of our politicians, who have created schemes that incentivise people to get into this sort of situation.

Case in point: in this week’s budget the Treasurer was crowing about their ‘Help to Buy’ program, which allows low-income earners and single parents like you to buy a home with just a 2% deposit.

Now I’m not a gambler, and as a single mother you shouldn’t be either.

Keeping a roof over your kids’ heads is your first, second, and third priority. And it doesn’t matter if it’s rented or owned – just that you have one.

So it sounds like you’re going to have to make some tough decisions, which are best discussed with a financial counsellor (see the number above).

Scott.

Did You See That Post on Facebook?

With all the rumblings in the news and socials about the world economy collapsing, we are a bit worried about our super and savings – we are getting a bit long in the tooth and are ready to retire in 18 months (we’re in our early 60s).

Hi Scott

With all the rumblings in the news and socials about the world economy collapsing, we are a bit worried about our super and savings – we are getting a bit long in the tooth and are ready to retire in 18 months (we’re in our early 60s). My brother keeps saying we should put our money into silver (he buys silver coins). I just don’t know how I can go down to the shop to buy my bread and milk with silver. Is it a viable investment option? What happens to our super and our savings in the bank if it all tanks? (Apparently they can take it all and leave you with nothing, banks included.)

Mia

Hey Mia,

Let’s break down a couple of keywords in your question.

First up, “socials”.

For God’s sake do not get your news from Facebook … or any financial advice for that matter.

Second, “brother”.

Your bro may be a lovely dude, but if he is advising you to put your super into silver I would suggest he’s been reading too much Facebook himself.

Third, “they” (as in “they can take it all and leave you with nothing”).

Who are “they”? The Government? Bill Gates? Jeffrey Epstein?

That sounds like yet another comment on Facebook.

Look, Facebook’s algorithms have one aim: to keep you staring at your screen (and their ads) for as long as possible. So they are programmed to find emotional, scary, and downright crazy posts and amplify them. The end result is that these posts are served up on you and your brother’s Facebook news feed so many times that it feels like everyone is thinking it.

But they’re not.

Oh, and by the way, do not put all your money into silver. No one is going to take all your money and leave you with nothing. The Australian Government guarantees deposits up to $250,000, and it will not go broke.

Instead, here are two things you can do that will make you happier and wealthier:

First, consider starting to build up a cash buffer within your super fund. You could make extra contributions and direct that into cash so you can ride out any pullbacks in the share market when you retire in 18 months’ time.

Second, delete Facebook. Seriously. Stop trading your precious time and attention just to make a billionaire even richer.

Scott.

You are being too harsh with Equifax!

I appreciate you like CreditSavvy, but I think you are being harsh on Equifax, who provide a similar (identical?) facility. And you make it sound like if Optus offered you MILLIONS, you would say “No thanks, I am a good company”. For full disclosure, I work for Equifax.

Hi Scott,

I appreciate you like CreditSavvy, but I think you are being harsh on Equifax, who provide a similar (identical?) facility. And you make it sound like if Optus offered you MILLIONS, you would say “No thanks, I am a good company”. For full disclosure, I work for Equifax.

Jono

Hi Jono

Am I being too harsh with your employer Equifax?

I don’t think so. After all, in 2017 Equifax suffered one of the largest cybercrime breaches in history with the private records of 147.9 million Americans and 15.2 million Brits were compromised.

The reason I suggested people use CreditSavvy (owned by Commbank), is because they offer a free and simple way to lock down your credit file, which will stop scammers from running up credit in your name.

After years of paying for an Equifax subscription to monitor my credit file, I found a way of putting a lock on it, for free. That’s why I shared the details with my readers. It’s a good deal, especially in light of all the hacks going on. Including your own!

Scott.

Help! Our Family is Breaking Apart

Six years ago my partner purchased his first home for $340,000, with his two brothers. He pitched in $26,000 along with his first homebuyer’s perks.

Hey Scott,

Six years ago my partner purchased his first home for $340,000, with his two brothers. He pitched in $26,000 along with his first homebuyer’s perks. His brothers put in $15,000 and $3,000. Since then, they have all paid the same amount each week to pay down the mortgage quicker. The house is now worth a (conservative) $800,000. The area where the house is located is on the rise, so my partner doesn’t want to sell anytime soon.

However, the brother who put in $3,000 is annoyed and wants to sell up, and thinks he is entitled to a third, despite it being obvious he isn’t. (At one stage he didn’t even make his share of the mortgage repayments for a whole year.) The whole situation is messy and stressful, and it may be what breaks the family apart. I think my partner should cut him loose and buy out his share, but what is he really entitled to?

Sharon

Hi Sharon,

What a mess!

You’ve just described the reason I strongly advise against going into debt with family members. Even though the investment has done great, everyone is miserable!

At the very least you need to have a written agreement right from the start.

For me, it’s ‘Bros over Ho(me)s’.

If I were in your shoes, I’d do the following:

First, I’d suggest that it’s time everyone went their separate ways with this investment.

Second, I’d commit to selling the property. I don’t care if you think it’s going higher, the fact is it’s got bad family ju-ju (a non-financial term), and if you keep it (and buy out the others) it’ll serve as a constant reminder to them of the deal. If it goes well and the property goes up, they’ll feel they’ve missed out. And even if it goes down, they’ll still hold a grudge.

Third, I’d appoint someone independent, perhaps your parent’s accountant or a conveyancer, to broker a deal (which would include dealing gently but firmly with the entitled brother).

Lastly, don’t take your eyes off the prize: the most important asset here that needs to be protected above all else is the family relationship, not the property.

Scott.

Don’t believe them

Did you know that Australians are officially the richest people on the planet?It’s true, according to Credit Suisse’s latest annual global wealth report.

Did you know that Australians are officially the richest people on the planet?

It’s true, according to Credit Suisse’s latest annual global wealth report.

And yet it’s also true that Australians have some of the highest levels of household debt on the planet, according to the Bank of International Settlements (BIS).

In other words, we’re rich – on paper at least – because we have high house prices.

Yet that appears to be rapidly changing, with prices now falling at one of the fastest rates on record. Nationally they’re down 4.5%, with some analysts suggesting it’s only just beginning, with predictions of much larger falls of up to 25%.

I’ve consistently argued that I wouldn’t be surprised if house prices eventually gave up the 30% gains they made during the COVID period.

After all, what the Reserve Bank (RBA) giveth … by slashing interest rates to 0.1% and promising to hold them there during the pandemic … it can also abruptly taketh away. The 2.5% of hikes this year have added a massive $715 a month in extra repayments for the average borrower.

That’s huge.

It’s the sort of shock to the system that drives an economy into recession.

So where to from here?

Well, a lot will depend on how far the RBA hikes. Yet the problem is that the RBA has proven to be as accurate at calling interest rates – which they set! – as my youngest boy is at peeing standing up. Despite his best aim he invariably ends up spraying it all over the walls and floors.

“You promised me you got it in the bowl!” I yell.

“Oops. Sorry Dad” he says sheepishly.

My view?

We should enjoy our win – because much like my beloved Melbourne Demons – it ain’t going to last.

Tread Your Own Path!

You Have No Backbone, Barefoot

This is the third or fourth time I have written. I appreciate your principles are sound, however every column has a feel-good news story and none of them explain the backbone of how they made something happen.

Hi Scott,

This is the third or fourth time I have written. I appreciate your principles are sound, however every column has a feel-good news story and none of them explain the backbone of how they made something happen. I have written to you on several occasions asking about this. If someone doesn't have a spare penny to feed their kids and is living hand to mouth.....how can they suddenly start "doing the barefoot" with different accounts? I am not thick, but I am struggling to find the obviously missing piece?

Linda

Hi Linda,

Ah, the missing piece of the puzzle.

Here’s a clue: in almost every single feel good news story they start off saying something like:

“I read your book, followed the Barefoot Steps, and then things slowly turned around for me”.

The starting point of the Barefoot Steps is to go on a date night, set up your buckets, and get $2,000 in a Mojo account as soon as possible, even if it means selling your kidneys on eBay.

Scott.

UPDATE: The $32,000 Couch

Remember me? I wrote to you a while back and you shared my story "$32,000 couch."

Hi Scott!

Remember me? I wrote to you a while back and you shared my story "$32,000 couch." I wanted to update you. Not only did your advice see me lose ALL my debt but following your advice and doing the Barefoot Steps I am now getting closer and closer to buying my first house. As I write this with tears in my eyes, from the bottom of my heart I thank you! This single mum feels so capable and so excited about what more is to come. You are truly a star in my eyes.

Lisa

Hi Lisa

I remember you!

You took out a $4,000 living room package (couch, TV, coffee table) at hardly normal, via a GEM Visa card. And over the next decade it ended up costing you $32,000!

The business model of these bankers is basically to take advantage of people who don’t understand the complex contracts they’ve signed up to.

I told you that it was time to stand up to the bullies, and you sound like you have. Congratulations on following the Barefoot Steps, and proving them all wrong.

You Got This!

Scott

We are terrified

My husband is retiring this week. We are not sure if we should withdraw his super or leave it in his fund.

Scott,

My husband is retiring this week. We are not sure if we should withdraw his super or leave it in his fund. We would place it in a high interest account if that is the better choice. We are terrified the market is going to keep going down. What should we do?

Linda & Steve

Hi Guys,

It’s been a rough time. I can understand how stressful it must be for you.

First up, you should not panic and take your money out of super. When you are in the retirement pension phase, your income is tax free and protected in the case of bankruptcy. Besides, you can put some of your super into a high interest cash and fixed interest account within your super.

And that’s exactly what you should be considering doing. In my book I suggest people a few years out of retirement to start building up a cash buffer of a few years’ living expenses (minus any pension payments), so that you have enough money to ride out downturns like we’re experiencing.

Many people in your boat are taking on a lot of otherwise ‘hidden’ risk in their super funds because of large unlisted assets, and overly aggressive one-size-fits all portfolios. So you should definitely call your super fund and tell them you’re freaking out about the market, and sit down with one of their financial advisors.

Scott.

Please open this right now, it’s very important

Today I’m going to show you the exact steps that will stop scammers from running up credit in your name.

Best of all, it’s fast, easy, and free.

Today I’m going to show you the exact steps that will stop scammers from running up credit in your name.

Best of all, it’s fast, easy, and free.

Yet before I do, I want to take a moment to reveal the name of a company that made MILLIONS from the Optus Hack.

That company’s name is Equifax and they’re a credit bureau.

This week, in a blind panic, Optus agreed to purchase 12-month subscriptions to Equifax’s ‘Credit Protect’ service for their most affected customers. This service sends an alert if your credit file is accessed (by a scammer applying for credit in your name using stolen docs), and it costs $14.95 a month per person.

That’s not just a huge amount of dough for Equifax, it’s insanely great advertising to boot!

So let me square the ledger …

Equifax is the financial equivalent of Mark Zuckerberg. They hoover up your personal private credit information and sell it off to any financial institution they damn well please. Yet unlike Zuck, if you want to monitor who they’re pimping your private data out to, well, you have to pay them $14.95 a month*!

*Except you don’t.

I’m afraid Optus has been scammed again.

They didn’t need to pay Equifax all that money. There’s a much better workaround, and it’s free.

I want you to pay close attention to this, even if you aren’t an Optus customer. After all, just this week Standard and Poor’s came out saying that Aussie banks are among the most vulnerable to a cyber attack in the region because of their work from home policies and all the stuff they’ve got in the cloud.

Bottomline?

This isn’t the first mass hack, and it won’t be the last.

Now, I don’t think simply having an alert on your credit file provides you enough protection.

Here’s the way I think about it:

An alert is like having a security camera on your front door.

You’ll get an alert that you’re getting robbed … but your TV still gets flogged!

If you are scammed – and one in four Aussies have been – it can take upwards of 30 hours to sort everything out, (most of which involves sitting in long telephone bank cues, listening to Daryl Braithwaite’s Horses.)

Instead, what you want is a big arse lock on your door that makes it impossible for the robber to get in your house.

Thankfully there is one app that will let you put a lock on your credit file.

That company’s name is CreditSavvy, and it’s a division of the Commonwealth Bank. (The fact that they’re owned by big yellow gives me a certain level of comfort … though I still wouldn’t trust them educating my kids).

Creditsavvy bills themselves like a fitness coach for debt, which in itself is kind of weird. Their schtick is that they calculate a personal ‘credit score’, which for me is about as useful as the score I give my four year old daughter’s nightly dance concerts:

“10 out of 10 Honey, BRAVO!”

In both cases we’re just needy adults desperately trying to keep your attention. (Credit Savvy makes its money by selling leads to finance companies to get you into debt).

However, part of their app that I’m interested in allows you to lock your credit file with a swipe or click of a button.

So here’s what I want you to do, step-by-step to lock down your credit file so that scammers can’t rip you off.

Step 1: Download the Credit Savvy app (either in the Apple or Google app stores).

Step 2: Verify your details (I used my driver’s licence and Medicare card).

Step 3: Press “protect” from the bottom navigation.

Step 4: Press “Request a ban”. Credit Savvy will then let the other credit agencies know you’ve got a ban on your file within 2 business days.

Step 5: On the 16th day the Credit Savvy app will remind you that your pause is ending. When you get that alert – and this is important – click “ban my credit report for 12-months”.

And that’s it!

From then on if anyone tries to access your credit file, the Credit Savvy app will alert you.

Though it will also be locked so the bank or financial institution won’t be able to access your file. However, this will not count against you. To be clear, it will not harm your ability to take out credit.

Now if you are applying for credit (or say moving home and applying for utilities and the like), all you need to do is temporarily lift the ban on your credit file for a week or so. And then put that lock straight back on using the Credit Savvy app.

Tread Your Own Path!

A Follow Up to the Barefoot Investor Book?

I have read your original book four times, well, the audio book that is. It was excellent and I attribute it to my strong financial position today.

Dear Barefoot,

I have read your original book four times, well, the audio book that is. It was excellent and I attribute it to my strong financial position today. But what now? We recently have moved into free housing provided by our work and are earning collectively $400,000 a year now - we have all our buckets set up, we have $80,000 in savings, $30,000 in index funds and our is super set up for success. We even called a financial advisor to get specific advice, but he was more about borrowing and he recommended we read the Barefoot Investor (I’m glad it was a free appointment!). So again I ask, what now? Is there a book 2.0 for those who followed your advice and are now reaping the rewards?

Clint

Hi Clint,

First up, well done for sitting through my audiobook four times: that thing goes for like 6 and a half hours!

You’ll be hearing my voice in your sleep!

It’s a timely question you ask, because I’ve just finished writing a companion to the Barefoot Investor. It’s called:

Beyond Barefoot: The Next Chapter.

I wrote it to mark the 10-year anniversary of sitting down with my wife at the Romsey Pub and sketching out the Barefoot buckets with Liz. It’s written especially for Barefooters, and there are three brand new Barefoot date nights, and a brand-new bucket as well.

However, I won’t be selling it in bookstores.

Instead, I plan to give it away as a free bonus for people who pre-order my new book. If you’re interested you should ensure you open the email I send you next week, because this is the only place it’ll be available, and only for that week!

Please forward this email to a few of your mates so they don’t miss out!

Scott.

Blood on the Floor

Thank you for helping me over the last few years. I have managed to both save and pay some large life bills thanks to sticking to your simple plans.

Scott,

Thank you for helping me over the last few years. I have managed to both save and pay some large life bills thanks to sticking to your simple plans. However, I just lost a big chunk of my investment money with the current market wobble. I’m optimistic it will be back on par with 3 years, based on what history has shown us, although a little nervous. My question now that push has come to shove, and blood is on the floor, do I keep buying my index funds, or pause?

Thanks,

Ollie

Hi Ollie,

This isn’t blood, it’s a paper cut!

Our market is down by roughly 10% in the past 12-months, which is totally and utterly normal.

The stock market is the only place where prices go on sale … and everyone runs out of the shop!

My suggestion?

The only thing you need to pause is looking at your share prices each day.

Scott.

Retire in Seven Years?

I just came across an article in Forbes describing how it would be possible to retire in seven years by investing half your income in closed-end funds (CEFs).

Dear Scott,

I just came across an article in Forbes describing how it would be possible to retire in seven years by investing half your income in closed-end funds (CEFs). What do you think of CEFs? Are they worth investing in?

Tammy

Hi Tammy,

I read the same article, right to the bottom.

Then I clicked on the following ad:

The #1 BEST new trick to rapidly burn belly fat & detox (start this tonight).

Apparently the best new trick is eating avocado, and buying a lot of their expensive pills.

You and I both read the same thing: clickbait.

It’s an American article, but a closed end fund is the equivalent of a Listed Investment Company (LIC), like the Australian Foundation Investment Company (AFIC), or Argo Investments (ARG). They’re perfectly decent investments (that I own!), though they have largely been superseded by simpler Exchange Traded Funds (ETF) index funds.

Retiring in 7 years, or getting a six pack doesn’t require gimmicks, just a lot of hard work.

Scott.

Where Are They Now?

My children are now 10, 7 and about to turn 5. We are still in our family home and my name is the only one on our mortgage.

Hi Scott

I sent you an email over 5 years ago; after my husband left me pregnant with our 3rd child. I was a terrified mess. I'm writing to give you an update and to say thank you.

My children are now 10, 7 and about to turn 5. We are still in our family home and my name is the only one on our mortgage. I have paid off my credit card and cut it up, I have renovated our bathroom with cash, and we are about to go on an overseas holiday. Best of all, I’ve got $30,000 in the bank, offsetting my mortgage. Your book has changed mine and my children’s lives. I’m teaching them everything I know and they're going to have the best start to life financially once they start working.

Tara

Hi Tara

I love a happily ever after – thanks for the update! Now let me break this to you: the book I’ve just written is even better than The Barefoot Investor, and it’s written directly for kids like yours. It’s out in a few weeks, and if your kids are anything like you, they’re going to absolutely love it.

Scott.

Barefoot Calls a Single Mother in the Middle of the Night

I’m a 57-year-old single mum. I bought a property 3 years ago and work, as a nurse, almost every day to make ends meet.

Hi Scott

I’m a 57-year-old single mum. I bought a property 3 years ago and work, as a nurse, almost every day to make ends meet. I get anxious when I think about the age I will be when I finally pay off my house, age 71! Will I even be able to work at that age? Then I start thinking of how to make money quickly. The lotto obviously is not going my way, so I looked into the stock markets and opened an account with CoinDaq. They are very helpful, but I do feel uneasy. I invested $2,500 and they supported me, so I added $2,500. I made 23% profit, about $1176.17. Which I’m excited about but somehow it seems too good to be true? Now they try to convince me to take $50,000 from my super and then I will make up to $9,000 a month with a ‘bonus’ of about $230,000 every 3 years. What is your opinion about this?

Kind regards

Linda

Linda,

As I’m reading this, it’s currently 4:35 am, (see above).

I’m debating whether I call you right now and completely FREAK YOU OUT.

It would go something like this:

“Good morning, it’s the Barefoot Investor. You are being robbed RIGHT NOW!”

(I’d scream ‘RIGHT NOW’ down the line, for dramatic effect).

Then you’d bolt upright in bed, and listen nervously for the burglars rifling through your stuff.

However, they didn’t climb through a window, and nab your telly Linda. They came in via your computer, and they convinced you to willingly hand over your cash.

Linda, they are scammers.

Literally the very first website that comes up when you Google ‘CoinDaq’ says:

“Coindaq is a scam site”.

The robbers have already stuffed $5,000 of your money into their duffle bag. Yet they haven’t left. They’re now searching around for the big pay day: your superannuation.

Again, to be clear:

YOU ARE BEING ROBBED RIGHT NOW!

No matter what they tell you, never ever speak to them again.

Scott.

If You Move I’ll Kill You

“If you make so much as a sound … I swear I’ll kill you”, she hisses.

“If you make so much as a sound … I swear I’ll kill you”, she hisses.

It’s 4.30am, my morning alarm has just gone off, and Liz has been up all night with our 18-month-old.

So I creep down the hall in the pitch black – past our sleeping toddler – praying that I don’t hit a landmine piece of Lego.

Why do I get up so early?

Well, with four kids, a book that’s about to be launched, and a full-time farm, life is busy … so I follow the army motto: get up before the enemy.

And it seems, post the pandemic, that we’ve all won the battle of being able to work from home … yet we’re losing the war. A new study from La Trobe University has found that working from home increases the likelihood of weight gain, exhaustion and burnout.

The main reason cited in the study is a lack of routine. So, as someone who’s been working from home for the past 20 years, I thought I’d share with you my routine.

You need to get up at 4.30am and START BLOODY WORKING!

Just kidding.

It’s not just the start of the day that matters … its also how you end your day. So let me tell you about a simple little ritual I follow at the end of each day that has radically reduced my stress and overwhelm.

First, I set an alarm on my phone for the end of my work day. When the alarm goes off, I grab a nice knock-off drink and close every single one of the tabs in my browser(s).

Then – and this is important – I shut down my computer.

Watching the computer screen go blank is my visual cue that the work day is over. And then I go full 1980s and leave my computer in the office.

My final step is to go for a walk outside without my phone. Sometimes it’s only 10 minutes. It’s just a way to get my body moving, and it helps me mentally transition from work-Scott to taxi-dad.

Soldier on!

Tread Your Own Path!

The Scumbag Landlord

My wife and I are very lucky. We own two investment properties that basically pay for themselves. Trouble is, we live in another state and rent ourselves.

G’day Barefoot,

My wife and I are very lucky. We own two investment properties that basically pay for themselves. Trouble is, we live in another state and rent ourselves. If we sold our two rentals we could afford to buy a family home for cash — but we feel obligated to our tenants. Both rentals have long-term tenants and we charge about $50 a week less than market to help them out. If we sold, they’d be out on their own and unlikely to be able to afford to rent anywhere nearby, and their kids would have to change schools and I’d feel like a scumbag capitalist. What should we do to not make two families homeless but get ourselves into our own home?

Brendan

Hi Brendan,

You sound like the sort of bloke I’d like to have a non-alcoholic beer with.

As a renter yourself you understand just how absolutely bonkers things are right now:

The national rental vacancy rate sits at just 0.9%, according to SQM Research. Meanwhile, rents have rocketed up 20.1% in the last 12 months alone!

I have never seen anything like it.

It’s a terrible situation, and one that I’m glad I don’t have to grapple with … as a renter, or a landlord.

After all, my share portfolio doesn’t have feelings (nor does it suffer burst water pipes at 3am), and my dividends just magically appear in my bank account a couple of times a year.

That said, if I were in your shoes I’d sell the properties and buy your own family a home. That’s not because I’m a scumbag capitalist, but because your first responsibility is to your family.

Besides, there are other ways to help struggling people in your community than renting out a few joints slightly below the market rate. You could volunteer at a local food bank, or you could donate money to the Financial Counselling Foundation, who help and fight for some of the most vulnerable people in our community.

Scott.